The software industry is in an era of explosive growth. In our 2014 CEO / CFO Outlook study, 29 percent of the participants said their planned revenue growth over the next 12 months is 50 percent or higher; and within that group, 17 percent believe their revenue growth will increase by 100 percent or more.

Sand Hill Group conducted the study in March and April, using an online survey of quantitative questions and in-depth follow-up telephone interviews of some of the online participants. CEOs and presidents comprised 50 percent of the online survey participants, and 70 percent of those participating in the phone interviews were CEOs.

A major focus of the study findings is that the degree and pace of growth is dramatically disrupting the status quo and causing significant transformation of companies’ operating infrastructures.

Software executives reported that they struggle with maintaining equilibrium among operational and investing priorities that push their companies in opposite directions at the same time. Examples: old deployment and pricing models versus new models and new pricing pressures, or addressing existing customers’ demands and maintaining the legacy cash cow versus developing new products for new customers.

These prioritization decisions are becoming ever more complex and increasingly interrelated. The decision choices are all interconnected; none of them are standalone. Moreover, operational change must be funded, and that challenge is significant because of the opposite directions in prioritization.

We asked the participants to rank 10 growth strategy opportunities. They believe their companies’ top three growth opportunities over the next 12 months are “acquiring new customers organically,” “launching new products” and “selling more to existing customers.” However, these three strategies also are at the crux of the dilemma of software companies being yanked in opposite directions.

Big Data and social are top growth areas

We also explored opinions about what will drive industry revenues in 2014 to 2016. The survey asked participants to rank five factors (Big Data / analytics, mobile, security, customer experience, Internet of Things, social / collaboration tools) that will have the greatest impact. In the #1 spot was Big Data / analytics; but surprisingly, it tied in importance with social and collaboration tools.

The study found that the social / collaboration driver impacts software companies’ spending as well as their customers’ spend. Many software companies dramatically increased their social media efforts, funding and staffing in 2014. A slightly higher percentage of companies focus this effort on supporting and retaining customers than on reaching prospective customers. Several executives highlighted the trend of social data and search becoming more important in cloud and SaaS solutions.

Internet of Things

Although the IoT is still a nascent market, the study pinpointed two IoT technologies of growing interest in this early phase. We asked the study participants to rank the expected impact of five IoT technologies on their business. They responded that their highest degree of competitive opportunities is in sensor technologies and in security solutions for the Internet of Things. However, among the five tech areas, sensors and security also ranked highest as competitive threats.

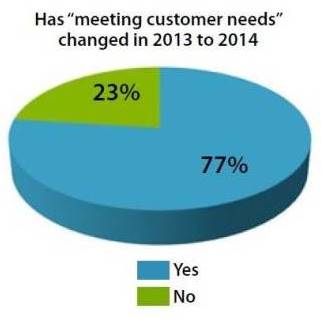

Meeting customer needs is a huge issue

Several executives commented about the raised stakes in the crucial effort to delight customers. They observed that “meeting customer needs” is much more problematic in 2014 than it was in 2013, and the pace of growth exacerbates the situation.

Customers are more sophisticated in their demands and also demand that products be easier to use and want broader solutions for more types of users. As one executive commented, despite the challenges, it’s more important now to meet customer needs “more completely” because customers have a growing number of options and switching costs are lower.

Talent needs

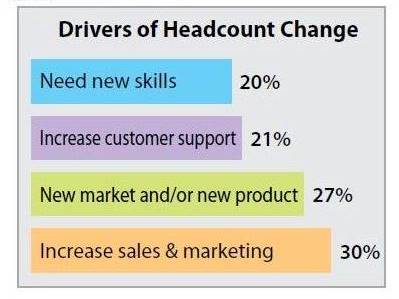

Many executives in the study described recruiting/hiring challenges, especially among companies competing for talent in Silicon Valley and companies trying to develop mobile apps requiring Android skills. The majority (82 percent) reported that their headcount will increase over the next 12 months, with 24 percent of that group predicting it will “increase significantly.”

However, unlike prior years, this year’s participants ranked “needing new skills” as the least important driver of the increased headcount needs. The more dominant drivers reflect the needs resulting from the fast-paced growth the industry is now enjoying.

The study found several changes since the prior two CEO / CFO Outlook studies we conducted in 2010 and 2011. For example, this year’s executives ranked “new business initiatives” as the biggest influence driving customer software spending in the next 12 months, instead of “increasing efficiencies and reducing costs” as in prior years. Fewer companies use “churn” to track their business now. And the percentage of participants that use customer acquisition cost (CAC) as their business tracking method is twice as many as in 2011.

The opportunities in this era of growth are exciting, but the accompanying degree of change is challenging. The Software CEO /CFO Outlook 2014 report provides a detailed look at how the software industry is performing and the transformational change and conflicting needs that software companies must address.

Click here to review the contents and buy the report, “Software CEO / CFO Outlook 2014: The Complications of Change.”

M. R. Rangaswami is co-founder and CEO of Sand Hill Group and is the publisher of SandHill.com.