2021 SEG SaaS Index Summary

The SaaS industry survived its first major pressure test in 2020, ultimately proving its resiliency. Here are a few highlights from Software Equity Group’s sought-after 2021 annual report:

- Aggregate software industry deal volume reached record peaks during the second half of the year, materially outpacing any prior period on record.

• SaaS M&A volume reached an astonishing 425 transactions during 4Q20, representing a 13% increase over 3Q20, and stunning 30% over any prior quarter (326 deals in 3Q19).

• Heightened and sustained buyer demand for SaaS companies drove a breakout in EV/Revenue multiples over the historical trend.

• Private equity investors drove the majority of SaaS M&A deals during 2020, accounting for 52% of all acquisitions during the year.

• Healthcare, Financial Services, and Real Estate were the three most active verticals in terms of M&A deal volume.

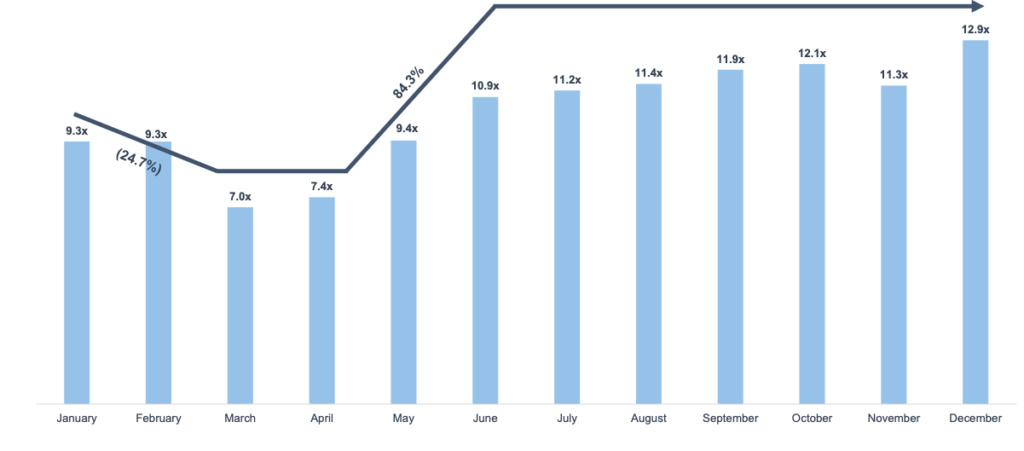

SEG SaaS Index: Public Market Multiples

Monthly: After plummeting in March, the median EV/Revenue multiple for public SaaS companies quickly experienced a sharp V-Shaped recovery by May and climbed to new record heights for the remainder of 2020.

Anual: On an annual basis, the SEG SaaS Index posted a record EV/Revenue multiple of 11.5x in 2020, notably two times greater than the 5.5x EV/Revenue multiple from just four years ago (5.5x in 2016).

For further insights into the SEG Annual Report findings, click here.