It’s often said that buyers are getting smarter and more powerful. In fact, one recent study of 1,400 business-to-business buyers conducted by the Corporate Executive Board found that roughly 60 percent of a typical buying decision — including researching solutions and ranking options — occurs before a supplier has even been contacted.

That’s bad news for suppliers and solution providers. It means they aren’t engaging buyers soon enough to truly shape and influence buying decisions. Under such circumstances, they not only run the risk of becoming “column fodder” in a vendor selection process but also are vulnerable to severe margin erosion in the deals they win.

To address these vulnerabilities and maximize growth, sellers need to raise their own IQs.

That’s what an expanding circle of companies are doing, particularly in sectors and segments that involve a complex, technology-oriented sale. They are realizing they need to adopt and apply sales intelligence in their client outreach and growth efforts if they are to perform at their potential.

As research on companies that have actively embraced sales intelligence demonstrates, you can substantially increase revenue performance by ensuring your selling team is supplied with relevant and actionable information that clarifies:

- Which prospective buyers (and decision team members) to target

- When buyers are likely to be open to new options and offers

- What conversations will create the incentive to change and the confidence to take action.

This article provides a framework for understanding the primary applications and the key dimensions of sales intelligence. Drawing on market studies and real-world experiences, you’ll learn how companies are capitalizing on sales intelligence strategies, skills and tools to take sales performance to new levels.

Sales intelligence lays foundation for insight-driven selling

A new consensus is emerging among companies engaged in a complex sale: Rather than just working harder, it’s time for sales professionals to work smarter. The good news is that sales intelligence makes this possible — delivering compelling business results.

“Effective use of sales intelligence increases revenue productivity per sales rep by 17 percent,” according to research firm CSO Insights. “Innovations in sales intelligence are helping reps gather and leverage the insights they need to find more opportunities, build consensus across multiple stakeholders to close more deals and optimize the size of those contracts through effective cross-selling and up-selling.”

Indeed, insights derived through intelligence gathering aren’t simply valuable as a means of targeting prospective buyers; they also enable sales professionals to act as trusted advisors and consultants. That’s critical. As the Corporate Executive Board’s Brent Adamson and Matthew Dixon point out in a recent article in the “Harvard Business Review,” the biggest driver of B2B sales performance today is “a supplier’s ability to deliver new insights.”

However, it’s difficult to position yourself as an authority and advisor to your prospective clients unless you deeply understand them — the implications of their current situation and the potential impact of taking a new direction. You need solid intel that puts you in the room with the right people and prepares you to conduct a relevant and value-rich sales conversation.

Three key applications of sales intelligence

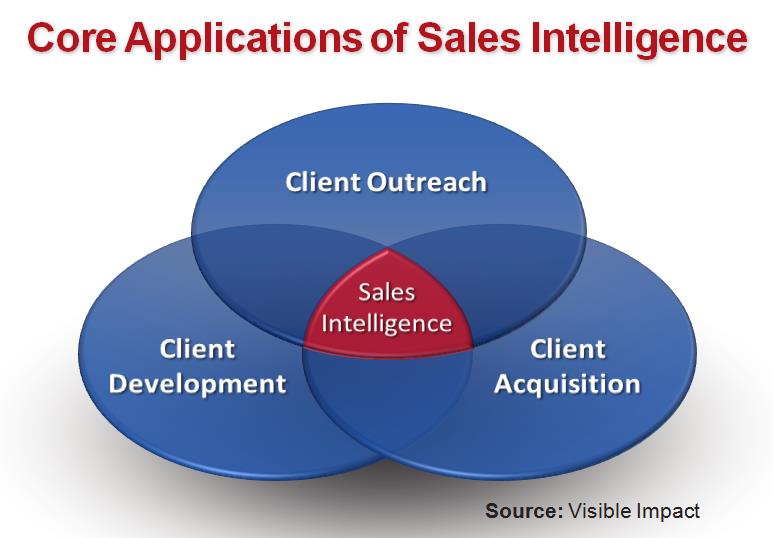

To appreciate sales intelligence more fully, it helps to understand how it is applied by companies in their sales efforts today. As we see it, there are three primary applications: client outreach, client acquisition; and client development.

Client outreach. While outreach can take many forms, it’s clear companies are now actively using sales intelligence to engage in outbound lead generation and appointment setting. Rather than just “smile and dial,” for instance, some reps engage in light research to determine possible hot buttons, relevant connections or other conversation points that might warm up an otherwise cold call.

Sales reps for Santa Barbara-based Curvature use a technique called “3×3” (coined by telesales training firm Vorsight) to set appointments with targeted prospects. Relying on a data-rich software solution called InsideView, they spend three minutes gathering three points of conversation to prepare for an initial call or email exchange.

