While wreaking havoc on various industries, Amazon’s path of disruption provides great examples, insights and strategic growth lessons for almost any business. With a focus on how to better serve customers, Amazon has created new value and innovative business models while disrupting other companies and industries.

While wreaking havoc on various industries, Amazon’s path of disruption provides great examples, insights and strategic growth lessons for almost any business. With a focus on how to better serve customers, Amazon has created new value and innovative business models while disrupting other companies and industries.

In this follow-up article to Amazon Style Disruption: Learning from the Masters, I’ll pick up on Amazon’s monetization and expansion strategies. As we saw in part 1, Amazon has excelled at vertical and horizontal integration. It leveraged its expertise in fulfillment and logistics to integrate vertically back through its supply chain. It has spanned the entire value delivery system from the one-click ordering through its own e-commerce systems and Amazon Market Places, all the way back through outsourced delivery providers, highly optimized distribution centers, leased aircraft fleets and freight forwarding companies, and manufacturers’ shipping docks.

Horizontally, Amazon has also continued to move into many different product categories and geographically into many countries. A great example is Amazon’s push to recruit Indian merchants. It plans to spend over $5B in the next few years while bringing India’s 1.3 billion people into Amazon’s market. Fully 27,000 Indian sellers are bringing 75 million products online.

Amazon will help these small sellers offer their wares in the US with everything from warehousing to shipping and even ad buying while charging fees that approach 30%. In this one initiative alone, Amazon is bringing new products, from new sellers to foreign markets and offering them at lower prices while taking a profitable cut of all the transactions and services. And they also eliminate some of the traditional middlemen in this disruption.

Two Examples of Amazon’s “Value Creation” Strategies

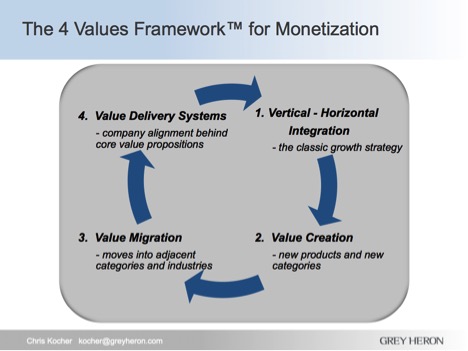

Now let’s dive into Amazon’s “Value Creation” – the second of Grey Heron’s Four Values Framework* a structured approach to developing new growth and monetization strategies for our clients.

Value Creation, unlike horizontal or vertical integration, is really about creating something entirely new – a completely different product, service or even an entirely new category. There are numerous examples of Amazon’s Value Creation but two are particularly noteworthy: the Echo/Alexa platform and Amazon Prime.

1. Amazon Echo/Alexa – Smart speaker or entirely new platform and UI/UX?

The first Amazon Echo was introduced in 2014 to little fanfare. Since then it has grown into a full product family with about 20 variations and has sold about 15 million units. It has created a whole new category of product. Google, Apple, Microsoft, and Samsung despite their technology and market presence are struggling to catch up. In Apple’s case, they have yet to ship their first Siri powered speaker, due out soon. (See The Empire Strikes Back in Amazon-Google Battle Royal over Smart Home for more insights on this topic.)

Although this product category of smart speakers didn’t exist until 2014, Gartner is predicting this will be a $2.1 billion dollar market in 2020. Companies like Bose and Sonos have seen their sales negatively impacted and altered their strategies. Sonos is even licensing Alexa for some of its products.

Even though this is a huge new market, it may be the tip of the iceberg. This isn’t just a new product – it’s really a natural language, AI-enabled, voice interface platform. It will become the battleground of many of the largest tech companies. All of them need to have a horse in this race. (For more in-depth analysis on this looming platform battle see my article: Amazon’s Tectonic Impact on the Developer Community- the race to AI-enabled, Natural Language, Voice Interface Platforms.)

This is a battle over a much bigger space than just speakers. As voice interfaces expand from smartphones to smart speakers, TVs, radios, cars, refrigerators and all sorts of household and building appliances, it will become a natural way to interact with all kinds of devices.

And Now, Alexa for Business – Amazon comes to the Office

Amazon announced at their recent November re:Invent conference a whole slew of new Alexa offerings for the office. Building on the Alexa platform, these new products will take them into the enterprise market and complement their already dominant AWS cloud platform. Amazon is enabling all kinds of new functionality with over 20,000 skills built into Alexa. It is also linking to many mission-critical enterprise applications like SAP Concur, SalesForce, Microsoft Exchange, Ring Central, Success Factors and others.

In addition to integrating with established leaders in the enterprise and offering toolsets for developers, Amazon is helping those developers and partners generate new revenues – one of the most critical aspects of building an ecosystem and securing developer support.

Amazon is enabling “in-app” or “in skill” monetization by letting users buy add-on products and services within these new applications. (For more detail, see Amazon adds in skill purchases.) This will help secure more developers that build more capabilities, attract more partners and excite more customers to use the Alexa platform in a virtuous cycle – often called the Flywheel Effect.

Essentially Alexa and other natural language voice interfaces will help power ubiquitous connectivity and computing wherever you are, on whatever device you are interacting with. In the long term, these will be transparent and just embedded into all types of “things.” In fact, these Voice UIs will help accelerate the adoption of the Internet of Things (IoT). And of course, all of this capability coupled with easy access to skills, applications, and content will provide a gateway for ordering more supplies and products from Amazon.

