In our extensive work with technology companies across sectors like enterprise software, communications and networking, and data/information services, we continue to see recurring inflection points that present an ideal opportunity for companies to proactively re-examine their pricing strategies. One of the most significant of these, and perhaps the most difficult for business leaders to plan for, is the threat posed by technology disruption.

The pace of technological innovation over the past 15-20 years has been unprecedented. Many of today’s technology leaders — Google, Amazon, Apple (circa 1998) and Salesforce.com — had either yet to launch, were in their infancy or had just begun to transform their business models. These companies significantly “changed the game” with respect to how technology products and services were priced and delivered to customers — with highly disruptive and oftentimes fatal implications on existing players (the incumbents) in their respective markets.

A prime example of technology disruption leading to innovative pricing can be found in the fields of sales force automation (SFA) and customer relationship management (CRM), which were dominated in the early 1990s by on-premises enterprise software companies like Siebel, Oracle, SAP and PeopleSoft. During this period, these companies raced to build out larger and more complex ERP platforms (often through acquisition).

Large enterprise customers paid upwards of $5M, $10M, even $50M to customize and implement broad CRM packages across their organizations — often with disastrous results. A single on-premises enterprise seat license for Siebel sales force automation software could cost upwards of $7,000 per seat.

The high prices for software licenses, coupled with hardware infrastructure costs, huge professional service implementation fees and ongoing maintenance contracts drove massive capital outlays — and more often than not — extremely dissatisfied customers, as many implementations failed to live up to expectations. In the early 2000s, as the technology bubble was bursting, Siebel held 45 percent market share in the CRM space.

Salesforce.com was founded in 1999 with the stated mission to “end software” as business customers had come to know it by offering more standard, multi-tenant, hosted CRM software delivered as-a-service — and armed with far more flexible per-user, per-month pricing models. Salesforce.com initially targeted small and midsized businesses that were priced out of the market by the large ERP vendors, but it made steady inroads into larger companies over the subsequent decade. Fast forward to 2013, and analysts predict Salesforce.com, with over $3B in revenue and growing while its larger ERP peers struggle, will become the #1 CRM vendor by market share.

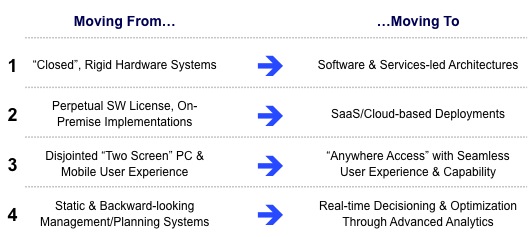

Although there are many technologically disruptive forces at play in today’s business landscape (e.g., social media), we will focus our attention on four of the most impactful trends, each with distinct implications on competitive pricing models.

These disruptive trends have profound implications on business models and product offerings in the marketplace, and by extension, are bringing titanic shifts in pricing models. We find this to be true whether the company in question is the disrupter (like Salesforce.com) or the disrupted. We will discuss these trends by providing examples of the challenges companies have faced, drawing from lessons learned from our client and professional experience.

Disruptor 1: Closed, rigid hardware shifting to software or services-led architectures

Telecommunications and networking is a prime example of an industry that has undergone a hardware-to-software shift, following a rapid adoption curve from time-division multiplexing (TDM) switching equipment to Internet protocol-based (IP) technology. With IP-based systems, much more of the intelligence and logic control has shifted to reside in software applications that drive the physical network infrastructure, versus embedded in the core hardware components themselves.

And with emerging industry standards in software-defined networking (SDN), there is potential for another step-change in terms of expanding network intelligence and responsiveness, while further simplifying and automating network provisioning and administration. These evolutions will continue to have profound implications on solution pricing — and on networking equipment in particular.

Working with our client, a leading network equipment manufacturer, we found that in addition to core product pricing, they needed to rethink service and support pricing models. For example, customer support and maintenance services represent a substantial portion of technology equipment providers’ revenue and profits. TDM hardware-centric maintenance offerings and pricing that provided bundled remote technical assistance, spare parts and on-site technician repair had to shift to a software-centric model (e.g., firmware updates and bug fixes, along with remotely-delivered technical assistance). The historic pricing methodology, based heavily on physical units and network end points, transitioned to pricing based largely on software licenses and usage-based entitlements.