Michael Lodato, senior vice president at Curvature, has seen conversions to the appointment stage rise from 10 percent to 45 percent as a result of the approach. “Getting those meeting-acceptance rates way up is all about intelligence,” he says, explaining that he puts equal weight on smart targeting, meeting preparation, and factors of “social proximity” — such as shared connections — that can open doors.

Companies such as Curvature also actively monitor the status, actions and behavior of their prospects for what they call “sales triggers.” If you are selling office equipment, it probably makes sense to identify and respond when a prospect is opening up new offices. A big merger or acquisition might be a trigger for a solution provider focused on the integration of legacy IT platforms. Such triggers often suggest a prospect is in a state of flux, transition or disorientation — creating opportunities to provide guidance and present alternatives to the status quo.

Client acquisition. When preparing for an initial meeting, high-performing reps tend to seek out deeper levels of sales intelligence. If you’ve secured a meeting with a qualified prospect, you want to ensure you’ve done your homework and know most of the key issues you can possibly learn up-front. Ideally, the amount of research you conduct should correspond to the perceived value of the opportunity.

Vienna, Va.-based Eloqua, a provider of marketing automation software, has been actively training its sales people to capitalize on sales intelligence and social media tools that facilitate research and provide greater insight into the lives of potential buyers.

Jill Rowley, Eloqua’s top sales performer for most of her 10-year tenure, explains that she actively prepares for a sales meeting by studying three factors: the industry, the company and the individuals on a decision committee. With one large client she pursued and won, she describes using LinkedIn’s SalesNavigator tool to identify individuals at the company who attended the same college as she.

As she cultivated relationships with fellow members of her alma mater, she gained the trust to ask probing questions: “Can you help me understand your business? Who’s who in the zoo? Where’s the power base? What are you struggling with right now?”

Client development. Yet another core application of sales intelligence lies in extending the value of existing client relationships. (In fact, this application might more accurately be called account intelligence.) The question here is how to identify opportunities to up-sell and cross-sell to existing clients. After all, it’s much harder and more costly to acquire new customers than it is to grow existing ones. Why neglect the clear and present opportunity to grow existing accounts?

With massive amounts of customer data and a proliferating array of products, Dell is one company that realized sales intelligence could help it seize customer growth potential. Leveraging the salesPRISM solution from Lattice Engines, the Round Rock, Texas-based IT giant concentrated on enabling “intelligent cross-sell targeting” and “contextual sales conversations.”

By integrating and analyzing multiple data sources (internal and external), the solution generates actionable insights for sales. As a result, sales teams can identify emerging opportunities within accounts and then engage customers in more timely and relevant conversations. “We are most successful when we engage customers about Dell solutions in a timely manner that respects the customer’s business context,” says Jeff Hamlin, director of small and medium business marketing for Dell.

Three levels of sales intelligence

The term “sales intelligence” lends itself to many possible interpretations. So there’s value in having a framework that deconstructs its various dimensions.

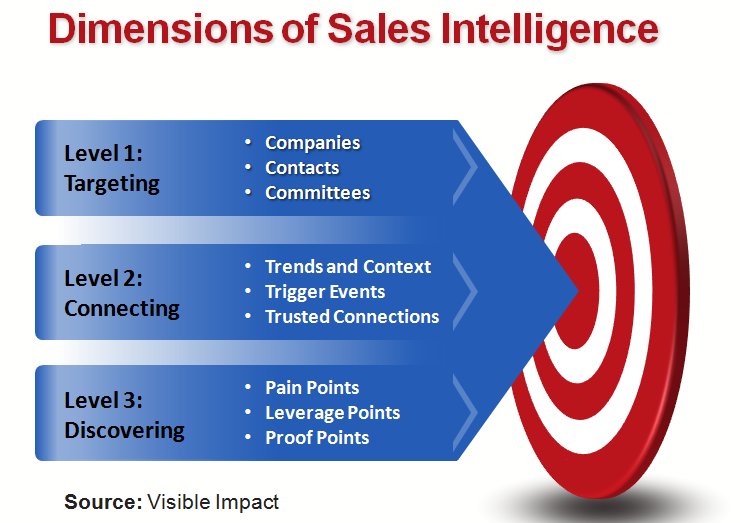

One way to look at sales intelligence is in the process-related phases one typically moves through when applying it. We recognize three key levels in relation to these phases: Level 1 (Targeting), Level 2 (Connecting), and Level 3 (Discovering).

Each level is associated with particular types of actionable intel. The deeper the level, the greater your understanding of a particular opportunity. And the more you know your buyer and demonstrate your knowledge in conversations, the greater your likelihood of building trust with prospects and expressing relevant value in sales conversations.

Level 1 Intelligence: Targeting. Intelligence gathering begins with the challenge of targeting and segmentation and moves on to deeper profiling around individual decision team members.

