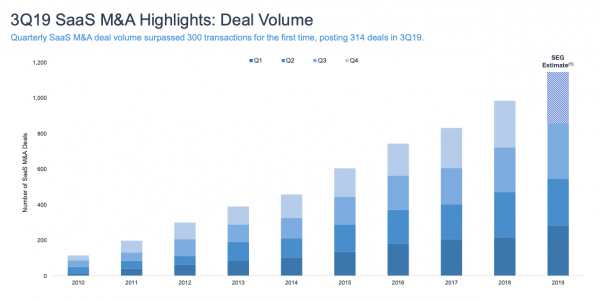

SaaS M&A deal volume and valuations reached record levels in 3Q19, as deal volume surpassed 300 transactions and sellers posted a median multiple of 4.8x EV/Revenue.

This 3Q19 SaaS M&A Update report by SEG includes historical deal volume by product category and vertical, valuation stats, most active buyers, notable deals, historical private equity activity, and more.

Report Highlights:

For the first time, M&A deal volume for the overall software industry (including SaaS, on-premise license model software, internet, and mobile deals) eclipsed 700 transactions in 3Q19.

• Specific to the SaaS M&A market, deal volume reached a historical high of 314 SaaS transactions in 3Q19, a 24.6% YoY increase from 3Q18’s 252 transactions. Annual deal volume is expected to reach approximately 1,100 – 1,200 deals by end of 2019.

• M&A targets with a vertical focus comprise approximately 42% of SaaS M&A transactions in 3Q19. Verticals with the highest deal count in 3Q19 include Healthcare (28 deals), Financial Services (18 deals), and Real Estate (12 deals).

• SaaS M&A transactions posted a strong median multiple of 4.8x EV/Revenue in 3Q19. The SaaS M&A revenue multiple has been trending up over the past few quarters, increasing from 4.3x EV/Revenue in 3Q18.

• The high multiple was driven by some notable mega-deals in 3Q19, including Splunk’s acquisition of SignalFX (21.0x EV/Revenue), Main Capital Partner’s acquisition of GBTEC (16.2x EV/Revenue), and VMware’s acquisition of Carbon Black (8.9x EV/Revenue).

• Private equity buyers drove M&A activity, composing 56.7% of SaaS M&A deals in 3Q19. Equity-backed strategic acquisitions noticeably increased over the past few quarters, making up 41.7% of SaaS M&A deals alone. In comparison, this buyer group only comprised 34.5% of deals in 3Q18.

Click here to read the full SEG 3Q19 SaaS M&A Update!