The notion of mobile business intelligence (BI) has been around for more than a decade, but until recently the technology and culture weren’t ready for users to embrace it. In fact, that was still the case in 2010 when we conducted our first mobile BI study; we were early in the market and few people recognized the coming impact. Just two years later mobile BI is now mainstream, and our 2012 study shows that some users conduct business intelligence activities exclusively on mobile devices.

A few findings jumped out to me as notable in our 2012 Wisdom of Crowds® Mobile Computing / Mobile Business Intelligence Market Study. The first is the growing sophistication in use of mobile business intelligence. For the first few of our studies, almost all of the activity was around viewing content. People wanted to look at reports, look at key performance indicators and maybe get some alerts. Now many are beginning to request features like navigation and interaction.

Folks using mobile BI are doing so in a more dynamic way than ever before, so they want to filter information and drag and drop and drill down and navigate. This is very encouraging for the industry, as it means that more users are getting more value out of business intelligence solutions.

Although mobile BI is starting to filter downwards within organizations, the top consumers remain primarily executives. This is encouraging, since once execs realize value from business solutions, they want others to benefit too and push it down throughout their organization.

One of the surprising findings in this year’s study is that participants indicated less interest in automating customers and suppliers than in the past. When we first started serving the market back in 2010, the organizations participating in our study seemed to suggest that customers and suppliers were in their future for mobile BI. But this year they seem to have pulled away from that, instead focusing very heavily internally. Given the impact that mobile BI has had in organizations, I think they’re trying to drive it further down to line managers and individuals and have defocused on customers and suppliers. I think there is more value in their minds to getting more internal constituents automated with it.

Organization size makes a significant difference in BI

Large organizations represent 22 percent of the participants in our study; 43 percent were midsize, and 35 percent were small organizations. The study reveals important differences in mobile BI adoption according to organization size. The biggest areas of change are coming from the smallest of organizations; indeed, they are driving much of the change.

Smaller businesses (1-100 employees) are able to adapt to the market very quickly. Anytime they can drive a wedge in a market and turn it into a competitive advantage, they will do that. Agility is their greatest strength. Our study found almost twice as many small business participants as midsize and large organizations view mobile BI as “critically important.”

The findings show a U-shaped adoption curve. There is certainly intent on the part of the largest organizations, but it takes them a lot longer to implement BI solutions and of course it’s much more costly. With fewer employees, small organizations can execute quickly execute. Midsize organizations are stuck in the middle; although they have clear interest in mobile BI, they don’t have the agility of a small organization or the resources of a large organization.

We found that the smaller organizations also have the highest degree of cultural readiness for mobile BI. What makes them prepared? They’re already using and are comfortable with mobile technology. From our survey results, we know that executives and sales and marketing are probably the most culturally prepared for this than IT. Retail is the most culturally prepared vertical industry for mobile BI.

An important trend among the small organizations is that they widely connect to the public cloud. There is real synergy between cloud-based BI and mobile BI. Small organizations are a natural fit for public cloud implementations of BI.

