Inc42 recently released the Annual Indian Tech Startup Funding Report 2017, which provides a meticulously detailed analysis of funding trends and Merger & Acquisition (M&A) activity in the Indian startup ecosystem for the period 2014-2017.

The Indian tech startups raised $13.5B in funding across 885 deals in 2017. The sectorwise breakdown of deals reveals that the EnterpriseTech, HealthTech and FinTech had witnessed the maximum number of deals in the year 2017.

Marking a sweeping victory is the EnterpriseTech sector, occupying the first spot in terms of tech startup funding in 2017. The enterprisetech startups raised a combined funding of $531M across 131 deals in 2017. The second spot was taken up jointly by the TealthTech and FinTech sectors with 111 deals each.

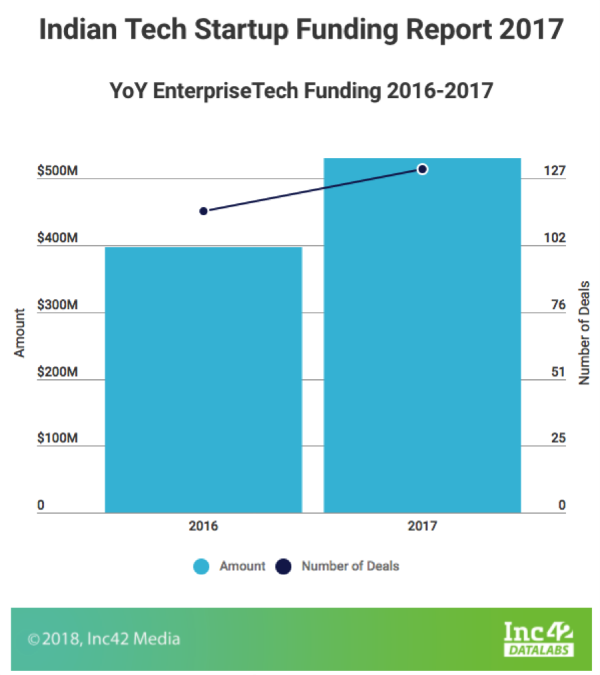

EnterpriseTech

EnterpriseTech startups raised about $531M across 131 deals in 2017, a rise of 34% in comparison to the deals materialised in 2016. However, in comparison to 2015, there was a drop of around 10%. Interestingly, as far as the deal composition is concerned, the deal percentage in the enterprise sector has risen significantly since 2016. Growing at a pace of 14% YoY, it is expected that the sector will continue to grow further. IDG Ventures emerged as the most active investor in the EnterpriseTech sector in 2017.

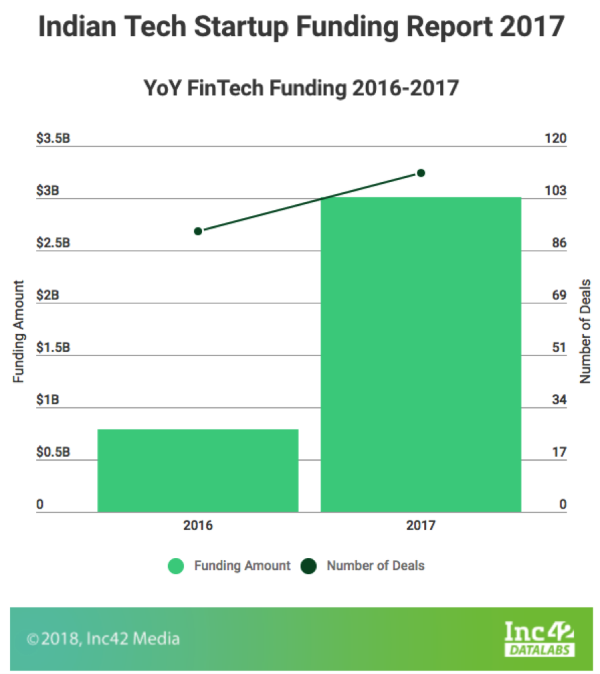

FinTech

The number of deals in the FinTech segment has been growing significantly since 2014. Starting from just 26 deals in 2014, the year 2017 reported 111 deals in FinTech, a rise of 21% from 2016. As far as the amount being raised in 2017 is concerned, $3.01B was invested in FinTech startups, which translates to a 281% increase from 2016.

