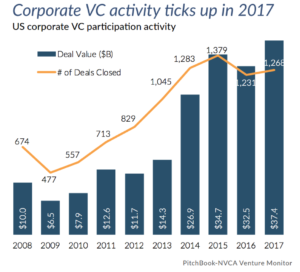

Corporate venture capital activity continues to explode: Investments grew from $10 billion in 2008 to $37 billion in 2017, and now account for about 44% of all U.S. VC. And software companies pulled down about one-third of that corporate cash – more than any other group of startups. Clearly, tech leaders are finding these strategic investments quite fruitful in terms of delivering rapid innovation and ecosystem development in markets for emerging technology.

Albert Kim is an expert on the power of corporate VC. As head of Ericsson Ventures, Kim is focused on building out the 5G ecosystem and augmenting Ericsson’s $370 million in R&D funding. Formerly with Investor Growth Capital, Goldman Sachs and McKinsey, Kim’s recent investments include deals with Trifacta, Realm, Matterport, and Menlo Security.

Albert Kim is an expert on the power of corporate VC. As head of Ericsson Ventures, Kim is focused on building out the 5G ecosystem and augmenting Ericsson’s $370 million in R&D funding. Formerly with Investor Growth Capital, Goldman Sachs and McKinsey, Kim’s recent investments include deals with Trifacta, Realm, Matterport, and Menlo Security.

Kim spoke with SandHill.com on the corporate VC difference, ecosystem building, and EV’s “impactful” portfolio relationships.

SandHill.com: Can you speak to the difference between the corporate VC investor and the traditional VC investor?

Albert Kim: Institutional VC is essentially one of many financial asset classes with its own risk and reward profile. The primary objective is to generate outsized financial returns. Corporate VC, depending on how the corporation chooses to implement it, exists along a continuum with pure financial return objectives on one end, and pure strategic orientation on the other. Most corporate VC groups try to blend both objectives.

Albert Kim: Institutional VC is essentially one of many financial asset classes with its own risk and reward profile. The primary objective is to generate outsized financial returns. Corporate VC, depending on how the corporation chooses to implement it, exists along a continuum with pure financial return objectives on one end, and pure strategic orientation on the other. Most corporate VC groups try to blend both objectives.

In Ericsson’s view, these two objectives actually reinforce each other in a virtuous circle: we strive to finance the best companies, leading to the best financial outcome, by finding ways in which Ericsson can uniquely help our portfolio companies and vice versa.

SandHill.com: The process of building an ecosystem is similar across technology categories. How do you identify target investments needed to fill out the ecosystem?

Albert Kim: Our investment areas go well beyond just 5G. But on the topic of 5G and ecosystem building, we think about it in terms of two buckets: ‘5G supply’ and ‘5G demand.’ The former area includes companies and technologies that can help optimize, improve and accelerate our own 5G offerings (areas including novel radio technologies, SDN. NFV, etc; as an example we were investors in Nicira, an early pioneer of SDN).

On the other hand we also look for companies that are trailblazers in often still quite early ecosystems, that, at scale, could drive demand for very high-bandwidth and low-latency wireless connectivity (examples include AR/VR, autonomous vehicles, etc; for example Ericsson is an investor in the AR/VR company Matterport).

SandHill.com: You mention EV’s ability to develop “impactful” relationships with their partner portfolio companies. What characterizes an impactful relationship for Ericsson?

Albert Kim: We believe the key to the success of Ericsson Ventures is to identify points of leverage that Ericsson can bring to our portfolio companies and vice versa. The impact can be delivered in various ways including: Ericsson becoming a customer of the investee company, a GTM partner, or a source of deep insights into specific technologies, markets or business models.

All of these could go the other way as well, for example, the company provides a unique business model of innovation learnings to Ericsson. One example of impact would be an acquisition of a portfolio company, which happened in the case of our investment in Nodeprime.

Clare Christopher is editor of SandHill.com.