Successful serial entrepreneurs are almost as rare as “unicorns.” Venture capitalists bet big on these proven leaders with hopes their winning streak will continue.

Auren Hoffman is a bonafide entrepreneurial champion. With the launch of SafeGraph, he embarks on his latest venture since selling his customer data service, LiveRamp, to Acxiom for $310 million in 2014. The sale was only one in a long line of successful startups Hoffman has built and sold, including Rapleaf, GetRelevant, Bridgepath Inc., and Kyber Systems – a company he founded while still an undergraduate at UC Berkeley.

Auren Hoffman is a bonafide entrepreneurial champion. With the launch of SafeGraph, he embarks on his latest venture since selling his customer data service, LiveRamp, to Acxiom for $310 million in 2014. The sale was only one in a long line of successful startups Hoffman has built and sold, including Rapleaf, GetRelevant, Bridgepath Inc., and Kyber Systems – a company he founded while still an undergraduate at UC Berkeley.

SafeGraph plans to democratize access to data by providing access to the “largest ground truth dataset in the world.” The first initiative focuses on understanding the movement of populations using geospatial data. Working with co-founder Brent Perez, Hoffman has assembled a team of fifteen people who aim to build a “unicorn” that adds value to society. I asked him about his unique approach to financing and his advice for aspiring entrepreneurs

M.R.: Congratulations on SafeGraph’s $16 million Series A round. It is unique that so many individuals – current and former colleagues, angel investors, industry innovators and thought leaders – are backing SafeGraph (Full disclosure: I am one of these individual investors.) Why did you fundraise in this nontraditional way?

Auren Hoffman: We aimed to optimize SafeGraph’s position by bringing lots of people into the round who can help shape the business in the future. Alex Rosen at IDG Ventures led SafeGraph’s Series A round. We picked Alex because he has a lot of experience and knowledge with data businesses.

We also brought in over more than 100 individual investors – all of whom can be very helpful to our business. For example, we tapped some of the best minds who are thinking deeply about the future of AI: Peter Thiel (my long-time mentor, friend, and first backer of LiveRamp), Adam D’Angelo (CEO of Quora and former CTO of Facebook), Romesh Wadhwani (CEO of Symphony Technology Group), and Bryan Johnson (former CEO of Braintree). Other groups of investors are leaders in areas such as government, policy, academia, real estate, finance and marketing. I’m also proud that more than thirty current and former employees at LiveRamp have invested in SafeGraph as well.

M.R. In your experience as a serial entrepreneur, do you find yourself repeating the same best practices? Do you find yourself – despite your best instincts – making the same mistakes?

Auren: It is really hard not to fall into the trap of doing what you did before. But blindly repeating one’s strategy and tactics can be fraught with peril because the world keeps changing. Just because a strategy or tactic worked five years ago does not mean it will work

today. I find that a good practice is for one to challenge their core assumptions every year or so.

M.R. What is the best piece of advice you share with fledgling technology entrepreneurs?

M.R. What is the best piece of advice you share with fledgling technology entrepreneurs?

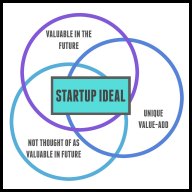

Auren: When picking a business to start, it is good to choose one that lives in the middle of the following Venn diagram overlap:

- Something that will be very valuable in the future

- Something most people do NOT think will be valuable in the future

- Something you have some sort of unique advantage in

LiveRamp (my last company) and SafeGraph (my current company) both certainly lived in this overlap.

M.R. Rangaswami is the co-founder of Sand Hill Group and publisher of SandHill.com.