These major shifts to the client’s customer support offerings and pricing models had to be accomplished with careful attention to the “before and after” price point impact on customers and reseller partners.

For companies with hardware-centric portfolios, the challenge is how to drive innovation to evolve existing products while developing new scalable offerings that more closely resemble higher-margin software and services and, while driving this transformation, carefully shifting pricing models and business systems without alienating the core customer base. IBM’s transformation during the 2000s is a prime example of this; it spun off the PC business in 2005 and is expected to exit the low-end server business.

Disruptor 2: Perpetual license, on-premises implementations to cloud-based deployments

Anyone reading technology news headlines in the past few years is aware that the enterprise software sector has been undergoing a dramatic shift of its own to Software-as-a-Service (SaaS) or cloud-based deployments. Historically, software vendors sold perpetual software licenses, which were then highly configured and implemented at the customer site, typically with much complexity, time and expense. At the customer “go live” date, after final customer approval, typically a pre-bundled, multi-year maintenance contract would then kick in. Software maintenance contracts typically entitle customers to product bug fixes, updates, patches and a window for technical support. Maintenance contracts have typically been priced at 20 percent of software license list prices.

Given the highly customized nature of most large-footprint enterprise software installations, along with the large up-front investment in licenses and professional services, many customers have found themselves “locked in” to paying ongoing maintenance fees. Over the past 5-10 years, as new license growth slowed, many software vendors extracted value by simply raising their maintenance rates without providing incremental perceived customer value — to the extent that many customers came to view maintenance as an inevitable tax or cancelled it outright.

With SaaS or cloud-based deployment models, customers can avoid (in many cases) multimillion-dollar up-front capital investments for software licenses, long implementation cycles and annual price increases on maintenance contracts. Customers have been able to “variable-ize” their software investment by paying recurring monthly/annual fees on a subscription, per-user, or usage basis.

As a result, the competitive dynamics and underlying economics of many tech verticals (data storage and legal technology, as examples) are being transformed by these shifts in product delivery and pricing models.

Up to this point, many SaaS offerings were point solutions or somewhat narrow in scope in terms of functionality (e.g., talent management, time and expense management), or customers had to tacitly agree to give up certain features for standard, out-of-the-box functionality. However, newer vendors like Workday are gaining traction and mindshare with larger-scale, more fully featured and configurable cloud-based deployments for core ERP and BI/analytics functions. This is a significant threat to “traditional” enterprise software vendors.

The offering and pricing implications clearly differ for incumbents vs. the disrupters. Incumbents must determine whether they can and should launch cloud-based offerings and for which customer segments, while balancing how to maintain or enhance the value of their core software and maintenance offerings. Most critical, they must consider how to execute the new offering launch without cannibalizing their installed base of maintenance-paying customers.

The critical issue these “disrupted” vendors face is that many competitive cloud solutions have been priced to be comparable to or well below their maintenance offerings from a total cost of ownership (TCO) standpoint.

Disruptor 3: “Mobile first” user experience

With the introduction of the iPhone in 2007, mobile phones ceased to be merely telephonic devices with little to no onboard computing capability. In only a few years, worldwide adoption of iOS and Android-based mobile devices surpassed even the most aggressive growth projections. Analysts now predict sales of 1.2 billion smartphones and tablets in 2013, a 50 percent year-over-year increase; and this will surge to 2.2 billion units by 2017.

As these smart devices become almost indispensible in daily life, they are driving the growth of bring your own device (BYOD) in the enterprise space. Add to that a vast and growing ecosystem of purpose-built lightweight applications, and enterprise mobility is poised to move beyond email, calendaring and basic collaboration to meaningfully transform core business processes and workflows.

Although still in the early innings of the game, as data access and partitioning, network security, legacy integration and other operational issues are being worked out, the full disruptive potential of enterprise mobility is only just beginning to be understood. However, in sectors like retail, warehousing and logistics, healthcare, education and professional services (including legal), the impact of this disruptive technology is already being felt.

