In a shot across the bow of the Trump Administration, which hasn’t been shy about implementing taxes and tariffs for foreign goods entering the United States, the United Kingdom has decided to tax large online businesses that operate within its cybershores.

Britain’s Treasury chief, Philip Hammond, made the announcement earlier this week as he announced his budget, which eases or eradicates many of the country’s austerity practices of the last eight years.

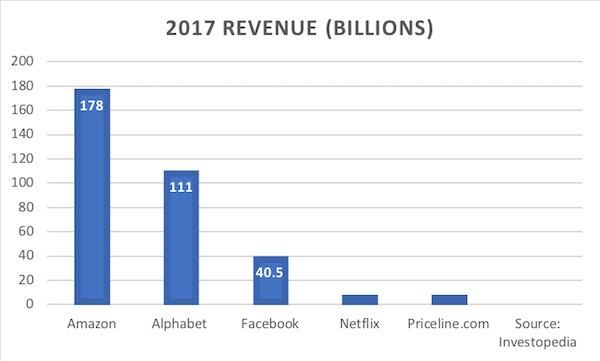

Hammond said the tax will be “narrowly-targeted” at “established tech giants” – most of which are American-based – rather than tech startups. The tax will affect companies making at least $640 million a year in global revenues, such as Amazon, Facebook and Google.

The tax is a new strategy: Companies generally pay their taxes where they’re based or where they have regional headquarters (generally low-tax havens like Ireland in the case of the European Union).

“The rules have simply not kept pace with changing business models,” Hammond said. “And it’s clearly not sustainable, or fair, that digital platform businesses can generate substantial value in the U.K. without paying tax here in respect of that business.”

The U.K. tax is set to begin in April 2020 and is forecast to bring in about $500 million pounds per year. Will other countries follow suit?

Clare Christopher is editor of SandHill.com.