This KeyBanc Capital Markets report provides an analysis of the results of a survey of private SaaS companies which KBCM Technology Group’s software investment banking team (formerly Pacific Crest Securities) conducted in June – July 2019.

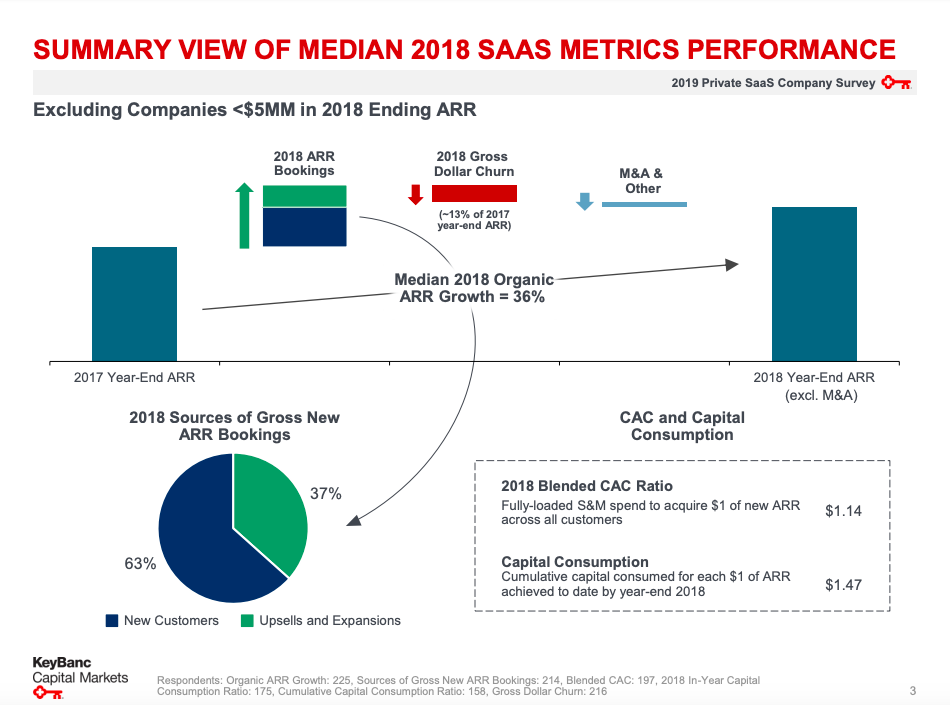

Overall, growth remains strong among private SaaS companies, with survey respondents reporting a median of 40 percent year-over-year organic annual recurring revenue (ARR) growth. That being said, only one-in-five companies are operating at or above “The Rule of 40%,” a much-discussed key measure of best-in-class SaaS company performance calculated by adding a company’s growth rate and free cash flow (FCF) margin. Interestingly, the survey results found that “The Rule of 40%” performers do not necessarily distinguish themselves with lower churn rates compared to those that fall below the threshold—what sets them apart are significantly lower customer acquisition cost ($0.51 vs. $1.26) and capital consumption (0.7x vs. 1.5x) ratios.

“As the SaaS industry continues to become more sophisticated, operators and investors are looking more closely at performance-driving metrics,” said David Spitz, managing director of KBCM’s Technology Group and primary author of the survey. “This year’s survey results show that while strong retention is clearly a necessary component of efficiency, the most elite performers differentiate themselves most in terms of high sales productivity and low capital consumption.”

David Skok, investor at Matrix Partners, author of the SaaS-focused blog forentrepreneurs.com and active supporter of the survey for the past eight years, added: “SaaS businesses continue to play a pivotal role in our economy. As they’ve matured, it’s become increasingly important to benchmark and track core performance metrics so that they’re maximizing potential. The survey continues to be a yardstick for SaaS companies, especially those striving for ‘The Rule of 40%’ excellence.”

(Source: KBCM / Business Insider)