Render unto Caesar … I recently met with a client CFO of a $100M software (not SaaS) company and in the course of our conversation she repeated a question her CEO had put to her recently: “Why do we pay so much in taxes; why can’t we pay something more like what GE pays?” It is a good question, especially considering that many software companies are paying at the high end of the tax range, a similar percentage to what a well-established vendor would spend on marketing: 7-10 percent of revenues. So it is worth taking a look at. And most companies don’t put half as much thought or analysis into their tax strategy as in their marketing strategy.

What are the ranges of tax rates that peer software and SaaS vendors are paying? GE isn’t a peer to any software company, and especially not for a $100M vendor with a completely different asset and expense structure. GE, at almost $150B and as one of the most profitable companies in the world, paid only 1.7 percent of revenue in 2012. It reminded me of when Mitt Romney said he paid something like 14 percent of his net income in federal taxes — while I, as a fellow resident of Massachusetts and small business owner, pay three times as much. Would that I had his asset and income structure!

Microsoft, with a similar market cap as GE, but half the revenue at $74B, paid 7.2 percent of revenue in 2012. Oracle, with $37B in 2012 revenues, paid eight percent in total tax. Maybe Bill and Larry ought to have seats at the tax policy table in Washington instead of GE — but that’s another discussion. Perhaps more comparable to GE would be to look at IBM with a mix of manufacturing and software and $105B in revenues; they paid 5.1 percent of that revenue in taxes last year.

We did some quick analysis of tax as a percent of revenue for the software and SaaS industries through our Peer Builder in the OPEXEngine Financial Insights Reports to see what comparables looked like.

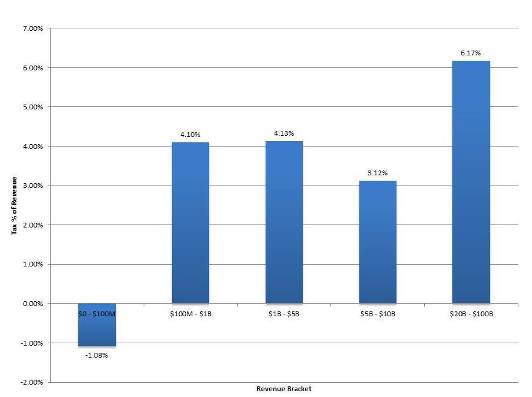

First we looked at the overall software industry (113 public companies — this group did not include primarily SaaS companies) and ran averages for total tax paid as a percent of revenue by revenue size.

The averages reflect a range, especially in the mid-sized revenue group, between $100M and $500M, with outliers in this group like Synchronoss Technologies paying six percent last year, as compared to Solarwinds paying 12 percent of revenue. Here’s the chart of the averages:

FY 2012 Average Tax as a % Revenue by Revenue Size for overall Software Industry

Source: OPEXEngine Financial Insights Reports for Software Peers

Tax comps vary by software industry segment

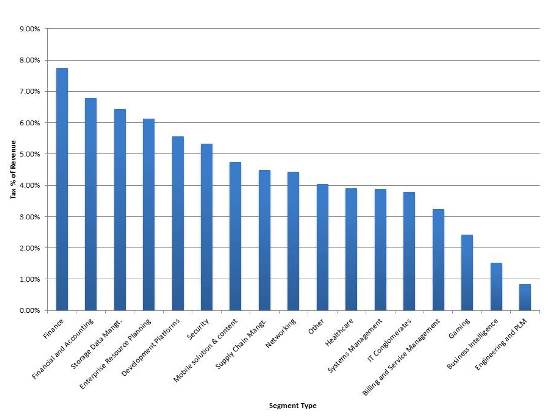

We also looked at the software industry by product type to see what the comparables were by segments. There was a smaller range of numbers and fewer outliers when averaged by segment.

FY 2012 Average Tax as a % Revenue by Software Industry Segment

Source: OPEXEngine Financial Insights Reports for Software Peers

SaaS vendors pay less tax

Now if we look at the SaaS industry, a smaller group of 35 vendors, ranging in revenues from $60M for E2Open to $2.3B for Salesforce, the average for the whole group is 1.23 percent but rises to two percent if Salesforce is excluded. Salesforce paid negative one percent tax for fiscal year 2012 (on an operating profit margin of negative 1.6 percent).

Even when excluding Salesforce, SaaS companies are paying a smaller percentage of revenues in tax than comparable software companies. The SaaS segment is relatively young, with most companies having only gone public in the last five to seven years at the most. And SaaS companies are less profitable as a whole than comparably sized software companies, which correlates to their differing tax spend.

So, the CFO in the beginning of this blog can tell her CEO that, while they are paying far more as a percentage of revenue than GE, they are paying within the range of comparable software companies. Clearly, tax rates do not correlate entirely to revenues and profits, but different industries and segments have different tax rate averages.

“A democratic government is the only one in which those who vote for a tax can escape the obligation to pay it.” Alexis de Tocqueville

Lauren Kelley is CEO and founder of OPEXEngine. She brings 25 years of tech company management experience to OPEXEngine, as well as six years as an international economist at the U.S. Department of Commerce’s Office of Computers. She managed worldwide sales and strategic development for ecommerce pioneer, Art Technology Group, managed 20 countries for Borland Software, and helped build Compaq Computer’s business in Eastern Europe in the early 1990s. Ms. Kelley is currently based in Boston and has previously lived and worked in London, Paris, Munich, Bonn, Berlin, and Kingston, Jamaica. Contact her at lauren@opexengine.com.