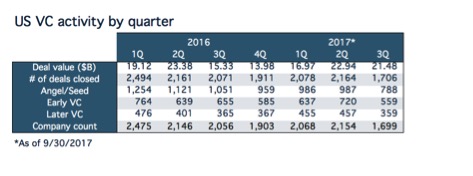

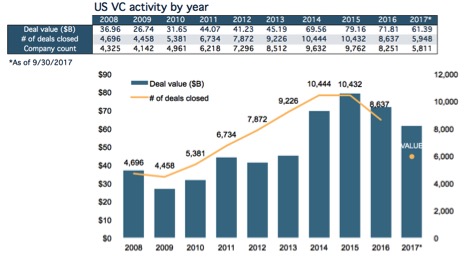

Venture investors deployed $21.5 billion to more than 1,699 venture-backed companies during the third quarter, bringing 2017’s total investment to $61.4 billion deployed across 5,948 deals to date.

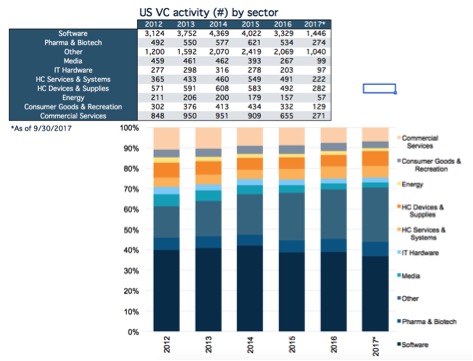

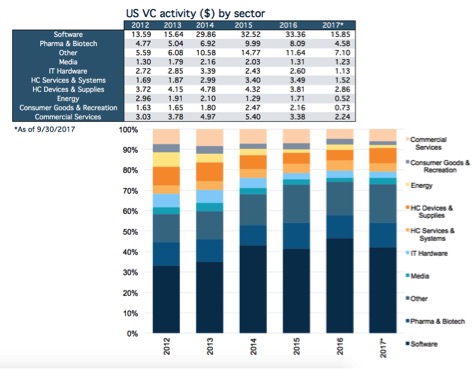

Software attracted more funding and accounted for more exits than any other sector. The $250 million raised by Slack and Via were software’s biggest deals of the quarter.

The NVCA identified several additional trends in its latest analysis of third-quarter VC activity:

- Investment into venture-backed companies in 2017 is on track to match or exceed dollars deployed in 2016, and if this pace holds, full-year 2017 venture capital (VC) dollars invested could be the highest in the past decade, according to the 3Q 2017 PitchBook-NVCA Venture Monitor. However, the big numbers are partially due to several “mega-deals” completed in the third quarter, like WeWork’s $3 billion infusion of VC.

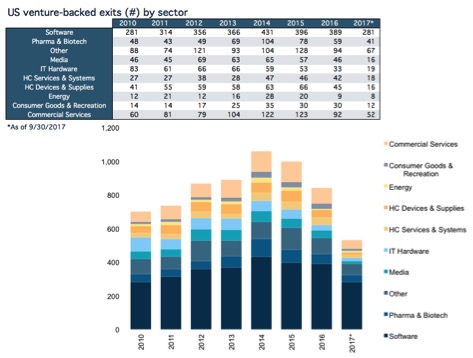

- Mega deals inflate deal value and have become the new normal in VC where investors pump larger amounts of capital into fewer companies, especially in the later stages. In fact, deals that carried a valuation of $1 billion or more represented less than 1 percent of 2017 deal count, but nearly 22 percent of the aggregate deal value. Meanwhile, private equity firms are increasingly providing an alternative liquidity option for a tepid exit market, which is pacing for the lowest number of exits since 2010.

- Across all of 2017 to-date, late-stage deals have accounted for more than 20 percent of total deal count for the first time since 2012, while angel and seed investments have fallen below the 50 percent mark of completed financings for the first time in the same period.

- So far in 2017, there were 530 venture-backed exits, on track for 707 exits for full-year 2017, compared to 839 total exits in all of 2016. While exit value has been somewhat buoyed by a handful of recent unicorn exits, 2017 exit value is also pacing to be the lowest since 2013.

- Following several quarters of strong fundraising, 3Q activity declined considerably. On an annual basis, $24.4 billion has been raised so far in 2017, a slightly slower pace than 2016, which raised a total of $40.4 billion.

- Refer to the charts below for details and visit the NVCA/PitchBook site for more analysis and links to download complete data sets.

Clare Christopher is editor of SandHill.com.