Small and mid-sized enterprises are driving the business intelligence market today and BI vendors are scrambling to create offerings for the SME market. Our recently released report on findings of our Wisdom of Crowds® Small and Mid-Sized Enterprise Business Intelligence Market Study examined trends and BI penetration in this market, SME use of BI tools, vendor assessment and how their SME BI priorities differ from large enterprises.

Out of a total of 1,182 survey participants in our broader 2013 market study, we segmented responses of 523 SMEs comprised as follows:

- Small enterprises (1-100 employees) — 250 study participants

- Mid-sized enterprises (101-1,000 employees) — 273 participants

The study found that the adoption of business intelligence tools in small enterprises has been a trickle-down effect from the large organizations market over the past six to 10 years. About one-third of small enterprises and more than 20 percent of mid-sized enterprises have used BI products in the past three to five years, and the lion’s share have only one or two years of experience.

The affordability of BI products today compared to five or 10 years ago is a significant factor in SME adoption. Ten years ago, they either used spreadsheets or had to buy into the large-footprint enterprise software products. Today there are inexpensive downloadable mobile and cloud BI tools.

Like large organizations, SMEs’ most-sought outcome of business intelligence is “making better decisions.” However, SMEs place a higher priority on revenue growth and competitive advantage stemming from BI than larger organizations, which are more concerned with an outcome of increased operational efficiencies.

SMEs drive the cloud BI market

More than 30 percent of the SMEs studied use hosted BI solutions from public cloud providers. That’s a significant contrast to the 10 percent of large enterprises. Even though adoption is still nascent, smaller organizations are much more aggressive in their use of cloud BI solutions because it’s far more economical for them and it’s easier for them to get things up and running much more quickly than large enterprises. Cloud BI has a leveling effect; they can do things that their larger competitors can do, but at a fraction of the cost.

Clearly smaller organizations are the most aggressive and ambitious when it comes to cloud-based deployment today. Even so, the majority of SMEs stated that they currently have no plans for cloud computing past 2014. This is partly because there are a lot of downloadable apps already sitting on desktops and laptops, and those won’t go away soon. In fact, there are even some free options out there.

Another factor is that there is still a lot of fear, uncertainty and doubt in the marketplace for cloud solutions, and cloud BI in particular. A greater percentage of smaller organizations reported that they plan to use the cloud after 2014 than large organizations; but overall the market is still somewhat tentative about public cloud-based deployment. Technology adoption usually follows an evolutionary path, but it takes a little more thinking and a little more convincing that cloud is a safe way to proceed. SMEs are subject to that as well, but not quite as much as the large enterprises.

I believe a year from now when we study the cloud BI market again the number of implementations will increase for SMEs. I think implementations will increase across the board this year, but particularly in SMEs. Perspectives and markets change. And ultimately we’ll all end up in the cloud. That’s just the way it’s going to be unless something tremendously disruptive comes along to change that. The cloud is where all the innovation is today and will occur in the future. If organizations want to tap into that innovation, they need to be in the cloud.

BI management

Executive management drives SMEs’ BI initiatives decidedly more than in large enterprises. The chain of command is a lot shorter because they’re smaller. And often the owner advocates it, so it’s more likely that things will happen much more quickly. Also the scope is much narrower in a 100-person organization versus a 1,000-2,000-person organization.

In writing my last book, “Profiles in Performance, Business Intelligence Journeys and the Roadmap for Change,” I focused predominantly on small organizations. I figured it would be very difficult to find a large organization with what I called a “performance-directed culture.” In fact, for the most part, that was true. It’s really hard to find large organizations that can be as agile as a small organization. They do exist, but they are few and far between. So most of the case studies in the book are predominately SMEs, and their senior management team gets involved to make things happen.

When senior management drives BI initiatives, change management is easier to deploy and the odds of successful BI initiatives are much higher. And our study clearly evidenced this success factor.