For software and technology vendors serving these industries, the innovation paradigm has begun to shift to designing applications first and foremost with the mobile user and mobile workflow in mind, and secondarily the traditional PC- or desktop-centric approach. Enterprise mobility is already driving significantly greater productivity, process efficiency and customer responsiveness in day-to-day situations.

Incumbent enterprise software vendors and device manufacturers face several key threats from a pricing standpoint. Their offerings are being undercut in the market by lower-cost, feature-rich and highly scalable mobile solutions. These solutions can be highly configured and rapidly deployed with relatively low CAPEX and startup requirements. This new breed of native mobile and Web apps are designed as part of a seamless, synched and highly “sticky” multi-device user experience to keep users deeply engaged.

Evernote, Box and TitanFile are several mobile-first or mobile-centric products that have begun to make significant inroads into the enterprise with more robust, “hardened” capabilities for the business user and teams. These products allow users a range of free basic features while driving conversion to highly flexible subscription or tiered usage plans as the product becomes more embedded into day-to-day workflows — thus posing a serious challenge to traditional enterprise collaboration and productivity applications. Plus, subscribers are typically not locked in to a long-term contract and can “turn off” their plan whenever they like.

Some incumbent offerings are being disintermediated as their core feature set is subsumed into higher-value mobile solutions. A notable example of this is Garmin devices and other location-based services having been fully integrated into iOS and Android smartphones at no incremental cost to the user.

Mobile payments are perhaps the next disruptive wave as Square, PayPal, Google Wallet and others vie for a more seamless mobile and banking/payment experience.

The challenge incumbents face is how to selectively evolve or open their product architectures for mobile use cases in order to provide a seamless user experience to keep users engaged or to reach net-new customer segments. Incumbents must give careful consideration to the pricing model(s) they employ – whether charging for the app itself, pegging to a usage-based metric (e.g., GB per month) or bundling into a broader solution, so as to not cannibalize or negatively impact existing revenue streams.

Disruptor 4: Real-time decisioning and optimization through analytics

A critical requirement for managers and executives to make informed pricing decisions is access to robust and timely datasets from both internal and external sources. The growing availability and “democratization” of enterprise data for business users — be it customer and channel transaction records in greater segment-level detail, sales team performance data or application log and usage data from SaaS applications — all provide executives and managers greater insight into customer preferences and purchasing behaviors.

From an external standpoint as well, there are many more sources from which executives can gather intelligence around competitive offerings, price points and the voice of the customer. In fact, access to the various data streams themselves is becoming less of an issue, as opposed to quickly extracting meaningful insights and making them available to key stakeholders to drive improved pricing decisions.

The challenge many incumbents face from a pricing strategy and execution standpoint is that they are making pricing decisions with imperfect, out-of-date or narrow datasets. They are depending on systems with historic or backward-looking financial and ops data, point-in-time customer or transaction data and outdated competitive intelligence. And in many cases, sales teams and managers are simply relying on gut feel based on unique past experiences. Most companies lack a comprehensive approach to integrating transaction data, customer attitudinal or behavioral insights and relevant competitive intelligence to inform pricing decisions in a timely manner.

In addition to Amazon with its well-documented predictive analytics capabilities and emerging Big Data disruptors like Palantir, a growing number of incumbents like Procter & Gamble are knocking down data siloes across the enterprise and harnessing analytics and visualization tools to make more informed and immediate business decisions.

The most innovative and effective management teams have extended these advanced analytics techniques to their pricing and “customer success” processes. They understand that pricing is not an art or a point-in-time event but, rather, an ongoing, data-driven and iterative process involving stakeholders throughout the organization.

Innovators like Vendavo, Gainsight and Totango are building automated tools to help managers and sales teams optimize pricing, proactively manage customer churn and target upsell opportunities through deep analytics.

Success stories are beginning to emerge around companies achieving tangible financial ROI by combining a rigorous pricing approach and analytics. Companies are leveraging customer transaction data and real-time competitive intelligence to drive more disciplined sales behavior to price bids more effectively. Others are monitoring usage and real-time demand to more effectively negotiate contracts.

