One year ago, Software Equity Group started their 2022 report on M&A trends with a simple observation: the stock market activity was not for the faint of heart. That view led to a much broader inquiry throughout the report into the myriad of dynamics at play and the associated impact on the software M&A market.

So how are Founders and CEOs exercising caution when considering M&A and liquidity events in the face of ongoing economic uncertainty, and is their restraint warranted?

To cut to the chase: it depends. For software businesses with the right profile (more on that later), there is tremendous opportunity in the current M&A landscape.

To better assess the state of the market, SEG analyzed data from our annual survey of CEOs, private equity investors, and strategic buyers, in addition to our quarterly report and our transactions.

HERE ARE SEG’S 4 TAKEAWAYS FROM THE RESEARCH:

1. Cautious CEOs Are Holding Off On Going To Market

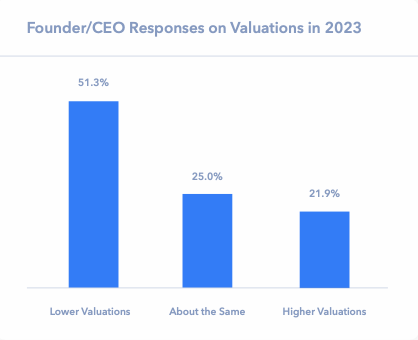

Not surprisingly, the macroeconomic environment has colored their perceptions of the SaaS M&A market. Seventy-eight percent believe valuations are the same or lower than last year, and over two-thirds believe the market will improve in the coming years.

As a result, many are waiting to explore and see what the future holds before going to market.

2. Buyers And Investors Face Shortage Of Opportunities

In contrast to the CEOs’ viewpoint, buyers and investors are finding that the competition is holding steady or getting stronger. They are eager to do deals with high-quality businesses, but there are not as many opportunities available as in 2022.

Meanwhile, 66.7% of strategics say they have seen no change or a decrease in the volume of high-quality SaaS companies in the market over the past year. This supports the idea that high-quality M&A opportunities are scarce in 2023 and high-quality businesses that pursue a liquidity event receive outsized interest from buyers and investors.

3. Growth, Retention & Profitability Are Key

Given the uncertainty in the macro markets over the last 18 months, it is not surprising that buyers have become more risk-averse, and the profile of a highly desirable asset has shifted.

Nevertheless, while revenue growth and retention are weighted strongly, there is little interest in businesses burning significant cash. In 2020 and 2021, the high-burn, growth-at-all-cost model was considered an attractive asset. In 2023, the story has now changed.

4. High-Quality Assets Are Demanding Premium Valuations

The current market represents a classic supply and demand dynamic. When the supply of a good decreases, and the demand for said good stays the same or increases, its price is expected to increase.

Where is the data that supports it?

The answer is hard to find in the public markets. The share prices of public SaaS companies in the SEG SaaS Index have rebounded this year but are still down roughly 36% from COVID-level peaks.

The Nasdaq has sharply rebounded from 2022 lows, due to the “Magnificent 7” companies and excitement over artificial intelligence. Most notably, valuations in M&A deals have decreased by 36%

since 2021.

There Is Good News For SaaS Companies.

It is easy to understand why CEOs are cautious right now, and many are right to be. The landscape has shifted from where it was a few years ago, with buyer and investor priorities shifting as well. It is clear, however, that the deficit of profitably growing assets on the market is working in favor of sellers.

This is due to increasing competition for highly sought-after software companies that display strong revenue growth and retention. One thing everyone agrees on: higher valuations lie ahead.

To read the full SEG review on SaaS M&A: 4 Buyers’ Perspectives, click here.