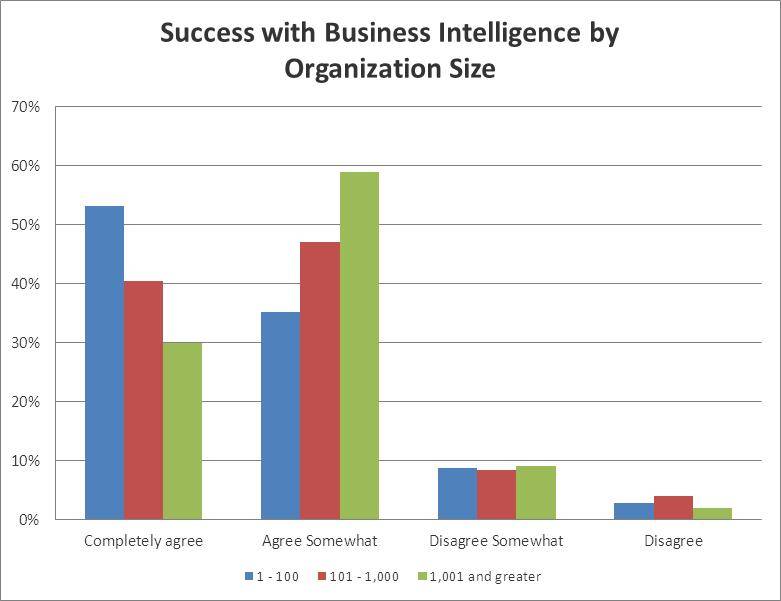

According to our SME BI study, smaller organizations perceive themselves to be more successful with BI initiatives than larger organizations. As the figure below shows, small enterprises were the highest percentage of organizations reporting that they “agree completely” that their BI experiences have been successful. Mid-sized organizations were more likely to “somewhat agree.”

The numbers in the above figure are striking; but they make sense. I think small organizations tend to be like the Native Americans and the buffalo. When they took down an animal, they used every part of it for their very survival. When small organizations invest in technology, they will get the full value out of the investment. In many cases, it’s the owner’s investment and comes out of the profits of the organization.

One of the case studies in my book is about a mid-sized manufacturing company in west Texas. Its owner for a quarter of a century is also a great CEO. He runs the organization very well and is very well respected. He makes sure that they get a return on their investments in technology and they get it pretty quickly because it comes out of his pocket. All the employees are motivated to make sure the company gets the value from those investments, and they don’t take this responsibility lightly. They are very serious about turning a profit, and if technology won’t facilitate that objective, the company won’t invest in it.

SME priorities for BI functionalities

Compared to our 2012 Wisdom of Crowds Market Study, SMEs in 2013 reported that mobile device support, SaaS and dashboards are the areas of highest interest. Open source declined as a priority since 2012, as did Big Data and complex event processing. SMEs’ place SaaS/cloud and mobile device support as a higher priority than large enterprises.

SMEs have far less interest (3.5 as a weighted mean) in data warehousing (DW) than larger organizations. Heretofore, they had to bring in MySQL or SQL server, which is a significant investment for smaller organizations and not core to their business. Today SMEs find other ways to address the data warehousing need such as using in-memory structures and cloud solutions.

