Many software and services firms commit significant energy and capital to the development of new products and new markets. But often a powerful lever within their existing core business is overlooked — retaining existing customers. Customer retention is a powerful tactic as its benefits compound over time in repeat orders, new purchases and referrals. Research shows that customer profitability tends to increase over the life of a retained customer [endnote 1] and that reducing customer attrition by five percent increases average customer value by 25 to 85 percent [endnote 2].

In many companies, customer attrition goes unnoticed or is hidden by other factors. For example, one of our software clients believed their growth slowdown was driven by a customer acquisition strategy that had not kept pace with changes in the market. However, a deeper analysis revealed that the slowdown was driven mainly by an increase in account churn in the largest accounts. Account losses far surpassed the wins.

Churn carries many hidden costs. For instance, dissatisfied customers often broadcast their dissatisfaction over a multitude of social media outlets — in many cases before the company realizes it has lost a customer. Even one negative remark can dissuade others from choosing your company and adversely impact the execution of your strategy. There is also the cost of replacing lost customers with new ones, an expense that can soar as high as five times the amount of retaining current customers [endnote 3].

For all these reasons, it is critical that software and services firms better understand and reduce their customer attrition, the invisible killer of revenue growth. Here are five highly effective steps for reducing unwanted customer attrition.

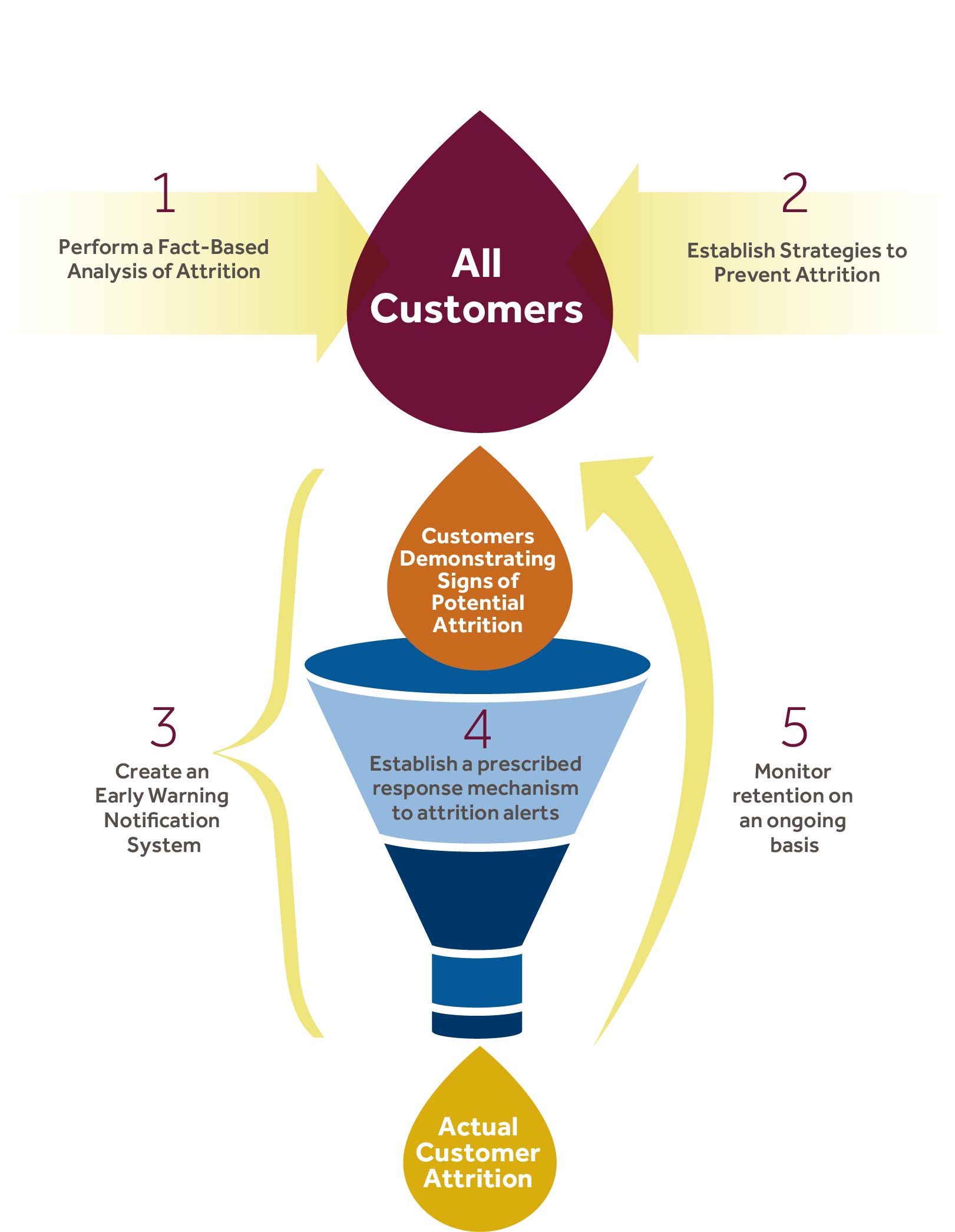

Figure 1: A Multifaceted Approach to Improving Customer Retention

Step 1: Perform a fact-based analysis of attrition

Any initiative to boost customer retention must start with a thorough understanding of the underlying drivers of attrition and how they translate into creation or destruction of economic value. It is not enough simply to know, for instance, that you lost 22 percent of your customers last year. You need to know what types of customers you lost, why you lost them, where they went and the impact of these losses on long-term value.

To enable this analysis, begin by defining attrition for your business. For example, if revenue from a specific customer declines from $400,000 in one year to $100,000 the next year, should that be considered attrition? What if that customer was your most unprofitable customer? What if that unprofitable customer was the source of many referrals? Should customers with ongoing maintenance/support revenue but minimal to no new revenue be included in the definition of attrition? Each company must consider these types of questions and develop its own meaningful definition of customer attrition.