As the pace of decision making increases, impacted largely by disruptors #1-3 discussed above, executives at incumbents and challengers alike will feel greater pressure to make timely pricing decisions in the face of increasingly complex datasets and market forces. The challenge will be how to harness the power of Big Data, cut through the noise and make key insights available to stakeholders at key moments — all in the context of a disciplined pricing process.

Counteracting (or leveraging) technology disruption in your pricing strategy — key considerations

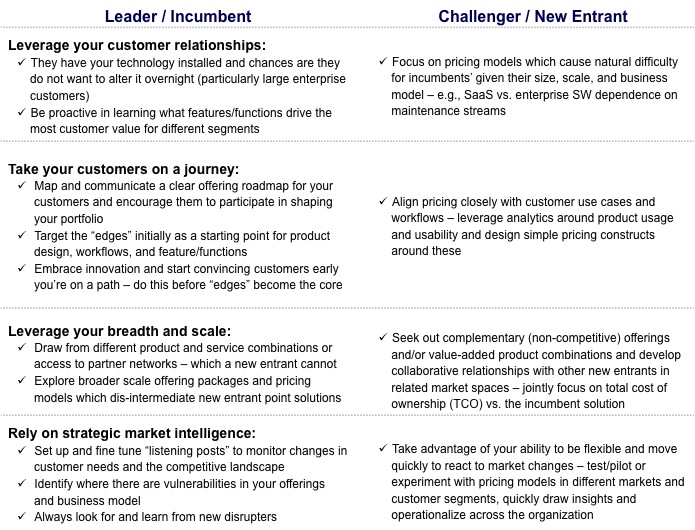

Whether your business and your pricing models are impacted from one or several of the disruptors above, the question is: What can you do to counteract these forces and/or how do you find new opportunities to compete?

Part of the answer lies in how you are positioned in your market. There are typically two jumping-off points. Are you the traditional incumbent with a large installed base of customers and operating from a relative leadership position? Are you the relatively new market entrant looking to establish a beachhead and attract and retain new customers with a differentiated product architecture and pricing model as key levers at your disposal? This positioning will color the choices and considerations available to you:

Technology innovation will continue to create threats and opportunities, impacting both incumbents and disruptors from a pricing standpoint. There are many variables to consider when thinking about how to develop your pricing strategy and take it to market. Clearly, the specifics on how to execute these approaches will vary depending on your industry, prevailing customer dynamics, the nature of the new technology and overall pace of innovation, etc. Pricing is not a point-in-time event; rather, it is an ongoing and iterative process. Whether you are an incumbent or challenger, following a methodical pricing approach will provide your team a framework to rapidly develop, test and execute an appropriate and successful competitive response.

Eric Pelander is a partner in and co-founder of Waterstone Management Group, a consulting firm that advises technology investors and senior management teams of technology-led clients on strategy and related execution initiatives. Eric’s personal work with clients has focused on growth strategy and execution, including go-to-market and services improvements. Contact Eric at epelander@waterstonegroup.com and follow him on LinkedIn at www.linkedin.com/in/ericpelander.

Jonathan Zorio is a principal in Waterstone’s Chicago office and leads Waterstone’s thought leadership and initiatives in Pricing Strategy and Execution. Jon has 15 years of strategy and operating experience in enterprise software and technology services. He focuses on design, launch and scale of new technology offerings, as well as ongoing operations improvement. Contact Jon at jzorio@waterstonegroup.com and follow him on LinkedIn at http://www.linkedin.com/in/jonathanzorio.

Apurba Pradhan is an associate in Waterstone’s San Francisco office and consults on growth strategies related to new offering design/launch of software and services. Additionally, he has 10 years of operational experience in product development and marketing. Contact Apurba at apradhan@waterstonegroup.com and follow him on LinkedIn at www.linkedin.com/pub/apurba-pradhan/14/621/a59.

Steven Michalkow, an analyst in Waterstone’s Chicago office, also contributed to this article. He consults on growth strategies related to new offering design and launch. Steven’s previous experience is in economic research and analytics. Contact Steven at smichalkow@waterstonegroup.com and follow him on LinkedIn at www.linkedin.com/pub/steven-michalkow/11/7b/14a.