MGI Research conducted an independent benchmark of 121 publicly listed software companies (effectively the global universe of public software firms). This article summarizes the key findings related to software industry growth, stock market leaders and laggards, and sector profitability.

Highlights include:

- Highly concentrated revenues and profitability — Microsoft, Oracle and SAP are over 63 percent of industry revenues and generate 75 percent of all EBITDA

- SaaS upside potential equals the hype — SaaS is about 10 percent of all software revenues

- Disappointing stock market returns YTD — Only six companies have delivered returns >20 percent YTD

- Worldwide software revenues are >$275 billion per annum

- Total software industry profits are $80 billion per annum

The benchmark does not cover the Internet or social media sectors.

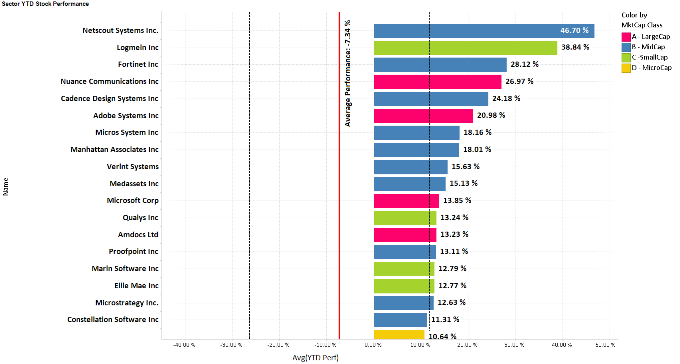

The momentum play in software stocks has fizzled

As of June 26, 2014, the date of the benchmark study, shares of software companies generated an average year-to-date (YTD) return of -7.3 percent. Of the 121 names in the benchmark, only six produced returns greater than 20 percent YTD, and only 19 delivered returns greater than 10 percent.

Among the leaders, there were only four large-cap software names: Microsoft, Adobe, Amdocs and Nuance. Each one of these could be considered a special situation rather than representation of a broad secular growth trend.

© 2014. MGI Research. All Rights Reserved.

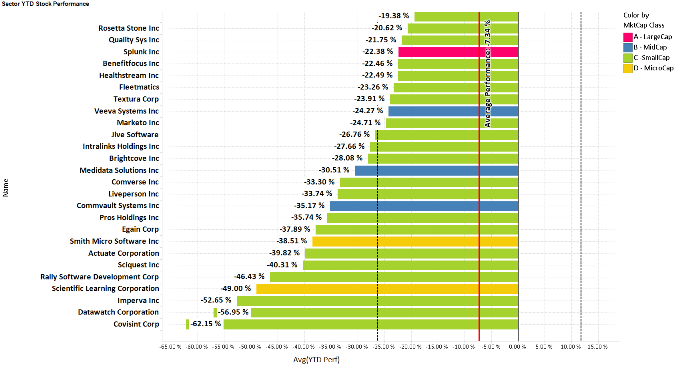

On the opposite side of the performance spectrum, 26 (21 percent) of the 121 companies benchmarked lost more than 20 percent of their value.

In comparison, MGI Research conducted a similar benchmark in November 2013 and found that only seven percent of software companies had lost more than 20 percent on a YTD basis. Many of the leaders in 2013 are on the casualty list in 2014 — namely Splunk, Medidata Solutions and SciQuest, among others. Also on the list are some of the higher-profile IPOs of 2013 — namely Veeva Systems, Marketo, Benefitfocus and Covisint.

© 2014. MGI Research. All Rights Reserved

In spite of 2014’s lackluster performance in the stock market, the software business remains highly viable. The combined revenues of the 121 companies benchmarked nearly reach $230 billion. If the revenues of private software companies and the software divisions of integrated technology vendors (e.g., IBM) are included, total worldwide software revenues are greater than $275 billion per year.

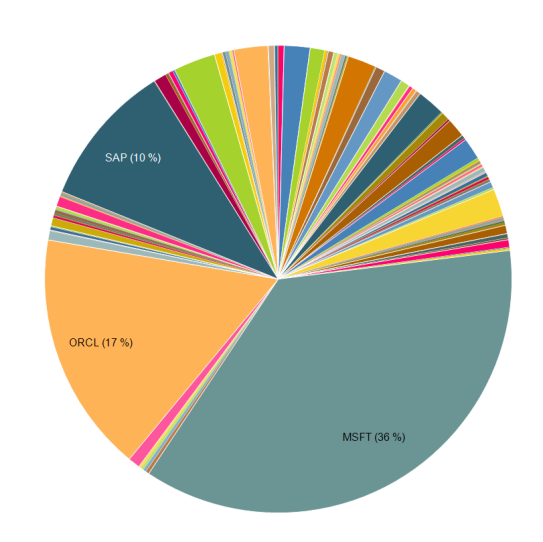

Industry revenues are highly concentrated

Within the benchmark group of 121 firms, Microsoft, Oracle and SAP represent over 63 percent of all revenues.

SaaS companies today represent less than 10 percent of all software revenues. The most highly visible SaaS company, Salesforce.com, is less than two percent of sector revenues. And fast-growing Workday is still tiny in comparison to an Oracle or SAP. In-line growth of three percent at Oracle produces a company that currently is two times the size of Workday.

For all the hype regarding the shift from on-premises to SaaS, the reality is that about 90 percent of all spending on software today is directed towards on-premises software solutions.

Growth rates, however, paint a different picture. SaaS software companies are growing 2X faster than the industry average of 14 percent, and on-premises firms are, on average, growing at one-half the industry average.

(c) 2014. MGI Research. All Rights Reserved.

Industry profitability is highly concentrated

In terms of operating profitability, Microsoft, Oracle and SAP earn almost 75 percent of sector EBITDA. This contrasts with SaaS companies, which generate only 3.5 percent of sector profits. Salesforce.com represents a tiny 25 basis points (0.25 percent) of the benchmark’s profitability.

As a whole, the benchmark group produced over $73 billion in profits, and MGI Research estimates total worldwide software operating profits of $80 billion per year.

While the market has cooled to the software sector, one could argue that the flight to growth names was overdone in 2013, and the high-flying stocks of last year are bearing the brunt of the market’s cold shoulder towards software.

Given the extreme concentration of industry EBITDA and the meager contribution SaaS companies make to sector profitability, CEOs and CFOs of SaaS companies may want to consider the potential impact of a stock market shift from growth to profitability.

On the other hand, given the 90/10 split between spending directed towards on-premises solutions vs. SaaS, the growth disparity between SaaS and on-premises companies will persist for years.

Nota Bene – All data is as of June 26, 2014. This data is for informational purposes only. It is not a recommendation or an offer to buy or sell any securities. All data is subject to change and MGI Research is not responsible for any errors, omissions or use whatsoever of this data.

Sandhill is proud to be a sponsor of the Billing Innovators Summit East, Oct. 23, 2014 at the New York Academy of Sciences, New York, NY. This MGI Research Case Study conference features interactive conversations with executives charged with delivering new products, services and pricing/monetization models.

Andrew Dailey is a managing director of MGI Research. He leads the enterprise applications and billing solutions coverage for MGI. He has over 20 years of diversified technology and financial services experience as a software executive, industry analyst (Gartner) and advisor to Fortune 500 companies. Follow him on Twitter.