A major impact of the cloud and SaaS models is the trend in the decline of deploying on-premises software. Sand Hill Group has studied this phenomenon for several years in our annual Software CEO / CFO Outlook study. It is piercingly clear from the findings in our 2014 study that software companies’ plans for deployment models will change significantly in 2015.

Recognizing the validity of both on-premises and off-premises models, our study found that customers across the spectrum are giving the green light to new-generation software models and starting to demand these solutions.

In our 2010 CEO / CFO Outlook study, 57 percent of the participating software companies reported they deployed on-premises software. That model dropped in 2011 to 48 percent.

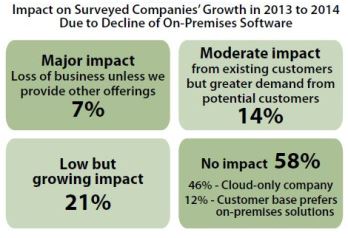

Our 2014 study found 100 percent of the 76 participants still offer on-premises solutions. As the figure below illustrates, they also reported that the impact of the decline in on-premises software has not yet resulted in major loss of business, but there is greater customer demand for off-premises solutions.

© 2014 Sand Hill Group. All Rights Reserved.

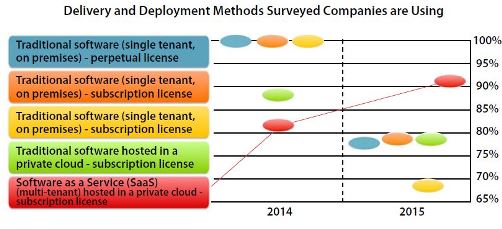

Due to customer demand, companies participating in our 2014 study reported their plans for deployment models will change significantly in 2015. Expect a sharp swing in offerings in a few months, as more than 25 percent stated they do not plan to deploy software in an on-premises model at all in 2015. The figure below recounts planned deployment changes for 2015.

© 2014 Sand Hill Group. All Rights Reserved.

In our follow-up phone interviews with some of the online-survey participants, executives had much to say about the cloud’s impact on deployment models and software company growth. They noted that the trend of customers moving to the cloud has accelerated even since late 2013. They cited the following factors as the biggest drivers of the adoption:

- Continual effort among Amazon and its competitors to drive down costs. This facilitates enterprises adopting cloud for core business functions such as ERP and enables greater speed and frequency of innovation

- More and more executives are getting comfortable with not having data stored locally

- A snowball effect of cloud solutions that can be easily integrated with other current solutions

- Enterprise and SMB ability to accelerate time to market for new apps and competitive advantage

Study participants also discussed the impact on software companies, noting several challenges they face. Nearly all executives cited the challenge of meeting demands for qualified talent. Although this issue has existed several years, the acceleration in cloud and SaaS adoption raises the stakes. As one executive stated, “There is a lot of pressure for software companies to take over markets and build solutions fast.”

Another executive, whose company has been cloud based for a few years, pointed out the difficulties associated with meeting customer needs “more completely” than in the past because new deployment models present a growing number of options for customers and switching costs are lower.

Other participants also brought up the fact that customer demands are changing due to the new deployment models. Solutions need to be easier to integrate into other platforms. They also need to be easier to use from the get-go.

A CEO commented that the new deployment models have created a “show me” market requiring that software companies focus more than ever before on customer satisfaction. Another stated that’s not so easy when customer demands “have really exploded” on the cloud side of software businesses.

Despite the challenges, the new software deployment models hold a lot of promise for growth in individual software companies and the industry. Most participants in our study believe off-premises solutions will drive a lot of growth over the next two to five years.

So what’s next after that? An executive we interviewed by phone as a follow-up to the online survey said the new deployment models and associated pricing models will shift to value-based pricing and “then the software industry will reinvent itself once again.”

The report, “Software CEO / CFO Outlook 2014: The Complications of Change,” provides insights into the challenges software companies face in dealing with differing demands from potential new clients versus legacy solution clients, current trends in value-based pricing, evolving trends in company growth goals and the industry’s future state.

The study included 76 respondents participating in an online survey of quantitative questions during March and April as well as individual follow-up, in-depth telephone interviews with some of the participants, which included some questions not asked in the online survey. CEOs, presidents and chairmen comprised 57 percent of the online survey respondents; of the remaining participants, 17 percent were CFOs, 10 percent were COOs and 16 percent identified themselves in the “other” category. CEOs comprised 70 percent of those interviewed by phone.

M. R. Rangaswami is co-founder and CEO of Sand Hill Group and is the publisher of SandHill.com.