My father was an executive and entrepreneur in enterprise technology, spending much of his early career at Digital Equipment in the 1970s. When I think about my childhood — between images of Saturday morning cartoons and Lego competitions — I have vivid memories of my dad’s business advice: “In technology, you either build the product or sell the product — otherwise you’re overhead.”

That advice stuck with me as I entered my early career in enterprise software, working as a VP at a large traditional tech company. I quickly realized that my dad was right. The people that really “mattered” to management were in product development or in sales. Once customers bought our products, they weren’t likely to switch.

Later, when I got my first CEO job in the SaaS world, I carried forward the same playbook. I remember commencing my role as CEO and putting one arm around my VP of sales and the other around my head of product. I figured the other stuff would work itself out. And I had good reason to believe that — the investors had told me that the product was “sticky” and that they had a 97 percent retention rate.

My learnings

Over the next four years, I got a crash course in reality and took away three lessons:

- Every company can contort its numbers to claim that their retention is “90-something percent.”

- Driving that “90-something percent” retention takes work.

- Retention can go above 100 percent, if you think about the ability to expand your clients’ spend.

While our company ended up excelling and eventually selling to Symantec, I realized I had my priorities wrong. Our retention rate had stayed in the 90s, but it easily could have been 110 – 120 percent if we had thought about Customer Success strategically. This linearly would have led to at least $50 million more in shareholder value.

I learned that in SaaS, it’s not about sales and it’s not about product — it’s only about Customer Success. And Customer Success is not about saving customers or reducing churn — Customer Success is about accelerating revenue.

Reinventing the funnel

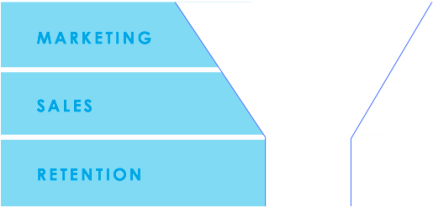

For a long time, B2B companies have used the visual of a funnel to talk about how they “acquire” customers.

Much like my dad’s advice from before, the funnel analogy needs a refresh:

- You are not “acquiring” your customers. Unlike the old world of enterprise software, customers aren’t yours. No, you don’t own them. Yes, they can leave you. They haven’t sunk millions of dollars into licenses and tens of millions into services to the point where they could never switch. Their loyalty is with you only as long as you deliver value.

- Successful companies will generate the vast majority of their revenue growth from existing customers. So the visual of the funnel is wrong — your existing customers are your biggest sales opportunity.

As such, we should consider rethinking the diagram as an hourglass.

When you think about Customer Success as a growth driver and when you aim for 100 percent dollar retention, a few things happen:

- Your growth accelerates. You now grow in two dimensions — by new customers and by new customer expansion. Nearly every hot SaaS company has north of 100 percent dollar retention.

- Your shareholder value increases. Since your revenue is growing faster, this is kind of obvious. As David Skok points out on his blog, shareholders also apply a greater multiple to high retention rate companies. This makes sense since high retention correlates with high value delivered. But this means you get a multiplier effect with retention. In the study Skok references, two percent increases in net retention yield 20 – 28 percent increases in valuation.

- Your CAC efficient frontier increases. In competitive markets, a company and its competitors bid up customer acquisition channels (e.g., pricing, PPC ads, etc.). From an economics standpoint, you can only pay so much to acquire a customer, and that “so much” is based upon your customer lifetime value (CLTV). Companies with higher dollar retention rates have higher CLTVs and therefore can spend more to grow.

Conclusion

I don’t get to say this too often, so I’ll relish it: My father’s advice is wrong. It was right at the time; but today, with lower friction for your customers, your success depends on your Customers’ Success. And your growth and shareholder value is at stake. So throw away your funnels — they were so 1980s.

Nick Mehta is CEO of customer success management company Gainsight. Prior to Gainsight, Nick was an entrepreneur in residence at Accel Partners. Earlier he was CEO of LiveOffice (now Symantec) and was VP at VERITAS Software (now Symantec). A huge sports fan, Nick thinks of his job as being head coach. He’s a big believer in the Golden Rule and tries to apply it to everything he does. Follow Nick on Twitter @nrmehta and Gainsight at @GainsightHQ.