Gaurav Bhasin, Managing Director, Allied Advisers

Inflation has surged in the US economy in recent months at 8.5% to its highest level in 40 years and impacted the business environment across practically every industry. Public and Private technology companies in particular have seen their valuations impacted.

Allied Advisers developed this article to provide insights into how inflation impacts technology company valuations and what business executives can do to navigate this choppy environment and suggestions to sustain growth momentum and earnings despite the inflation headwinds.

The inflation rate in the United States has swung from less than 1% during the peak of the Pandemic to 8.5% currently, the highest since 1981.

As a consumer, you have felt the bite of inflation while filling your car with gas unless you drive a Tesla! Inflation has also taken a bite out of technology stocks. It is not a coincidence that technology stocks have taken a severe fall during the recent rapid rise of inflation. There are very specific reasons why technology stocks decline during high inflationary periods.

Here are four reasons inflation erodes a technology company’s value:

- Increase in borrowing costs: Variable rate debt on company books becomes more expensive as interest rates rise with inflation, reducing net income. However, debt could still be a cheaper financing option compared to equity.

- Increase in supply chain costs: the rising prices of components and logistics have a deleterious impact on production economics at technology companies. For example, semiconductor chip shortages and resulting price escalations have substantially increased cost of goods for companies like Apple (-11%) Microsoft (-18%) and Roku (-58%)

- Increase in labor costs: inflation causes companies to increase employee wages to retain talent, especially in hotly contested areas like R&D, sales and engineering, resulting in an increase in cost of sales (resulting in lower gross margins) and operating expenses (resulting in lower operating profits). Wage inflation creates headwinds to high growth technology companies that rely on not just retaining but also growing headcount in critical areas to drive revenue acceleration.

- Increase in G&A costs: “keep the lights on” expenses like rent (though hybrid work due to COVID has helped reduce rent), utilities and insurance escalate in an inflationary environment, chipping away at cash and profitability

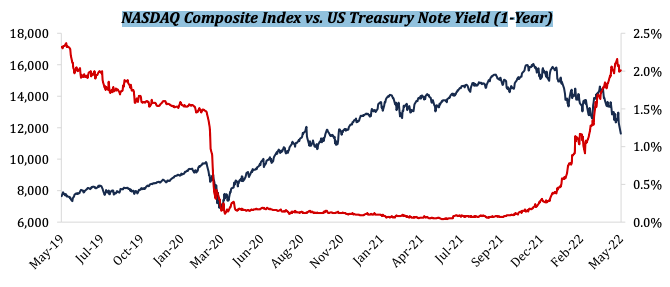

As inflation causes nominal interest rates to rise with monetary tightening, the present value of those future cash flows decreases since the discount rate (or the cost of capital) has increased. The

markets are always forward-looking, so software companies that derived most of their value from future growth have suffered the greatest declines in market price.

For a further insights on inflation and details on NASDAQ’s Composite Index vs. US Treasury Note Yield (1-Year) – click here for Allied Advisor’s full article.