Next, identify which customers fit that definition. Consider analyzing attrition rates by product lines, geographies, customer tenure, sales divisions or other dimensions that could provide insight. This exercise can illuminate pockets of higher attrition, which, if tackled effectively, can bring the highest impact in the shortest amount of time.

One of the most important facts a company must establish is what causes its customer attrition. Many companies believe they know, but it is easy to misunderstand the actual underlying causes. We have seen many clients’ departing customers blame price or another decision maker while deeper issues go unspoken.

For example, a financial services software company believed price was to blame for a block of customers leaving, but conversations with this group revealed the real problem was desire for a more integrated suite of products. While it may be frustrating to learn that some corporate beliefs are untrue, it is worse to be wrong as misinformation can drive an organization to fix problems that may not actually exist.

As you perform this analysis and begin to think about retention strategies, remember that not all customers are worth keeping. The optimal goal is to boost retention of customers with the highest lifetime value. Assuming your organization already captures customer profitability, be sure to assess the expected customer value beyond the current period to establish long-term customer value. This assessment should be a foundational consideration in establishing a target level of customer attrition.

Since no company will have zero attrition — nor should it want that as unprofitable customers are best let go — businesses must determine the level of attrition they are willing to tolerate within each major customer segment.

Step 2: Establish strategies to prevent attrition

Armed with the fact base about customer churn, you can now begin to create or adjust strategies to optimize customer retention. These adjustments might include pricing structure changes, adjustments in payment terms, product/service innovation and/or enhancement, service level customization by segment and adjusting the go-to-market model.

For example, a SaaS software firm implemented a tiered service level delivery model that varied based on customer profitability. Another software publisher added a named account model to support its high-priority accounts. Both approaches significantly improved customer retention within the most valuable customer segments.

