The SEG SaaS Index is a list of publicly traded companies that they have determined to be SaaS businesses (i.e., they primarily offer solutions via the cloud and may have a subscription or transaction-based pricing model).

In 1Q22 the median growth rate for the SEG SaaS Index reached 28.5%, with nearly a third of SaaS companies experiencing a growth rate of 40% or more. Note: this upward trend is also a result of more high-growth companies added to the Index.

Here are five highlight updates from the 2022 Q1 Report.

I) Due to the large influx of companies taking advantage of strong stock market performance in 2021, there were 14 additions to the SEG SaaS Index in 1Q22. Notable additions include Couchbase, Squarespace, PowerSchool, Instructure, Riskified, Alkami, and Monday.com.

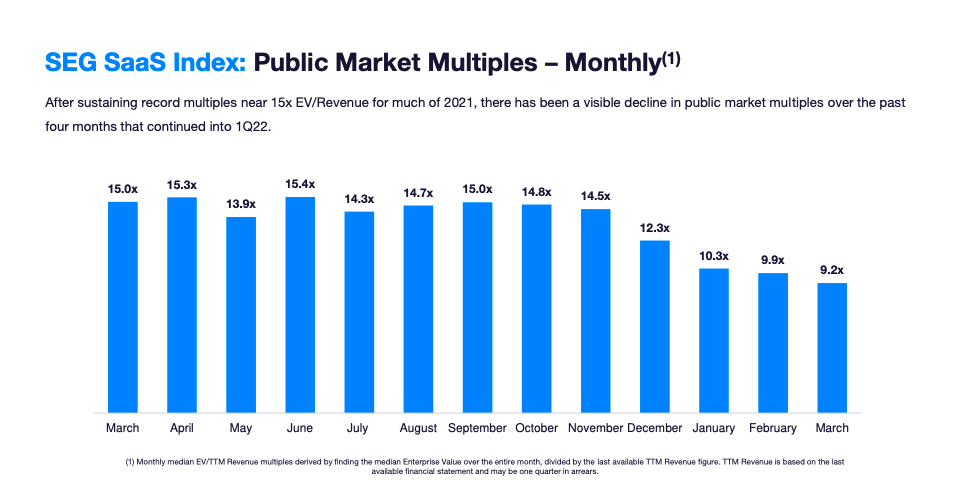

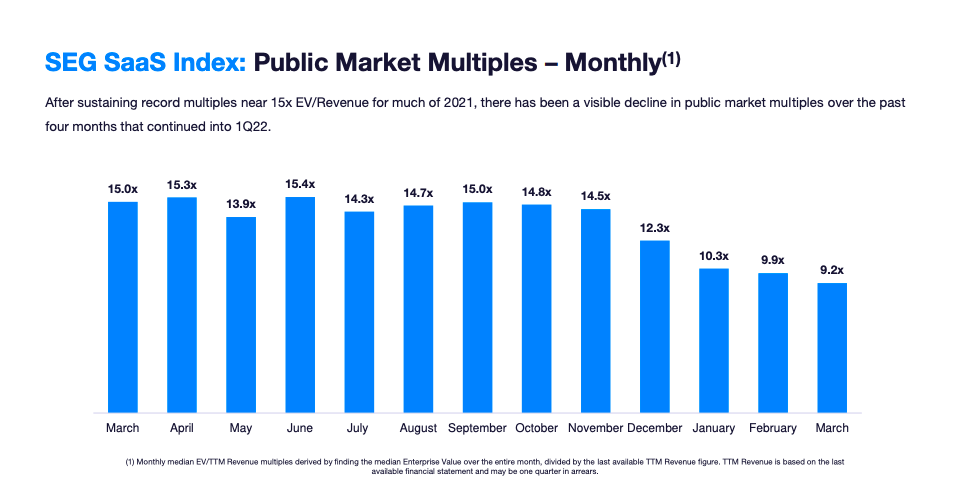

II) EV/Revenue multiples dropped significantly in 1Q22, down 30% from 13.9x in 4Q21 to 9.8x in 1Q22. This material decline over the last four months has occurred as investors shy away from riskier, high growth investments and focus more on profitability instead. Geopolitical unrest, inflation, interest rates, and federal monetary policy have all contributed to this shift.

III) Security and human capital management had the highest revenue growth in 1Q22 as employee retention, labor shortages, hybrid work environments, and increased attention on cybersecurity solutions brought these product categories into focus.

IV) Communications & Collaboration had the highest TTM revenue growth rate out of all product categories, with a median growth of 41.5%. Leaders in the space included Monday.com at 91.3%, Asana at 66.7%, and Twilio at 61.3%. This category was followed closely by Other SaaS and Security, with median growth rates of 35.2% and 33.3%, respectively.

V) The Weighted Rule of 40%: Generally, SaaS companies with a higher weighted Rule of 40(1) are rewarded with higher revenue multiples. In 1Q22, companies in the higher cohorts saw the most significant impact on multiples. We see this impact as a result of investors shifting toward profitability since these cohorts include many companies growing quickly but are unprofitable.

Click here for the full SEG 1Q22 SaaS Public Market Update.