India’s Enterprise Mobility Market (excluding devices) currently stands at USD 244 million. Over the last three years, enterprise mobility in India has seen exponential growth, and this trend is likely to continue for the next five years. We expect the country to have more than 100 million active mobile Internet users in the next five years. And we will see 40 percent year-over-year growth during the next five years, amounting to a billion-dollar potential over the five-year period.

At Zinnov we recently conducted the first-ever study on India’s enterprise mobility market, which encompasses hardware, network & data, applications and associated services. ‘The Enterprise Mobility Study – Indian Market Analysis” reveals that the exponential growth is due primarily to four drivers:

- Innovation

- Entrepreneurial and start-up activity

- Better devices penetration

- Increased acceptance of the majority of mobile platforms

Factors enabling the four main drivers include:

- Increased maturity of industry verticals towards adoption

- Declining costs

- Increased start-up activity

- Ecosystem play in market development

Add to this a combination of demand-side trends, and it’s clear that there is no looking back. As more and more employees get exposed to next-generation technologies and devices, the enterprises are beginning to follow suit.

Industries leading the way in applying mobility services include banking, manufacturing, retail, hospitality and healthcare. Upcoming adopters like automotive, logistics and consumer goods companies are increasingly using mobile supply chain systems to streamline inventory management, replenish stock, track demand, and manage shelf space and storage in an optimal manner.

As part of the study, we also interviewed 150 key IT decision makers in India to understand the softer issues driving enterprise mobility. They made some interesting observations. According to them, the key reasons for mobility are:

- Push from management

- Collaboration among employees

- Need to get more work time out of employees

- Pull from end users (customers or employees)

- Reducing communication costs

The interviewees revealed a different set of drivers from the business side of the enterprise, including:

- Better customer service

- Productivity advantage

- Employee satisfaction

- Competitive advantage

- Mobility ecosystem and platform adoption trends

It is also encouraging to see how the start-up ecosystem is evolving. Of the 750 digital start-ups in India, around 23.6 percent are in the mobility space, indicating a healthy entrepreneurial trend in this segment. Many tech companies such as RIM, Qualcomm, etc. are looking to provide seed funding and venture capital to start-ups working in the mobility space in India.

The Zinnov study found out that increased adoption of the majority of mobile platforms is a key motivation factor for start-ups. As platform adoptability improves along with network penetration and connectivity, more business functions like ERP, CRM, SCM, sales force automation, unified communication and billing are coming under the enterprise mobility ambit. This is coupled with maturing organizations that are trying to mobilize departments like HR, retail, customer service, finance and field service.

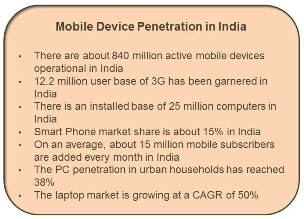

India already has an 840 million mobile phone subscriber base with 15 percent smartphone penetration. The tablet PC market in India sells about 1 lakh tablets per annum. OEMs are experiencing a tablet revolution. Almost all OEMs are coming up with innovative tablet offerings to tap the fast-growing market (e.g. Apple, BlackBerry, Samsung, Motorola, Acer, HCL, Beetel, G’Five, Huawei, etc.). All these facts point to a good device penetration that is further fueling the growth of enterprise mobility.

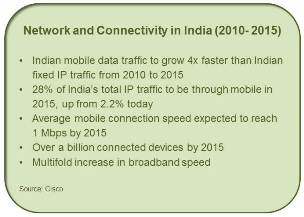

Networks and connectivity are also growing quickly and will continue expanding over the next five years.

Use cases

As enterprise mobility moves from being a concept to reality, a variety of innovative use cases are simultaneously emerging. Companies are now looking at enterprise mobility for functions like ERP, CRM, SCM, sales force automation, unified communication and billing – moving beyond traditional email and social networking uses.

As enterprise mobility matures among organizations, departments like HR, retail, customer service, finance and field service will look to mobilize in the next 24 months. This is over and above the early adopters like marketing, sales, IT, and corporate management.

Cost optimization

While mobility has a significant cost advantage from a business perspective, another noteworthy fact is the cost optimization within the enterprise mobility ecosystem, which acts as a double bonanza for the industry.

Companies today are optimizing their mobility investments with innovative approaches such as pay-per-use models, which will bring down operating costs. The majority of the IT decision makers we spoke to see this happening over the next two years, which speaks well for the industry,

Key challenges to adoption

However, we note a reason for caution. The Zinnov study revealed that, while the market is looking up, there are some key challenges that the industry needs to overcome to ensure that the enterprise mobility growth story remains intact.

Today, the average salary per employee in India is relatively low, and it is difficult for enterprises to give devices more than the salary of the individuals. Hence adoption is restrained to only the senior level.

Also, as Indian customers are found to be very demanding, the user expectation is to get everything delivered on the phone.

Other challenges include:

- Lack of standard supply chain in most industries

- Vernacular content

- Absence of key large players focus, making it difficult for core businesses to move to mobile applications

- Lack of business-centric mobile applications and appropriate back-end integration of applications

- And last but not the least, successful India case studies are not being preached in the market.

However, sustained initiatives and innovation by all the stakeholders in the ecosystem including hardware vendors, independent service providers, value added re-sellers, system integrators, wireless carriers and middleware players can ensure that the above challenges are easily met.

They are only going to gain from the fact that network and connectivity will significantly improve in India over the next five years.

‘The Enterprise Mobility Study – Indian Market Analysis” talks about India’s rapidly growing enterprise mobility market and how it is likely to change the innovation landscape over the next five years. It highlights interesting case studies, market trends and challenges. Click here to access the study.

Praveen Bhadada is Director – Global Consulting at Zinnov Management Consulting. Anurag Verma is a consultant at Zinnov and has worked with technology companies on syndicated studies and papers on topics such as IP capacity landscape in India, sectoral growth of Indian businesses, China R&D landscape, etc. He has also been a key resource working on syndicated studies for industry bodies such as NASSCOM and India Brand Equity Foundation.

Founded in 2002, Zinnov – meaning Zeal in Innovation – is a leading management consulting company providing advisory services in the area of global sourcing, emerging markets expansion and human capital optimization to Fortune 1000 and reputed SMB companies. Zinnov works collectively with clients to provide solutions that help in integrating organizational vision, business definition and processes.