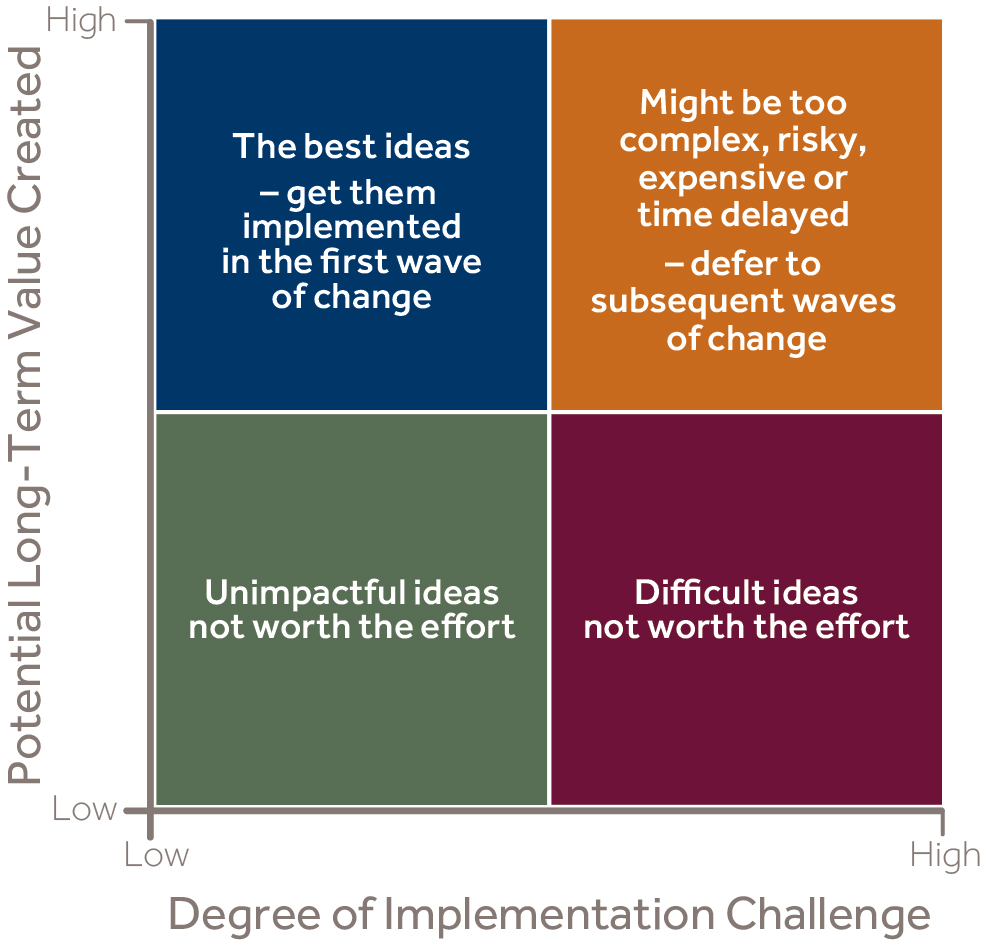

Depending on the severity of the attrition problem, a company may identify a number of needed changes. When this is the case, we recommend prioritizing and sequencing these changes, focusing first on the three or four most impactful initiatives to increase the likelihood of success.

Figure 2: Illustrative Framework for Selecting the Most Impactful Initiatives

Remember that every customer contact is an opportunity to reduce churn — even the contacts that occur prior to purchase. For instance, you can begin sharing your company’s knowledge capital at the earliest stages of the relationship to begin establishing your position as a trusted and valuable resource. A software firm could educate customers on new trends, share insights on solutions to challenges commonly faced, research or survey the market and create a benchmark against peers. This kind of information is an opportunity to deliver incremental value to customers beyond simply supplying them with software and support services.

Step 3: Create an early warning notification system

When companies conduct postmortems on customers who depart, they often realize there were warning signals along the way that were ignored or missed. The customer’s volume declined, their satisfaction/Net Promoter Score™ declined, quality problems developed, requests to customer service increased or the company’s 20-year sales rep retired. These factors need to be monitored to profile defection risk and identify triggers of potential attrition.

Research shows that 62 percent of customer defections can be prevented if discovered in advance [endnote 4]. The best way to achieve those reductions is through an institutionalized customer retention program that includes an early warning and intervention system. This system starts with the discoveries made during your fact-based analysis. It also incorporates triggers of potential attrition, such as those mentioned above, and customer economic value.

To help a software firm reduce customer attrition, we studied customers who had left in the past two years. Analyzing sales and industry data for the five years before each customer’s departure, it became clear that each one experienced a 10%+ revenue decline for two to three years before they left despite the fact that their industry vertical continued to grow. By using this metric as an attrition alert, the firm pinpointed current customers who met that profile and focused on providing them additional support. The initiative decreased their attrition rate by 15 percent.

Step 4: Establish a prescribed response mechanism to attrition alerts

Companies need pre-defined responses to attrition alerts but these responses should vary based on the nature of each trigger and the economic value of each customer. More aggressive responses, such as bringing executive leaders to on-site meetings, would be appropriate for higher-value customers.

Customers whose economic contributions to the company are more modest might warrant a lesser response, such as a call with someone on the leadership team. Unprofitable or only marginally profitable customers who show signs of attrition might best be allowed to take their unprofitable business to the competition.