You want to know which types of companies (in which types of industries) are most likely to both purchase your solution and become profitable clients. You then dive deeper into the dynamics of those prospective clients. You want to know: Who are the key decision makers and influencers? What can be inferred about them and their challenges? What are the potential dynamics of a decision?

- Companies. It’s important to focus on prospective buyers that reflect your targeting and segmentation hypotheses. This typically means focusing on specific criteria — such as industry, employee counts and revenue bands — to build and refine your prospecting targets and lists.

- Contacts. Recognizing that it’s critical to constantly refine data and put quality over quantity to maintain a powerful database, you must again use specific criteria — perhaps title, experience, location, etc. — that helps you hone in on the individuals that are most likely to influence a deal.

- Committees. As companies become increasingly diligent and risk averse, their buying decision teams expand. This requires you to target and track not only individual contacts but the presumptive members of a decision committee as well.

Level 2 Intelligence: Connecting. Beyond the role of targeting and profiling your prospects comes the challenge of reaching out to them and connecting. Intelligence gathering in this phase enables you to determine when and why it might make sense to arrange a meeting with a prospect. In fact, the intelligence you generate can help you justify your case for arranging that meeting.

You want to know: What’s happening in my prospect’s world that might justify change? What signals are being sent that suggest change might make sense? Who might make an introduction or referral to overcome an initial barrier of trust?

- Trends and context. You want relevant knowledge that reflects on trends, changes and challenges affecting your prospects. Sometimes you gain these insights by reading trade journals, tracking online groups or drawing on the targeted feeds associated with research tools. Such research provides context for prioritizing your outreach and engaging your prospects.

- Trigger events. Drawing on past wins, you can determine which events or conditions might indicate a loosening of the status quo and an opportunity to win a new account. Depending on the nature of your business, you might look for factors such as new product announcements, executive movement, new funding, new legislation, M&A activity, or negative/positive earnings announcements. Such signals — which can be tracked and identified in today’s sales intelligence tools — can initiate your outreach efforts.

- Trusted connections. If possible, you’ll want to find references, referrals, shared contacts and other personal connections that can open doors with prospects. Sometimes the connection may be a shared college, professional or company experience — factors that are readily identifiable in tools like LinkedIn.

Level 3 Intelligence: Discovering. If you’ve secured an initial sales appointment (or want to take extra steps to justify the case for a meeting), it becomes important to delve deeper and develop a greater understanding of your prospect. While published resources (including industry news and analysis, financial fillings and public statements) can aid in this effort, it may make sense to begin gathering intelligence through discussions and interviews with various parties who may understand a decision team’s existing challenges and objectives (such as employees, former employees, partners, etc.).

Of course, this discovery process will be further expanded in your actual conversations with decision team members. In fact, you can differentiate yourself through the depth of your questioning and the clarity of your ultimate assessment. You want to know: What are the potential costs and consequences of remaining complacent? What are the elements of a potential solution that can help your prospect achieve key objectives? What’s necessary to guide your buyer through a successful implementation of your solution? What past successes will give your buyer the confidence to move forward with a deal?

- Pain points. Change is unlikely to happen unless there is sufficient justification for making it. Since so many deals are killed by indecision, it’s apparent that many sellers fail to create a sufficient sense of urgency to drive action. To avoid this fate, you must identify and articulate the full scope of a problem (or problems) that makes the current state undesirable. These are costs and consequences that are often hidden and may be revealed through investigation.

- Leverage points. To win more deals, you must determine the key factors that represent value and differentiation to your buyers. You want to know the aspects of your solution — “leverage points” — that set you apart in their eyes so you can vividly express them.

- Proof points. Recognizing that buyers typically demand proof to support their decisions, it’s important to identify the sources of evidence that will solidify your case. You may need specific customer references, case studies, ROI assessments, product demonstrations, etc. Whatever matters to your buyer’s decision team, you’ll need to determine and deliver it.

Ultimately, sales intelligence supports the conversations you conduct, the insights you present and the decision-making efforts you guide. Your story — and more importantly, the stories your buyers tell themselves to justify their decisions — are deeply enriched by the intelligence you gather and deploy.

Sales performance leaders value sales intelligence

Leading sales practitioners recognize the power of applying these capabilities. They capitalize on sales intelligence to get appointments with qualified prospects, develop the case for a buying decision and engage buyers in more compelling conversations.

Instead of passively waiting for business to come to them, top sales performers rely on actionable information to seek and seize lucrative opportunities. “Is money being left on the table by companies that don’t leverage sales intelligence? Absolutely,” says Barry Trailer, co-founder of CSO Insights. As he sees it, sales organizations that “rationalize their tools and prioritize their time” can realize significant performance gains.