Mobile BI penetration

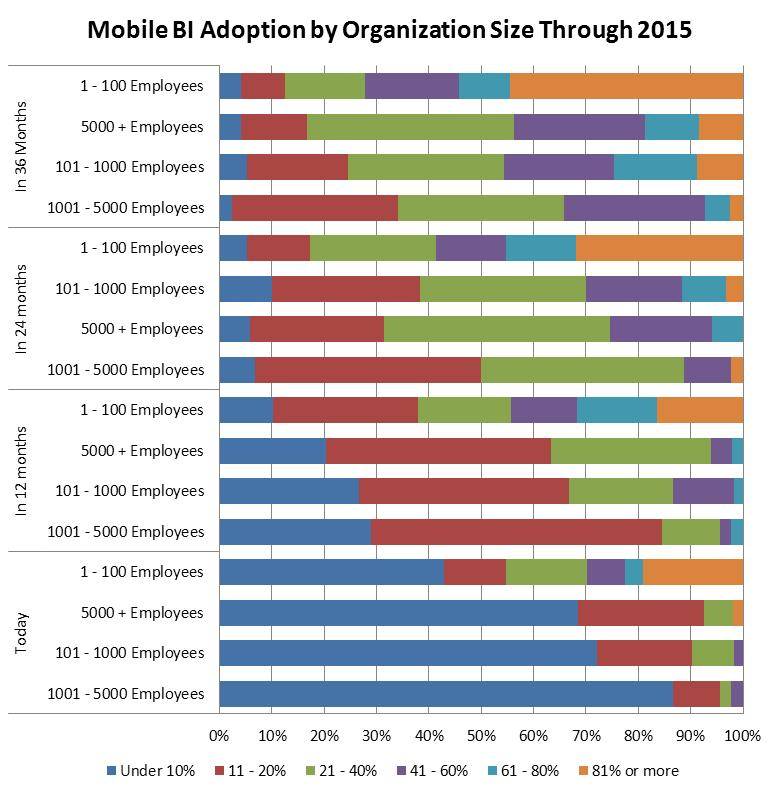

Penetration of mobile BI today is fairly modest. A majority of organizations report that fewer than 10 percent of users have access. Penetration is less than 10 percent today for 48 percent of small organizations and for 87 percent of large organizations. But 20 percent of small business participants report that their mobile BI penetration is 81 percent or higher. So penetration in the small organizations is significant today.

But our data, as displayed in the figure below, reveals that organizations of all sizes say they will be using mobile BI substantially by 2015.

Whether or not they will succeed with these plans is hard to say. But 12 months out is a reasonable planning horizon with budgets likely already allocated, and the figure shows that more than half of even the largest of organizations will be in the 11–20 percent band.

A significant finding is the number of organizations planning exclusive mobile usage of BI solutions. Seventy percent state that more than 11 percent of their BI usage will be exclusively mobile by 2014. Can we realistically expect to achieve this penetration by 2014? I think it’s unlikely. But several factors at play might get us close. One is the consumerization of IT. People are bringing their personal smartphones and tablets to the office and using them in a business context. The other thing is the generational change. For younger generations of users, the tablet is their preferred device, not just for consumption but for interaction, even as they move into the corporate world. So mobile BI is inevitably where we’re headed.

Security and data storage

Security capabilities inevitably will evolve. The industry has to become more sophisticated and organizations have to also invest in not only the technology but also the skills to manage all the devices that are out there. This is not a new problem, but there will be so many more devices out there that will potentially have sensitive information on them.

Some organizations have responded to this by not allowing local data or applications to be stored. Certainly industries like healthcare and government prefer more of an HTML5 or browser experience and do not want to see data downloaded onto devices. Our study found a split in vertical industries as well as company size around the decision of where to store data. More than 50 percent of large organizations say storage must be server based and not on the mobile device. But 60 percent of participants from small businesses say storage on mobile devices is fine.

Augmented reality

We added some new focus areas such as social media and augmented reality in this year’s study. A participating retail organization explained its use of augmented reality. People can go into one of their stores and use their mobile device to actually see products in their home setting. Over time I think we’ll see more and more of this kind of capability as organizations sink their teeth into mobile technology and start realizing what the devices and technology are capable of. That’s what creates the demand for the second and third implementation of mobile BI. Some retailers are on their fourth implementation. And that’s where much of the innovation is coming from.

Implementation trends

Each year when we look at the data from the previous year’s study, we see that organizations usually fall short of the BI plans they had. That was true this time around, too. They were very ambitious the previous year regarding their plans for 2012. Actual results show that they certainly moved the needle but not as much as they had expected.

Our 2012 study shows that participants are very ambitious again for 2013. I think the delta between ambitions and actual implementation will continue to close and we’ll see greater precision next year. They will probably fall short of their goal, but they’ll probably do better than the previous year because organizations are starting to realize what’s actually involved in delivering mobile BI in a meaningful way.

Another factor in coming implementations is the younger generation. Although organizations aren’t hiring a lot of new people right now, eventually they will when the economy picks up. As more and more college students enter the marketplace, they’ll go right to mobile and mobile BI.

The 81-page report on the 2012 Wisdom of Crowds Mobile Computing / Mobile Business Intelligence Market Study® includes information on mobile app priorities by organization size and industry, purchasing trends, user sentiment and plans for the future, enterprise mobile management, perceived benefits and limitations, importance of mobile BI by organization size and industry, targeted users, adoption, features, which vendors have the most complete/compelling mobile BI offering and more. Additional information can be found at www.dresneradvisory.com.

The Wisdom of Crowds® Mobile Computing / Mobile Business Intelligence Market Study was conceived and executed by Dresner Advisory Services, LLC, an independent advisory firm, and Howard Dresner, its president, founder and chief research officer. Howard Dresner is one of the foremost thought leaders in Business Intelligence and Performance Management, having coined the term “Business Intelligence” in 1989. He has published two books on the subject, The Performance Management Revolution — “Business Results through Insight and Action,” and “Profiles in Performance — Business Intelligence Journeys and the Roadmap for Change.” Prior to Dresner Advisory Services, Howard served as chief strategy officer at Hyperion Solutions and was a research fellow at Gartner, where he led its Business Intelligence research practice for 13 years.