To enable a timely and appropriate response, it is critical to:

- Establish pre-approved programs, tools and offers that can be utilized depending on the nature of each trigger and the economic value of each customer

- Create clearly defined response timeframes and escalations (e.g., customer contacted within three days of the alert and escalated within two weeks of the alert if no response)

- Issue alert notifications immediately upon detection as any delay increases the risk of customer attrition

Your sales team may be best positioned to drive your save efforts as they are in daily contact with customers. However, depending on how your customer-facing functions are organized, the customer save effort may be primarily handled by customer service, account management or other functions directly responsible for customer retention.

Regardless of who responds, success depends on (a) a strong commitment from front-line managers including regular reinforcement of expectations, follow-up and tracking and (b) incentivizing both managers and line personnel to retain customers. Too often, compensation models do not sufficiently motivate the behaviors required to retain profitable customers. Instead, the models place more emphasis — and more compensation — on attracting new accounts. As a result, customer retention activities are sometimes given lower or no priority.

Step 5: Monitor retention on an ongoing basis

Even with top-notch software, great services and a world-class customer retention mechanism, some customers will leave from time to time. Therefore it is important for companies to monitor retention on an ongoing basis through reporting and customer feedback. Companies should strive to embed analysis processes in their DNA rather than treat them as one-off exercises. This ongoing focus is particularly important for software and services firms, where constant change is a way of life.

Ongoing retention reporting keeps attrition risks front of mind and ensures rapid response. Regular reports also highlight where problems lie and where additional coaching may be needed. These reports can be leveraged to evaluate retention efforts for at-risk customers, determine incentive compensation payouts and publicly recognize the teams and individuals who have most improved customer retention or achieved the lowest unwanted attrition.

Retention reports are invaluable as you test new programs and alternative strategies for keeping customers. The results of those experiments will show up in the reports, enabling you to begin answering critical questions such as: What ideas work well? Which have little impact on results? Do results of the tests vary by product line or by customer segment? Companies can use the data to zero in on the best strategies to reduce attrition.

It is also important for software and services firms to continuously monitor customer feedback through routine follow-up with lost customers. This can be challenging since many lost customers will be reluctant to share honest negative feedback with the company and, in particular, with a sales rep with whom they have a close relationship. However, decision makers will often open up about why they left when talking to an independent third party.

Direct feedback from customers led one B2B software company to conclude it had excellent customer relationships and minor quality issues with one product. An independent assessment, however, revealed that 64 percent of customers had concerns about the quality of the implementation team, and that these concerns were a material factor in 31 percent of customer departure decisions during the previous year. That information was invaluable in driving strategy adjustments, ultimately reducing unwanted customer attrition.

Retaining existing customers is a powerful revenue generator that appears simple on the surface but is in fact a complex and challenging undertaking. Successful retention requires a strong fact base, a defined response strategy, an early warning system, company buy-in and continuous monitoring. It requires a process and level of investment similar to other strategies pursued by the firm.

In our work with more than 300 clients, we have found most firms struggle with some or all of the five critical steps. By following these steps, companies have achieved sizable reductions in unwanted customer attrition, significantly increasing revenue and improving their growth trajectories.

Notes:

1 Emmett C. Murphy and Mark A. Murphy, Leading on the Edge of Chaos, Prentice Hall 2002.

2 This was first calculated by Frederick F. Reichheld and W. Earl Sasser, Jr., “Zero Defections: Quality Comes to Services,” Harvard Business Review, September 1990.

3 Alan E. Webber, “B2B Customer Experience Priorities In An Economic Downturn: Key Customer Usability Initiatives In A Soft Economy,” Forrester Research, February 19, 2008.

4 Michael Lowenstein, “Model modelers in predictive churn,” SearchCRM, June 2002.

Carter Hinckley is a managing director with Blue Ridge Partners with more than 30 years’ experience in sales, senior management and consulting — all focused on helping firms grow sales more effectively. Before joining Blue Ridge Partners he founded and served as CEO of a boutique software consulting firm for 15 years. Prior to that, he held various executive roles at Merrill Lynch and The Boston Company. He can be reached at chinckley@blueridgepartners.com.

Corey Torrence is a managing director with Blue Ridge Partners. From strategy through implementation to executive management he has focused on achieving revenue growth and profitable bottom-line results. For over a decade he served as CEO and in other senior positions at several global marketing and technology companies. Prior to his corporate experience, he provided strategy and growth improvement services as a partner with McKinsey & Company and other global consulting firms. He can be reached at ctorrence@blueridgepartners.com.