Curvature’s Michael Lodato is succeeding by focusing on “social proximity” in his efforts to generate leads and appointments. By constantly monitoring and investigating the social linkages that connect a prospector with a prospect, his team is dramatically enhancing its conversion rates. Of course, this requires that sales people actively invest their time in building and nurturing their networks. It also requires them to identify and capitalize on meaningful connections such as a shared corporate experience or a relevant client reference.

Lodato describes “an invisible viral territory” that transcends traditional territories of geography, industry and company size. When you know the trusted connections available to you, you can strengthen client outreach, arrange more conversations with qualified buyers and get more opportunities into the sales pipeline.

But high performance also revolves around having visibility into and the ability to follow what he calls a “trust chain.” As he explains, corporate IT buyers responsible for network hardware decisions often know each other and are willing to act as references (or make introductions). “That community of people is actually fairly small and connected to each other out there in the viral world,” he says.

Eloqua’s Jill Rowley is succeeding by mining insights about existing customer successes and then seeking relevant points of intersection with potential customers. Having immersed herself in the details of existing Eloqua client experiences (including the 220 submissions for Eloqua’s recent performance awards), she knows which success stories will resonate with the companies she’s attempting to engage.

Recognizing that integration is a hot button for buyers of Eloqua’s marketing automation software solutions, she often investigates which web analytics, web conferencing, content management or e-commerce packages they use. She can then demonstrate the success of existing clients that rely on the same complementary tools.

Rather than saving success stories (and customer references) until late in a deal as a form of proof and validation, Rowley believes they must be deployed early in a sales interaction to engage a potential buyer and create confidence. “I use a customer story to get someone to want to become a new customer,” she explains. “I tell them a customer’s success story to help them to visualize what their journey is going to look like so they can confidently move forward.”

Rowley also learns from other parties that are trusted advisors to a potential client. She investigates what marketing agencies or consulting firms they rely on and will reach out to these partners for actionable intelligence. “It’s about looking at who is in that company’s sphere of influence and engaging them [to gather insights and guidance],” she explains.

Finally, it’s important to note how critical attributes like experience and inquisitiveness can be when it comes to discussions of sales intelligence. Rowley recognizes that much of her ability to prioritize her time and focus on gathering the right intelligence comes from having been in her role and profession over a 10-year span. It’s a factor that’s difficult to replicate (even if tools potentially help).

But it’s also clear that it takes dedication to continue learning with enthusiasm — and that successful sales intelligence gathering and application is strongly correlated with social connectedness.

“I read everything my customers read because I think it’s very important to know their world as well as they do — if not more so in some ways,” Rowley says, noting that much of this effort goes beyond a narrow focus on meeting a quarterly sales quota to building a network that has tremendous value (implied in her 4,200 LinkedIn connections). “I am constantly connecting with potential customers on LinkedIn. I track their interactions in online groups. I follow their tweets on Twitter and I re-tweet them. I ‘socially surround’ them.”

Smarter sales teams = stronger revenue performance

In the coming years, you can expect more investment in sales intelligence strategies, skills and tools.

Why? Buyers are simply more demanding than ever. They expect you to know them if you are to earn their trust and, ultimately, win their business. Indeed, you’ll win more often if you deeply understand your buyers and can engage them in truly relevant and compelling ways.

Of course, it’s important to recognize that dynamics can change — within your organization or in the broader marketplace. As such, it’s necessary to regularly assess sales intelligence value and effectiveness, and adjust goals or tactics as needed.

Similarly, it’s critical to promote, enable and reinforce proven practices around sales intelligence if you are to fully capitalize on it. Executive sales leadership is particularly significant in this regard. In fact, Aberdeen Group found that senior executives are active users of sales intelligence in 54 percent of the top performing sales organizations it studied (versus 38 percent of average performers and industry laggards).

But it’s also important for sales leaders to be wary of “analysis paralysis.” As such, they must strike a sensible balance between intelligence gathering and other aspects of sales execution. High-performing sales teams rely on their sales intelligence tools to productively gather insights. According to Aberdeen analyst Peter Ostrow, they generally spend less time engaged in research and more time actively selling than their lower performing counterparts at other companies.

And, finally, it’s vital to leverage sales intelligence in sales conversations. The insights you generate must be vividly expressed — whether in the field or in a virtual sales meeting — if you are to position yourself as a trusted advisor to your prospects and clients.

Bottom line: If exceptional sales performance is your goal, then it’s time to smarten up and make sales intelligence a priority. The more you know, the more you’ll grow.

Britton Manasco and M. Lee Sellers are principals with Visible Impact. With Visible Impact, you can strengthen your market positioning, elevate sales conversations and accelerate buying decision cycles. Get a free copy of VI’s new e-book, The Power of Visual Selling, at www.visibleimpact.com