With the Internet of Things (IoT) widely predicted to be a top trend that will reshape the software industry over the next few years, Sand Hill Group’s annual CEO / CFO Outlook study this year included a set of questions on the IoT’s impact to date on the companies responding to our survey.

Sand Hill Group’s 2014 study reveals that planned revenue growth over the next 12 months for 29 percent of the respondent companies is 50 percent or higher. Within that group, 17 percent believe their revenue growth will increase by 100 percent or more.

Further, they reported that they expect the biggest influence driving customer software spending in the next 12 months will be “new business initiatives.”

Their plans for participating in the Internet of Things movement from 2014 to 2016, however, are not as positive toward growth, as the executives view the IoT as both an opportunity and a competitive threat. Our survey found mixed opinions on the boundary between opportunity and threat, depending primarily on the type of business of the participating company. Executives identified their companies in one of the following categories:

- Application software solutions (43%)

- Vertical industry solutions (19%)

- Other (analytics as a service, data as a service, R&D, system integrators, private equity investors or IT advisory services) (14%)

- Infrastructure software solutions (13%)

- Platform/developer software (8%)

- Security software solutions (3%)

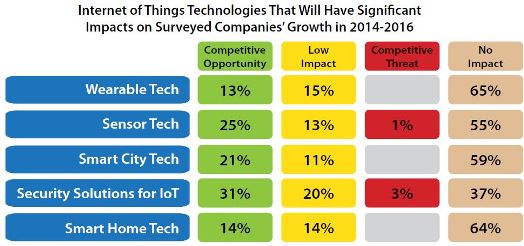

The survey asked participants to rank five IoT technologies as either a competitive opportunity or competitive threat to their business over the next two years:

- Wearable technologies

- Sensor technologies

- Smart City technologies

- Smart Home technologies

- Security Solutions for the IoT

Several respondents segmented in the “other” category as to type of business indicated the Internet of Things is an opportunity for them in the next 24 months. An Analytics-as-a-Service company identified four out of five IoT technologies as a competitive opportunity, excluding only sensors. An R&D company designated sensors, security, and Smart City technologies as opportunities, but not Smart Home tech or wearables. A systems integration firm identified Smart City technology as a competitive opportunity. A respondent in the area of IT services ranked wearables and sensors as areas of opportunity.

As the figure below illustrates, most respondents in our study view the five IoT technologies as a competitive opportunity. However, a few believe they face a competitive threat in coming months in the area of sensor technologies and security solutions for the IoT.

The Internet of Things is a nascent market; consequently, as the above figure shows, many of the respondents believe the IoT will have low or no impact on their business over the next two years.

The front-runner for the most impact (both opportunity and threat) among the IoT technologies is security solutions.

The study revealed that the majority of respondents believe security solutions (whether for the IoT or other areas) will be a high-growth area for software industry revenues over the next two years. And 63 percent of the executives ranked security as the #4 driver of impacts on software industry revenues in the next 12 months.

However, 54 percent stated that security is the most worrisome factor in the way the software industry is evolving. Many of the study participants believe there has been “too much of a blind eye” to security in the growing trend of software being managed and hosted in the cloud, and it’s a top concern for the Internet of Things.

In a follow-up telephone interview, a CEO commented that “Security is definitely the most troubling aspect about how the industry is evolving. There is no doubt about it. We’re getting more and more questions from clients about it this year, asking us about authentication, permissioning and encryption.”

The study included 76 respondents participating in an online survey of quantitative questions during March and April as well as individual follow-up, in-depth telephone interviews with some of the participants, which included some questions not asked in the online survey. CEOs, presidents and chairmen comprised 57 percent of the online survey respondents; of the remaining participants, 17 percent were CFOs, 10 percent were COOs and 16 percent identified themselves in the “other” category. CEOs comprised 70 percent of those interviewed by phone.

Click here to review the contents and buy the report, “Software CEO / CFO Outlook 2014: The Complications of Change.” The report provides insights into the current and future state of the software industry, identifies new trends and tracks evolving trends and assesses the goals and challenges of growing software businesses.

M. R. Rangaswami is co-founder and CEO of Sand Hill Group and is the publisher of SandHill.com.