Executives love metrics, especially in the technology/Internet space. Metrics equal transparency and proactive improvement across key business metrics. Companies that set the bar operationally grow more effectively, and that means better shareholder value.

A few critical KPIs are key to measuring the health of the business, setting goals and identifying reprioritization efforts that can address potential issues before they surface. At the C-level, every executive, especially the CEO, continually evaluates how the business is doing on key fronts like sales, customer success, product, etc. With the rise of a more complex buyer’s journey, marketing has a huge impact on growth. Understanding the variables that indicate marketing success is what we will dive into below.

This overview and the examples are meant to give you a baseline understanding of creating a predictable marketing-centric model that helps justify further investment and testing of program-mix spend.

First, evaluate your strategy and your go-to-market model. There are three main variables to consider as inputs for optimizing productive growth:

- Average deal size: Annual Recurring Revenue (ARR): Are you living in a fast-moving, low-price, world? $2k ARR deals closing in weeks, not months? Or are you selling $250k ARR deals that take 18 months to close? Maybe you have businesses across multiple types of models. Are your new customers coming from freemium products? Trials? Demos?

- Sales cycle (number of days from lead to opportunity to close): Once the sales team accepts a qualified opportunity, they have the hot potato! What’s the Service Level Agreement (SLA) that comes with that company asset? Should the sales person use three or four calls and 30 days to close the deal? How are those efforts tracked, reported and planned for in your metrics and their compensation plans?

- Velocity (number of deals/rep/month): How simple or complex is it to sell your products? How many deals can your sales reps manage and close, in parallel?

Having a common understanding of what these mean is critical for your organization. Then you need to summarize and adjust your investment mix each quarter by leveraging solid data that you and your CEO trust.

What generates a fast-moving new pipeline?

In most cases, inbound marketing is the fastest way to generate a new pipeline. Inbound marketing is comprised of two channels:

- Organic search: Keyword phrases plus a highly optimized, dedicated landing page (under your URL) with content tuned to that exact search phrase. Every organic search campaign should have a dedicated landing page with a call to action (CTA) that converts the anonymous visitor to a known lead via the form-fill associated with getting the CTA offer.

- Paid channels (paid search/PPC, advertising and social): Google AdWords, Bing, Yahoo, LinkedIn, retargeting, Twitter, Facebook, etc.

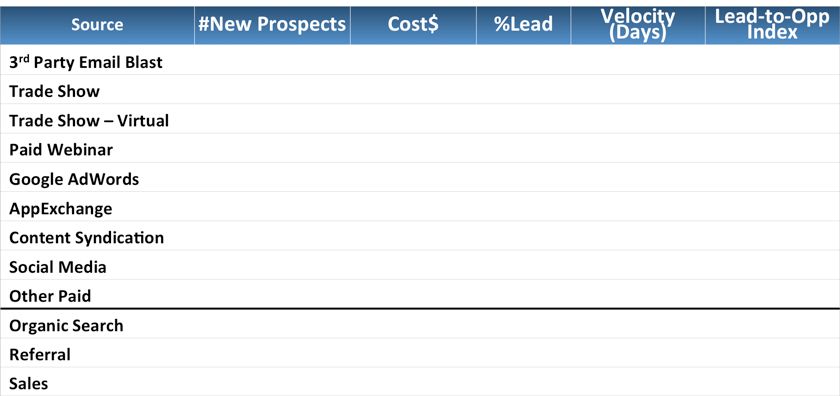

Use common definitions, attribution (I recommend multi-touch) and math to report results across your channels. Here is a useful top-of-funnel (demand generation) reporting template that will clarify which investments are the most valuable.

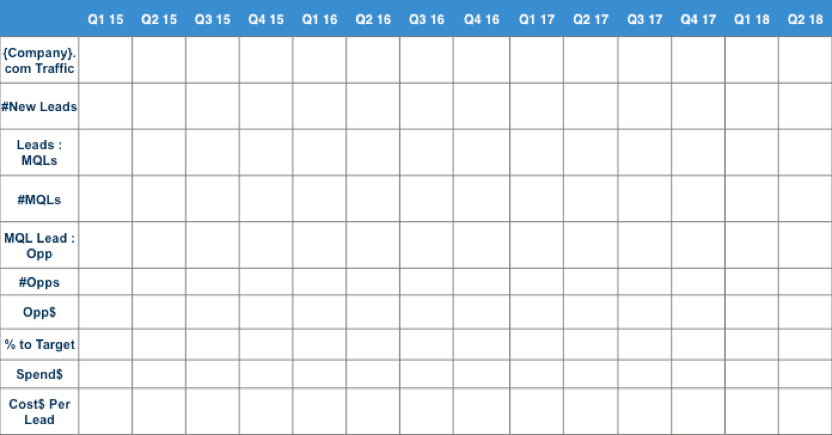

Here’s an example of a quarterly marketing report outlining pipeline growth and productivity results to track results and to share with your executive peers.

