The amount of bad pricing advice out there is shocking.

Some say you should go with your gut. Others say that you should go with your gut, then double it. Either way, it seems most common pricing advice has a gastrointestinal tilt.

Given the prevalence of poor pricing judgment, it’s no surprise that that 9 out of 10 SaaS and subscription businesses are relying on outmoded pricing strategies like cost-plus and competitor-based pricing. In our work with over 6,000 subscription software companies at Price Intelligently and ProfitWell, we’ve found that these strategies hamper your growth and leave millions in revenue on the table.

To help you craft a pricing strategy that works for you, we’ll cover how pricing impacts your bottom line and do a deep dive on the three strategies behind most pricing process: cost-plus, competitor-based, and value-based. Then, we’ll show you why value-based pricing is an exceptionally powerful approach for recurring revenue business and how you can implement it immediately.

Let’s jump in.

How Pricing Impacts Your Bottom Line

Your pricing is the lynchpin of your financial success because it sits at the center of your business. Your pricing affects which customers you acquire, how long they stay, and whether they’re satisfied with your product.

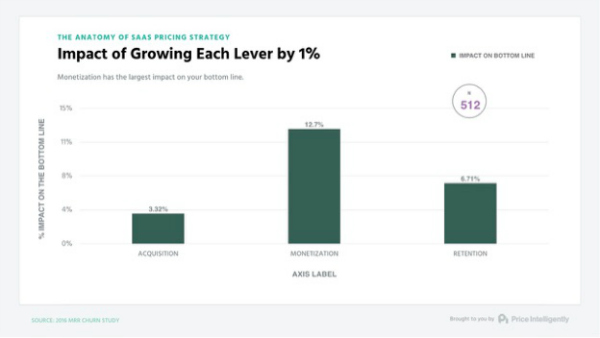

The statistical evidence attests to the centrality of pricing in your business. Getting your monetization in check has twice the impact of improving retention and four times the impact of improving acquisition on your bottom line. Companies that are continually optimizing their pricing have LTV / CAC ratios (a key measure of sustainable growth) 11x greater than companies that aren’t doing the same. Study after study has found that pricing is the most efficient way to grow your business.

Yet, SaaS founders and executives haven’t taken notice. Over 7 in 10 report spending fewer than 10 hours a year on their pricing strategy. Those who take the time to set up a solid value-based pricing foundation find that it pays dividends down the line, letting them consistently deliver benefits to their customers and avoid costly churn. Those who choose to rely on pricing models better suited to other businesses find their growth put in jeopardy by increasing costs and shifting markets.

In short, the pricing model you choose is incredibly important to your success as a SaaS business. We’ll do a deep dive on each of the three most common pricing models used by software companies, starting with the cost-plus model.

Cost-Plus Pricing

“A pricing method in which the selling price is set by evaluating all variable costs a company incurs and adding a markup percentage to establish the price.” — Price Intelligently Dictionary

Cost-plus pricing strategy is what most think of when they think of pricing strategy. It relies on the foundational principle of business: selling things for more than they cost.

The way it works is extremely simple: add up all of your costs to provide a product or service and add a flat profit margin on top to capture the value you’re delivering to customers. In software, your costs range from product design to the services you use to build your product to team salaries. Cost-plus pricing takes the sum of those costs and adds a 5%, 10%, or healthy 20% profit margin on top.

There are two big reasons why so many software companies default to this pricing option:

- It’s incredibly simple. As long as you keep an accurate tally of costs, you can figure out your price without so much as a calculator. No customer panels, data analysis, or strategy sessions are required.

- You’re going to cover your costs. As this is cost-plus pricing, it seems that you’ll at least make enough to break-even before you take your profits.

Taking those advantages at face value, cost-plus pricing seems like a failproof model, with little overhead and guaranteed profits.