Stagewise breakdown of funding reveals that seed funding deals stood at 48 in total, while growth stage reported as many as 31 deals. A significant jump was also made at the late stage, which witnessed a total of 25 deals i.e. a rise of 150% in comparison to 2016.

India is currently home to more than 500 FinTech startups, whose collective aim is to attain financial inclusion. The government’s enthusiastic promotion of cashless technologies such as digital wallets, Internet banking, the mobile-driven point of sale and others as well as the launch of IndiaStack including eKYC, UPI and BHIM have also managed to restructure the financial sector, disrupting the long-held monopoly of traditional institutions like banks.

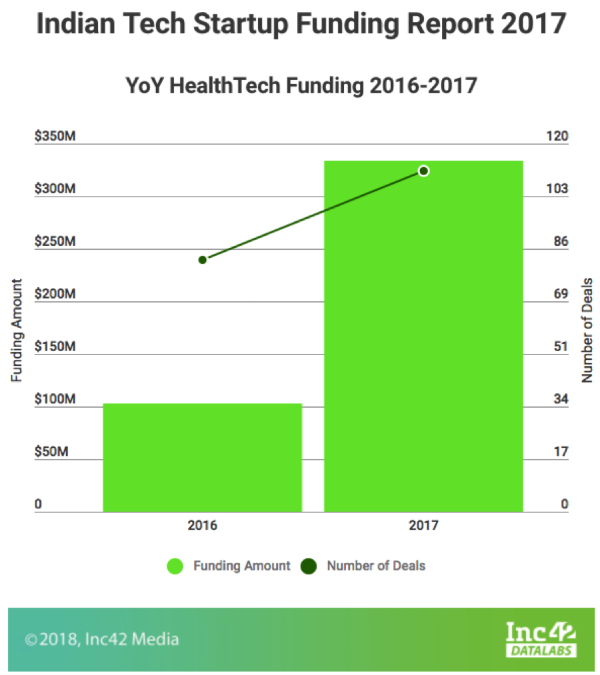

HealthTech

The funding in this segment stood at an all-time high in 2017. The sector witnessed 111 deals in 2017, making it the second most funded segment of 2017. Not just in terms of the number of deals, HealthTech startups raised over $333M in funding in 2017, which is three times the amount they raised in 2016.

At seed stage, 81 deals were sealed in 2017. As far as the other stages are concerned, there wasn’t any significant change in the number of deals in comparison to 2015, apart from the doubling of bridge funding deals.

A lot of innovations by tech startups have been witnessed in the healthtech sector as a result of the effective utilisation of AI and Big Data along with the launch of IoT innovations, among others. In 2016 and in the early 2017, a major chunk of the healthcare investments went into startups that are essentially working on telemedicine, doctor appointments and health apps but lately, we have also seen a rapid growth in wearable tech gadgets, genetic research and smart diagnostics space.

Surprisingly, hyperlocal and ecommerce took the fourth and fifth spots with a total of 99 and 79 deals respectively. Besides these sectors, some of the sectors that witnessed a significant number of deals and funding include transport-tech, traveltech, deeptech, edtech and media and entertainment.

Liked what you read so far? SandHill.com readers receive a 20% discount on the new report from Inc42, which contains many more insights and data in our full report which covers the funding trends across Tier I, Tier II, Tier III cities, across 14 industries and sectors segregated by the funding stage with details on average ticket size, investor types and a lot more for the duration of 2014 to 2017.

Shalini Jain is an executive with Inc42.