This will show the team how you are doing at a high level and will enable you to adjust the marketing plan.

Accelerate revenue growth with content

You don’t need a ton of content to accelerate revenue growth. But, over time, the company with the best content wins because content cuts through all the digital channels’ clutter and noise. Be a thought leader and see where your content stands versus your marketing campaigns and those of your competitors. Why does this matter?

- Great content engages new (previously anonymous) buyers early in their search to buy the right products.

- Great content used correctly (marketed to the right personas at the right stage of interest) increases your conversion rates (which improves your cost of acquiring new customers – customer acquisition cost (CAC).

- Acquisition inefficiency starts at the top of your funnel. Knowing what keywords engage new buyers and what promotions work best means you beat your competition and engage new buyers so they prefer your solution versus your competition. That means faster/higher conversion rates, and you get more value from your nurturing tracks and CRM systems.

The key is your numerator. We all need to convert more previously anonymous people into new, high-quality leads. How does that happen? From engaging new buyers early in their process of looking for your products (non-branded search, advertising and social campaigns coupled with your outbound marketing programs).

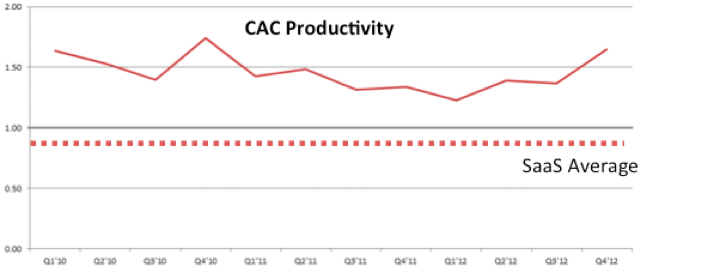

I prefer using the “Magic Number.” Magic Number = (Increase in quarterly recurring revenue∗4″ / (prior quarter′ s sales and marketing expenses)

Your magic number should be >1.25 to pour fuel on the fire. If it’s below one, you have a problem to fix; either your average deal size and sales cycle are too inefficient for your sales and marketing model, or your marketing spend mix is way off. Either way, understand the root cause of the issue and fix it before trying to accelerate your revenue growth.

Monthly opportunity reporting

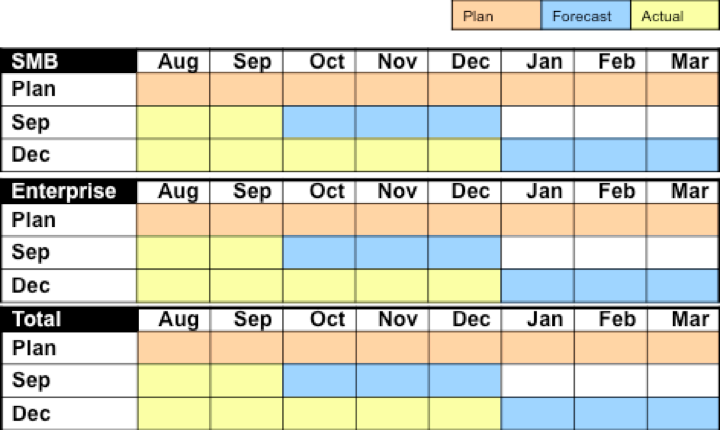

I saved the best for last. Below is my favorite report (simple but brutal) – a monthly opportunity report that is critical for your ability to predict the revenue impact from marketing’s pipeline contribution. The best forecast of future revenue is tracking opportunities that will turn into closed business.

If your opportunity-to-close percentage is 50 percent and your opportunity-to-close time averages 30 days, you can predict September revenue by adding up your total opportunities at the end of August, dividing by two and multiplying them by your average deal size.

Since you know how many opportunities need to be created from marketing-generated leads, you can also improve your ability to forecast future opportunities based on math and past conversion rates. Over time, your marketing model will be so seamless that your ability to forecast future quarters’ revenues will be better than that of sales leaders … and that will create a trust to invest more in your business.

From the CFO and CEO view, operating expense increases are limitless as long as they trust it turns into faster revenue growth in a predictable way. Review your existing marketing model, generate and utilize reporting tools that track the value of your content and succeed in effectively tracking your marketing efforts and generating new business. You can do it!

Paul Albright is CEO and co-founder of Captora. He has led product, marketing and sales in some of Silicon Valley’s most innovative, market-creating, software companies. Most recently Paul was chief revenue officer at Marketo, and drove revenue strategy that delivered global revenue growth over 100 percent year-over-year. At SuccessFactors, he grew revenues to over 80 percent year-over-year. Previously, he led worldwide marketing at NetApp and Informatica. He also served as an entrepreneur-in-residence at Greylock.