Participants in Sand Hill Group’s 2014 study on software industry trends indicated strong growth over the next two years for their businesses. Seventeen percent of the executives reported their planned revenue growth for the next 12 months is 100 percent or more, and 15 percent said their planned profit growth is 60 percent or more. That makes management of financial processes all the more crucial. Yet the study also shows that software executives encounter significant challenges in such processes as visibility, accuracy and efficiency in the Procure-to-Pay process or in delivering real-time, relevant information to all stakeholders.

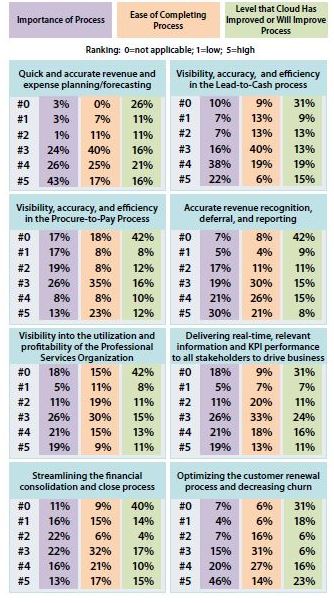

The study asked participants to rank three aspects of managing their financial processes: importance of the process, ease of completing the process and their opinion on how cloud computing could or has improved the process. The figure below from the report, “Software CEO / CFO Outlook 2014: The Complications of Change,” points out that the majority ranked “optimizing the customer renewal process and decreasing churn” as the most important aspect. The majority also reported that the “ability to streamline the financial consolidation and close process” has the lowest level of ease.

Surveyed Companies’ Ranking of Financial Processes

© 2014. Sand Hill Group. All Rights Reserved.

Let’s look in detail at how a cloud solution can improve some of these financial management processes.

Optimizing renewal and decreasing churn. The survey respondents ranked this process as #1 in importance and more participants identified it as the process that can realize the greatest improvement through the cloud.

To reduce churn businesses need to keep customers happy. A cloud solution makes it easier to move quickly to collect and analyze customer data from multiple sources and systems (e.g., CRM, surveys, news stories from the Internet, marketing systems, etc.). Your financial system must be able to receive information from your other business systems and processes. You can enter information the old school way, manually, or you can go the modern route with a cloud solution that automatically updates.

Checkpoint: Does your solution integrate seamlessly with the business systems you have in place today? Is it ready to integrate with any new applications you may want to add tomorrow? Are you free to choose your business applications based on functional fit, not integration concerns?

The cloud also makes it easier to create and manage online customer communities for better support, peer interaction, and training — all of which increase renewals and decrease churn. Nobody likes getting information from five-page reports or month-old PowerPoint charts. But everyone benefits from up-to-date information, anytime, anywhere access to better insight that allows faster responses to customer happiness threats.

Choose metrics that matter the most to each person such as customer satisfaction, churn and upcoming renewals, and then let your solution provider populate the dashboards with live data.

Checkpoint: Do your reports and dashboards convey the big picture at a glance? Can your reports and dashboards be tailored to each stakeholder? Can you add Performance Cards to quickly see trends in your key metrics?

Revenue and expense planning/forecasting. Survey respondents ranked this process as second in importance and the easiest to do. Even so, they agreed that the cloud can improve the process.

The cloud enables greater security and stability for complex forecasts. Spreadsheets can become corrupt, be deleted accidentally and have limits to their scale in size and the amount of computer processing required to manage them. The cloud eliminates these hurdles.

Moving to the cloud also improves version control. Users never have to email spreadsheets back and forth, managing conflicting versions. Everyone can access the forecast in the cloud anywhere, any time.

Checkpoint: Does your planning/forecasting solution allow you to track and report data using as many different dimensions (attributes) as you choose? Does it allow you to compare an unlimited number of actual, budget and forecast scenarios, giving users incredible business insight?

Visibility into the utilization and profitability of the Professional Services Organization. The surveyed executives stated this process is the most difficult to do. Here’s how cloud can improve it and make it easier:

- Easily establish the proper workflows for entering, reviewing and approval time and expenses from any device, anywhere

- View real-time dashboards to understand the progress and profitability of each client and project

- Integrate with front-end systems like Salesforce CRM, using Web services and standard APIs in the cloud, which avoids duplicate data entry and allows you to keep an eye on sales bookings and contracts

Checkpoint: Does your solution show you the true costs of past projects so you can make smarter project bids? Does it integrate with your CRM system so you can see what’s coming in the pipeline, line up the right people and materials and turn bids into projects without manual data re-entry? Does it include billing automation that helps you generate project invoices in the right format, using the right terms and for the right amounts? Finally, does your solution keep revenue recognition separate from billing and automate calculations and postings for you based on milestones, schedule or percentage completion?

Delivering real-time, relevant information and KPI performance to all stakeholders to drive the business. The pressure is on CFOs to provide faster and more granular visibility into what’s driving company performance. As the above figure on ranking of financial processes shows, respondents said this is the second most difficult process. They also agreed that cloud computing can improve the process.

First of all, cloud solutions were built in the modern era, with a focus on intuitive user experience. They enable financial dashboards that convey the real-time big picture at a glance, which can be tailored to each stakeholder and accessed anywhere, any time, on any device. In addition, the chart of accounts can be simplified or expanded without compromising reporting flexibility.

Checkpoint: Does your solution track operational and financial data by business driver to give you superior reporting power and a complete view of your organization? Can you — with just a click — create any kind of report, dashboard or visualization you want — with exactly the metrics that matter to investors, executive teams and leaders in finance, sales and other departments? Can you get fast answers to your business questions?

Procure-to-Pay process. The majority of survey participants indicated ease of use with this process. Nevertheless, cloud computing can improve it. The cloud makes it easier to configure the approvals process that works for your business, thus requiring less reliance on IT or expensive consultants.

Checkpoint: Can you track and view payments, approvals and reports anytime, anywhere? Can you see your accounts payable liabilities, vendor aging reports and bill and check register reports in real time?

Does your solution automate configurable processes that enhance internal controls? Does it allow you to define the workflows, approvals and internal controls to align with the way your business operates? Do you have visibility into the entire accounts payable process to ensure accountability?

The Sand Hill survey also asked CEOs and CFOs about the methods they expect to use during the next 12 months to improve their financial processes. Nearly one-third (32 percent) indicated they will invest in new systems over the coming year, as follows:

- 11% – Implement a budgeting, planning and forecasting solution

- 8% – Implement a new financial management system

- 8% – Implement a financial reporting and analysis solution

- 5% – Add on or re-implement existing financial management system

When considering investing in a new system, choose a cloud solution that offers all the benefits described in the “checkpoints” above. Make sure the financial system you select gives you the best management reporting and will enable you to make confident decisions as you grow your business.

Robert Reid is CEO of Intacct Corporation, a leading provider of cloud financial management and accounting software. With more than 30 years of experience in the software industry, Rob has a proven track record of driving explosive growth at innovative companies, and has demonstrated a deep expertise in bringing cloud computing to the world of business applications.