It also means that Amazon and the other big tech players need to woo the developer community to create new applications/skills using voice on these platforms or updating existing applications to support them. Developers will need to rethink their UI/UX strategies as they consider hybrid use cases and user interactions between multiple mediums: audio, video, images and text across phones, tablets, PCs, and other devices.

Implications for Tech Marketers

Amazon created an entirely new value offering in its Alexa-powered Echo smart speakers. That is hard to do. They also have expanded that into a complete product line with different price points and functionality. Originally targeted at the “Connected Home,” it is now extending these products horizontally into offices and business.

At the same time, they are solidifying a large ecosystem of partners that are building apps, skills and even new licensed hardware devices around Alexa. Furthermore, they have recruited thousands of developers to their platform. Not just by providing specifications, documentation, training, and other support, but more importantly, providing a path to monetize these new offerings on the Alexa platform.

So a key lesson here is whether you are creating a new category or have a new product in an existing category, consider how to leverage everything you do. Build out an ecosystem or work with key players and partners in an existing ecosystem to motivate them to support your efforts. Reinforce the platform and provide new value to your customers that further instantiates your platform while incenting your partners with new ways to easily monetize their offerings.

And if you’re developing a new hardware device, software, service or some kind of content, you should examine whether you can leverage Amazon or other vendor’s platforms in some fashion to offer a more comprehensive service to your customers.

2. Amazon Prime – Shipping service or membership club?

Is Amazon Prime a shipping service or a membership club? This is a little like the debate in the old Miller Lite TV commercials between “tastes great” and “less filling.” Like the beer, it’s a little of both.

Some people may think of Prime as just a $99 per year, free two-day shipping offer. In reality, it has many of the properties of a membership club with preferred benefits and customer loyalty: free two-day shipping, Amazon Music, Prime Video (videos and TV) and other services.

Some people may think of Prime as just a $99 per year, free two-day shipping offer. In reality, it has many of the properties of a membership club with preferred benefits and customer loyalty: free two-day shipping, Amazon Music, Prime Video (videos and TV) and other services.

However it is defined, this continually enhanced offering has created entirely new value for customers, strong brand loyalty and a powerful revenue engine for Amazon. With between 60-90 million members, the membership fees of this offering alone generate from $6-9 billion per year.

Also, note that the lock-in to Amazon Prime drives much higher reorder rates and brand loyalty. The average Prime member buys $1,300 worth of products per year vs. $700 for a non-prime member.

This also helps to explain why the new physical Amazon retail bookstores provide Prime discounts for books sold in-store. Whenever you look up a price at an Amazon bookstore, you see the regular price and the Prime member cost, with a substantial discount. For anyone who is not a member of Prime, this is a compelling incentive to sign up.

The stores themselves may not be that profitable, but they are optimized for signing up more Prime members that will have much higher Lifetime Values (LTVs). In a sense, the physical store is a kind of “loss leader” or seeding strategy to get people to sign up for Prime. This is very similar to the classic “razor and blades marketing” approach: Sell the razors cheaply and get users to continually buy the blades for a long-term revenue stream.

Extending Prime to students and business is another great horizontal move that builds on the new “Value Creation” of Prime. It is offering new pricing and bundles to reach new audiences and segments. Business Prime which was announced in October 2017, offers membership bundles of 10 for $499 or 100 users for $1299 bringing membership down to a new price point.

With this latest move, it accomplishes two things. First, it jumpstarts Amazon’s entry into the overall office supplies and business products market that is expected to reach $1.2 trillion by 2021. Second, it reaches a new audience of Amazon Prime users at work with discounted memberships. And they will all start to spend more money with Amazon, at work, and at home.

Implications for Tech Marketers

Prime is a great example of taking a simple and required shipping service and combining it with other value-adds (content and entertainment offerings). Even with no new technology, Amazon has created a whole new offering that generates significant revenues and increased customer profitability.

They started by turning shipping, which many companies think of as just a cost center, into a membership club to achieve a steady renewal subscription revenue stream. Then by adding more engaging content, they achieved a degree of “lock-in” with their members who spend on average $600 more annually than non-members.

This approach to bundling your own, and in some cases third-party offerings, has the capability to increase average sale size, customer retention, and long-term revenue growth. Do you have bundling revenue opportunities you should take advantage of?

Chris Kocher is a co-founder of Grey Heron, a management and strategic marketing consulting firm. He has 30 years in both strategic and hands-on operating experience helping executives and investors build revenues and shareholder value. He has consulted with over 130 companies on innovating with new business models, product strategies and monetization. Chris has held management positions at HP and Symantec in addition to advisory roles at startups. He has worked extensively on monetization, SAAS, IoT, ecosystems, partnerships and accelerating growth in new business initiatives. Email him at kocher@greyheron.com or follow him on LinkedIn.

* The Four Values Framework (4Vs) ™ is a structured approach to developing new growth and monetization strategies developed by Grey Heron Venture Consulting. It has been used with multiple companies to identify Vertical and Horizontal integration approaches, new Value Creation areas, Value Migration into new markets and product categories as well as building complete Value Delivery Systems to ensure strategic alignment.