Yet, cost-plus pricing quickly breaks down. Here’s why:

- Your costs fluctuate over time. There are a litany of unexpected events that can change the cost of doing business, from new hires to pricing changes for the services you depend on. Cost-plus pricing relies on a cost assessment fixed at a certain point in time and can’t capture the variations.

- Your can’t adjust your pricing to keep up. Given that your costs will continually change, you’re not going to be able to change your prices fast enough to keep up and your profits will suffer. Cost-plus pricing works brilliantly for businesses with a majority of fixed-costs like gas stations, but poorly for software companies.

This is what happens when you use cost-plus pricing:

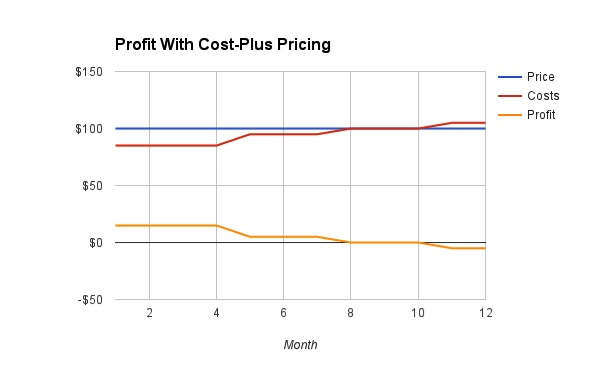

In the chart above, our company calculates its costs and then adds a 15% margin. Profit holds steady for a few months until some new costs crop up. These costs cut the profit margin to 5% and then to the break-even point, putting our company at the precipice of unprofitability. All it takes is for one supplier to raise prices for our company to start losing money on every sale.

The biggest problem with cost-plus pricing is that your customers don’t care about your costs. They care about the value you provide them.

If you’re like me, you don’t know what it costs your local coffee shop to make your coffee. You have no idea how much it costs for Honda to make your Accord. The price you’re willing to pay for your coffee or your car or anything else is tied to the value you place on them, not how much they cost to produce plus a reasonable profit margin. Naturally, your coffee shop and Honda are pricing their products more than it costs to make them, but they don’t rely on the cost of coffee beans or car parts to determine their margins.

Your customers care about how much value they get out of your product, not how much you pay your developers. You should charge them accordingly.

Cost-plus pricing is a common shortcut used to quickly throw together a pricing strategy, but it still requires a full accounting of your costs. Many new software companies opt for an even simpler (though no more effective) approach: competitor-based pricing.

Competitor-Based Pricing

“A pricing method that utilizes competitor prices as a benchmark, rather than setting a price based on company costs or customer value.” – Price Intelligently Dictionary

For a SaaS company breaking into a new industry, it’s a natural instinct to check out how your competitors are pricing their products. Especially if you don’t know how valuable your product is, you’ll select a price point somewhere in the comfortable middle ground between your major competitors.

Like cost-plus pricing before, relying on your competitors to guide your pricing strategy has two upsides:

- It’s really easy. You can spend 20 minutes poking around on your competitor’s pricing pages to find all the information you need to set your prices. There’s little additional research required here.

- It makes you relatively competitive on price. In a highly competitive market, competitor-based pricing makes sure that you aren’t pricing outside of what the market can bear. It seems safe: if you’re in the middle of your competitors, your customers aren’t likely to view your product as under or overpriced.

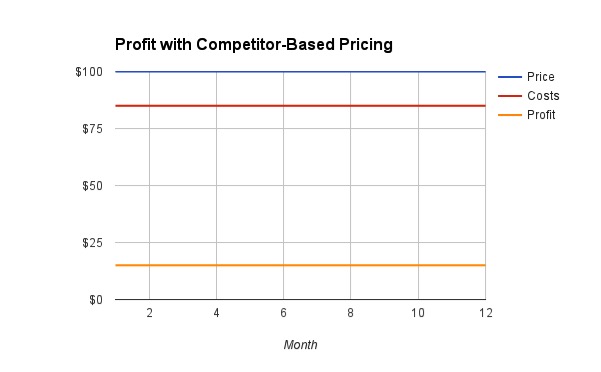

Yet, there’s a glaring problem with competitor-based pricing: you haven’t created a pricing strategy for your product, you’ve created one for your competitor’s product. If you aren’t building a differentiated product from what’s already on the market, you shouldn’t be building it. The same principle is true for your pricing: if you copy what’s already out there, the best-case scenario is that your profits look the same. More likely, you’ll end up with the profits you see below:

Your growth has flatlined. It’s certainly better than cost-plus pricing; here, you’re not losing money throughout the year. But it freezes you in place relative to your competitors, leaving you no good options to increase prices when your product increases in value without pricing yourself above your competitors.

The moral of the competitor-based pricing story is look, but don’t touch. You certainly want to be pricing your products in the ballpark of your competitors but you shouldn’t surrender your pricing strategy to the companies you’re trying to beat.

The fundamental problem with competitor-based pricing is similar to the issue with cost-plus pricing. Your customers don’t care about your competitors, they care about the value you provide.

Your customers are going to come to you for the unique product you make and the experience you provide. Don’t offer them a product they could get elsewhere for a price they’ve seen before.

While some of your customers may compare prices, few of the customers you actually want are going to make price their primary decision factor. It’s your job to convince customers that they need your product. Once they see that value, they’re much less likely to pay attention to what your competitors charge. The key is to center your pricing strategy on that value, so it scales as you add features and they increase usage.

Value-Based Pricing

“Basing a product or service’s price on how much the target consumers believe it is worth.” — Price Intelligently Dictionary

There’s only one person who can decide to buy your product. It’s not your suppliers or employees, as much as they contribute to making your product worth buying. It’s not your competitors, who provide a useful backdrop to stand out against.

The only person who decides to fork over the cash for your product is your customer.

It’s good practice to listen to the person with the cash. Value based pricing strategies embrace this by relying on the actual decision makers, your customers, for your pricing strategy. Value-based pricing is the only customer-centric pricing strategy out there.

There are three key reasons to set your pricing based on the value you deliver to customers:

- You determine precise willingness to pay. It’s essential that you figure out what your customers will actually pay for your product. To do that, you need to ask them about the value they perceive. Competitor-based pricing tries to get at this indirectly by determining what a customer is willing to pay for similar services. Since your product theoretically offers more value than your competitors, you should go directly to them to figure out what your product is worth to them.

- You build the most valuable product possible. Pricing strategy is more than the dollar or euro amount you quote your customers. It includes your packaging (the set of features offered in each plan) and customer segmentation (which customers your plans target). A value based approach helps you discover what your customers want, letting you prioritize development of feature sets to unlock more value for your customers (and enable you to charge more).

- You get to know your customers. Conducting the customer research required to build a value based pricing strategy can test your assumptions about your market and your product. You’ll understand the problem that your product solves for your customers, which is often different than the problem you set out to solve. This ultimately helps you align all parts of your business, from marketing to engineering, around the needs of your customers.

There is a downside to this approach: it’s not as quick or easy as cost-plus or competitor-based pricing. Proper value based pricing strategies aren’t developed overnight. You have to dedicate yourself to understanding your customers and be willing to correct your course based on what you learn. Yet, you can use what you learn as the basis of constructing quantified buyer personas, which you can use as a foundation for a wide variety of business decisions.

Value-based pricing is not going to give you an ironclad, 100% accurate picture either. Price sensitivity measurements and feature analyses are powerful but imperfect tools that give you approximations of the right pricing, packaging, and positioning for your product. But, you end up with a pricing strategy far closer to the truth (exact willingness to pay of each customer) than relying on costs or competitors to set your price.