Trends in user penetration of BI

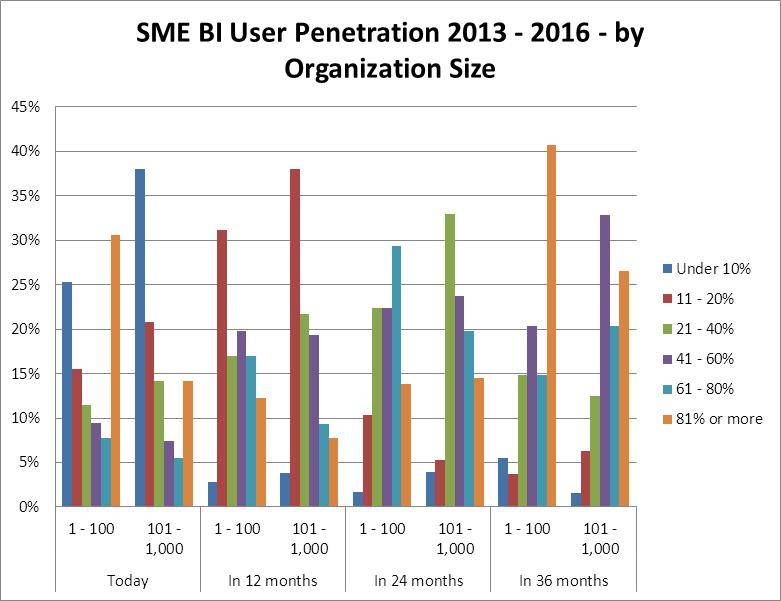

SMEs (especially small organizations) reported much higher user penetration of BI than larger organizations. They also have higher expectations for further user penetration over the next 12 months than large organizations.

The study found that small organizations expect the greatest penetration in the coming 36 months while mid-sized organizations expect middle digits overall. Mid-sized organizations lack the resources of large organizations and the flexibility of the small ones. To some degree they are sort of held captive by their previous investments in systems, databases and traditional enterprise solutions. Because their data are in their on-premises systems, to some degree they are reliant on what their ERP or operational system vendors offer. Their existing investments hold them back and they can’t afford to spend millions more like large enterprises that can afford to rip and replace.

I expect that greater penetration in the mid-sized enterprises will happen around the edges. But it won’t be as evident or happen as quickly as in a small or large organization. Around the periphery I suspect users are using downloadable BI apps and extracting data into them, but it’s probably not an enterprise program per se.

SME adoption of BI tools

More than one-third of the study’s SMEs reported that they only use one tool, despite the availability of downloadable and free apps. In small organizations, there is much more coordination and the people using BI are much more likely to talk to each other. They are much more aligned and tend to deliberate more about the selection of tools. Even if they want to experiment with BI tools, they tend to do it in a more coordinated fashion.

By contrast, large organizations have communication disconnects and therefore more people using different tools. It’s not unusual for them to have 10 or more BI tools or even not know how many tools their users have adopted.

Although large organizations can achieve tool standardization, C-level executives must drive that effort to winnow BI tools down to a manageable number of products.

The culture contrasts in the decision process for BI adoption between SMEs and large enterprises presents a clear message to BI vendors: If you’re dealing with a small organization, don’t try to play them or work on one functional area and try to exclude others from the discussion. They will talk to each other. In larger organizations, vendors have a better shot at getting in the door by focusing on one function (such as finance, IT or sales and marketing). But that’s hard to do in a small organization because they are more coordinated and very well aligned with the business.

Not the same thing next year

As I mentioned earlier, vendors are scrambling to create offerings that address SME priorities. Typically when vendors begin focusing on a market, it takes a couple of years to have an impact.

How will our 2014 SME BI study findings differ from 2013? I think changes in the market this year will be incremental — but noticeable and significant. As the SMEs now drive so much of the industry, it’s worth paying attention to their priorities.

The report on the 2013 Wisdom of Crowds® Small and Mid-Sized Enterprise Business Intelligence Market Study is available at www.smebireport.com. The report includes a Consumer Guide for SME BI, departments and functions driving SME BI, BI objectives by function in SMEs, BI tools in us in SMEs, vendor assessment scores, and more.

The Wisdom of Crowds ® Small and Mid-Sized Enterprise Business Intelligence Market Study was conceived and executed by Dresner Advisory Services, LLC, an independent advisory firm, and Howard Dresner, its president, founder and chief research officer. Howard Dresner is one of the foremost thought leaders in Business Intelligence and Performance Management, having coined the term “Business Intelligence” in 1989. He has published two books on the subject, “The Performance Management Revolution — Business Results through Insight and Action,” and “Profiles in Performance — Business Intelligence Journeys and the Roadmap for Change.” Prior to Dresner Advisory Services, Howard served as chief strategy officer at Hyperion Solutions and was a research fellow at Gartner, where he led its Business Intelligence research practice for 13 years.