Gaurav Bhasin, Managing Director, Allied Advisers

According to Allied Advisors in their Q3 report, last twelve years has been a robust market for M&A and capital raises for technology companies. Lately with volatile markets like we’ve had in 2022 and potentially being on the cusp of a recession, the question of “are the market conditions right” frequently comes up in the minds of investors and executives interested in exploring M&A.

Here are five focus points that will positively impact M&A in a volatile market:

1. Record dry powder capital with Private Equity (PE) and Strategics

Mega funds have been raised and sponsors are sitting on a record level of dry powder, estimated1 to be $1.9T1 as of June 2022; with leverage the amount is as large as $7.5T. While the current market turmoil and increase in borrowing rates have slightly dampened the pace of PE investments, the financial sponsor industry will continue to be a major driver of M&A.

2. Limited private financing and IPO / SPAC makes M&A attractive

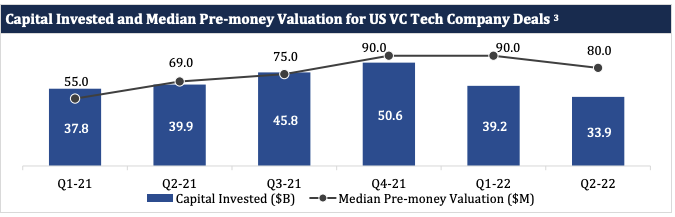

Privately held companies seeking capital for sustenance and growth will be challenged in volatile markets for raising financing. Venture deals for technology companies have been significantly impacted as investors have become more selective, focusing on companies that are able to meet revenue targets, are profitable or have a clear near-term path to profitability. The chart below shows the declines in volume and valuation of VC deals in 2022 as compared to 2021 for technology companies. High profile companies like Klarna recently raised $800M slashing its valuation by 85% per Reuters and there are other late stage private companies which have seen similar down-rounds.

3. Select technology sectors continue to be resilient attracting buyers

Companies with advanced technologies, large addressable markets, great product-market fit, strong

differentiation, mission critical software and superlative teams will do well in M&A and become attractive

targets for strategic and PE. Strategies often do the “buy vs. build” analysis and frequently decide it is better to buy than build and PE firms evaluate how they can bolster growth with capital and disciplined growth.

4. Valuation adjustments gets new strategic buyers out of the woodworks

The rapid rise in private company financing valuation at 50x, 100x or more ARR had many disciplined buyers priced out of the market. We are seeing increasing outbounds from corporate development at these companies to us who are now looking to deploy capital more aggressively into acquiring companies.

5. Run a competitive process and show scarcity

While valuation analysis and current comparable yields a certain baseline value, competition for your company from PE or strategic (ideally both) helps to achieve premium valuation. We have often been in

situations where there is a wide range of valuations when a process is run as strategic, and PE have different abilities to pay and assess synergies differently. Well prepared companies create multiple options by generating multiple term sheets from PE and strategics, thereby making it competitive.

For a further insights on Navigating M&A in Uncertain Markets in Q3 see Allied Advisor’s full report.