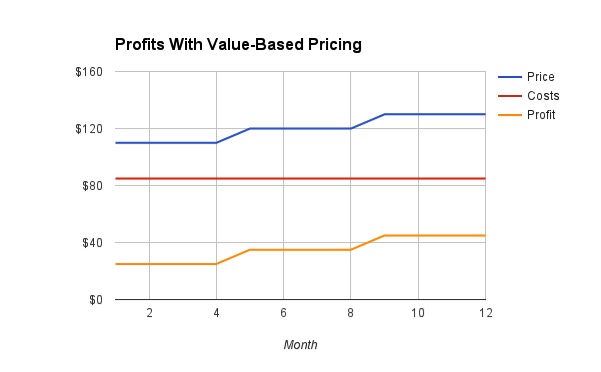

One area where value-based pricing makes a noticeable difference is your profit:

Value-based pricing gives you two abilities you don’t have with other pricing models. First, it lets you start at a higher price point than cost-plus or competitor-pricing if you establish that your customers are willing to pay more. Second, it gives you a clear path to raise prices as you learn more about what your customers need and build new features, adding value to your product. This example above features an aggressive pricing strategy, with two price increases within a year. This is entirely reasonable in SaaS, where the time to add new value is quick. In order to continually optimize your prices, you should be re-evaluating your pricing strategy every 6 months, and if you find room to raise prices, you should.

We’ve walked through theory behind value-based pricing. Now, let’s dive into how you can use it to drive your business’s pricing strategy.

Here’s how to implement value based pricing

In order to understand how much your customers are willing to pay for your product, you should start by understanding your customers at a basic level. Begin by aggregating demographic data about your customers. Go beyond age and gender and figure out the industry, role, team size, preferences, and problems of customers in each of your major segments.

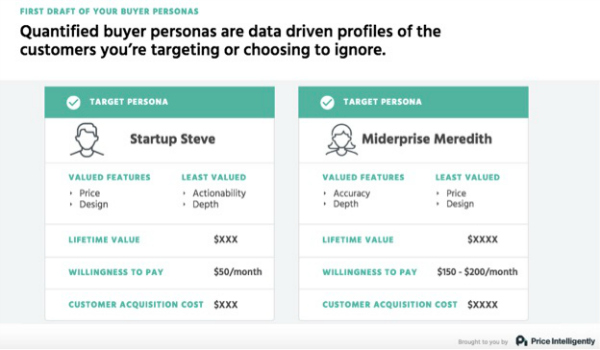

Once you’ve ironed out customer demographics, run surveys to pinpoint the value proposition that’s most important to them. Then, you can use Max Diff analysis and Van Westendorp’s price sensitivity meter to build out quantified buyer personas. At this point, you’ll be ahead of 90% of your competitors and ready use your buyer personas to design pricing, packaging, and positioning that maximizes your revenue and retention. In the course of your research, you’ll also learn about the right marketing channels to reach your customers and talk to some prospects that you may be able to convert at a later date.

This is a 30,000 foot overview of a few of the methods we’ve used at Price Intelligently to help thousands of SaaS and subscription companies optimize their pricing. We’ve captured more insights on our blog and in our 140 page ebook on pricing strategy.

Value is the only thing your customers care about

None of the pricing strategies we discussed are useless, but each requires the right business environment to work. If you’re running a gas station with mostly fixed costs, cost-plus pricing maintains a constant amount of profit regardless of supplier prices. If you’re in the ultra-competitive retail space, pricing in line with competitors ensures that you aren’t pricing your customers out of the market.

But there’s only one viable option for pricing a SaaS product: value-based pricing. The entire reason your company exists is to provide value to your customers. Figuring out exactly how much your customers are willing to pay for the value you provide and which features they want will give you a roadmap to profitability. You’ll also find your customers sticking around for longer, as the value of your product continually increases.

Value-based pricing lets your profitability rise alongside your value, no gut-decisions or arbitrary price points required. That’s a pricing strategy you can take to the bank.

Patrick Campbell is co-founder and CEO of Price Intelligently. Contact him at patrick@priceintelligently.com or @patticus on Twitter.