BofA Merrill Lynch’s new “Software Primer” aims to be the primary information resource for investors who are new to the software landscape, and also be a handy go-to guide for seasoned technology investors. In addition, our primer provides a lay of the land of various software markets from application software to middleware to systems software. In 156 pages, the research team lays out the major market dynamics impacting the growth and consolidation of the entire software landscape.

Of particular interest is BofAML’s proprietary cloud total addressable market (TAM) forecast. Read on for four key takeaway findings on market size, valuations, M&A activity and workload.

1. In the last 11 years, continuous innovation has led to a growing Cloud TAM

- When we published our first OnDemand/Cloud report in June 2006, we estimated the clout market to grow to $10.7 billion in four years form an estimated $5.5 billion market in 2005, assuming a 21 percent CAGR.

- By 2013, our estimates had increased by 22x and now we estimate the total cloud TAM for 2020 at $310 billion, up from our prior estimate of $283 billion.

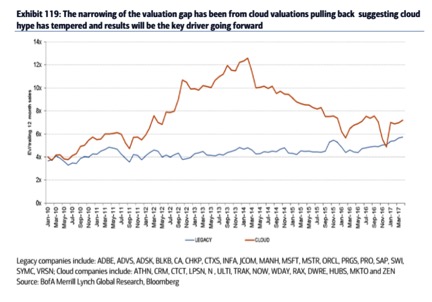

2. Cloud valuations previously had a huge premium to legacy names

- Cloud software valuation has gone up since the beginning of the year given recent market volatility. In addition, legacy software such as Oracle and Microsoft are now going through a cloud transition, increasing valuation, lifting the legacy software category, and decreasing the valuation gap with cloud names.

- The difference in revenue between traditional software and cloud companies has narrowed markedly since 2014, suggesting the hype around the cloud has tempered and results will become the key driver.

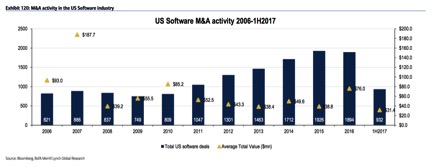

3. M&A and private equity deals increased in the last 10 years

- The industry has slowly become more consolidated. M&A activity increased as software companies enter new markets to avoid getting disrupted as shown in the number of deals in exhibit 120.

4. Cloud workloads forecast vary but public cloud workloads will likely double by 2020-21

- There are various estimates of cloud workloads but in our view, the best case scenario is that public cloud workloads will double from current levels, which we estimate to be in the mid teens.

- With the focus on hybrid cloud by Amazon (with VMware) and Microsoft (Azure stack – hardware + software with Microsoft’s Hyper VI) albeit with different approaches, we expect private cloud workloads to see some momentum in 2017. Public cloud environment. We expect a steady linear movement of workloads

- In our view, the overall goal for large public cloud providers is still focused on moving a majority of workloads into public cloud environment. We expect a steady linear movement of workloads to cloud vs. a hockey stick approach as it takes time to reconfigure legacy applications in cloud format. – BofAML

Clare Christopher is editor of SandHill.com.