Hortonworks and New Relic both had outstanding public debuts last Friday. That wasn’t a surprise – they’re both running extremely disciplined recurring revenue-based business models. The real story for me last week was the recent news from Adobe and Box.

In 2013 Adobe flipped the switch on their revenue model in a big way, converting their Creative Cloud platform to subscriptions versus perpetual licenses. Lots of people weren’t happy with the change. At one point NASDAQ called them to see if they wanted to halt trading.

Today it’s a different story. Last quarter they achieved revenue of $1.073 billion, near the high end of a targeted range of $1.025 billion to $1.075 billion. They added 644,000 new Creative Cloud subscriptions for a total of roughly 3.5 million subscribers.

But their most interesting number? A total digital medial Annual Recurring Revenue (ARR) of almost $2 billion. That’s two billion dollars that happens every year, rain or shine. They’re starting 2015 with a remarkable base of contractually obligated opportunity.

Their CFO Mark Garrett says that 2014 is the year that they completed their business model transition. Next year they expect revenue and earnings “to grow sequentially every quarter during the year.” Adobe is running a mature subscription-based business model.

Now let’s take a look at Box, which amended their S-1 filing last week. For the nine months ending in October, Box generated roughly $153.8 million in revenue, compared to $85.36 million during the same window the previous year. They almost doubled their revenue (and their losses are down as well).

Where did they find most of those gains? According to Box it was “an increase in subscription services.” Over 200,000 businesses and organizations are paying Box subscribers. As Phil Libin of Evernote once said, “The easiest way to get one million people paying is to get one billion people using.”

Box still gets hit for their sales and marketing spend; but when placed on a continuum with Adobe, in my opinion they simply represent an early growth-stage subscription business. I predict that Box will have a debut much like Hortonworks and New Relic, which are also on the left side of that subscription continuum.

Hortonworks and New Relic had a great day because savvy, circumspect investors are starting to focus on subscriptions across all industries – not just tech stocks. They’re looking not just at the money that got put in the books this quarter, but also the guaranteed recurring revenue that sets the benchmark for future growth.

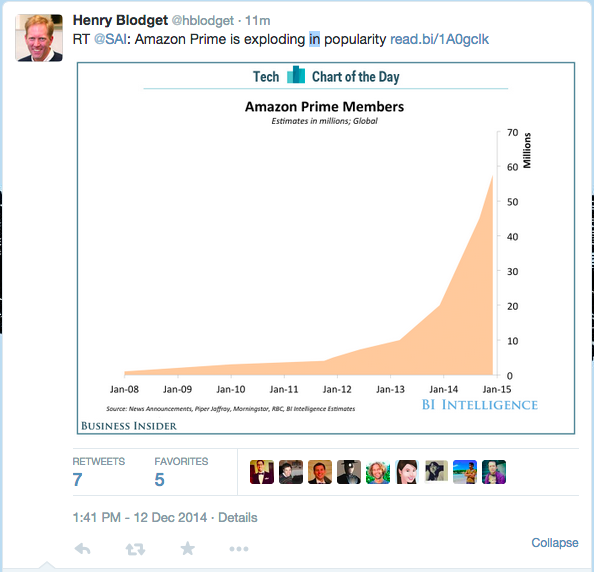

What’s the market for subscriptions? It is the market. From media to connected devices to retail (see Amazon Prime’s growth below) to software (Windows 10?), we’re seeing a broad, systemic shift towards recurring revenue in financial models. 2015 will be the year that subscriptions really break out.

Tien Tzuo is founder and CEO of Zuora. He is recognized as a thought leader in the SaaS industry and founded Zuora in 2007. As Zuora’s CEO, Tzuo has evangelized the shift to subscription-based business models and the complex billing structures they inherit, coining the phrase Subscription Economy. Tzuo was employee number 11 at Salesforce, where he built salesforce.com’s original billing system and held a variety of executive roles in technology, marketing and strategy organizations.