Conversations about social media have taken over a large amount of digital ink in cyberspace lately. We see this in our analyst inquiry calls as well. Organizations of all sizes are struggling to:

- Correlate social activities to tangible results

- Convert social analytics into actionable intelligence

- Create new business processes and rules to manage social interactions or to create social engagement.

The good news is that we have answers for all of these end-user questions. Our latest global research encompasses Asia Pacific (25 percent), EMEA (26 percent) and North America (49 percent) as well as companies of all sizes and industries. At present, SA&I product capabilities fall into four major categories:

- Social Media Monitoring

- Social Analytics & Intelligence

- Market or Customer Insights

- Social Engagement

“How much of your day do you spend on each social media platform? I’m finding myself, more and more often getting overwhelmed by the amount of time it takes to be ‘engaged.’ Any tips?” (Sherri Pellegren, social media strategist, online community manager at a jewelry retailer)

Organizations invest without clear ROI metrics

While social metrics that provide guidance or trend analysis are readily available in most social software tools via visualization, dashboards or other types of reporting on performance indicators, organizations struggle to understand how to align these metrics in a way that correlates to business goals and objectives. Our research found most fall into one or more of the following maturity levels:

- Clients know they need metrics but are uncertain as to what to use in order to be effective

- Clients expect vendors to provide them with a menu of available metrics or KPIs to choose from

- Clients know precisely which metrics they want for each of their business objectives.

In short, organizations invest for a variety of reasons — and acquire knowledge and experience along the way. This type of experimental laboratory approach is not all that unusual for emerging technology usage. (Remember text analytics usage 10-15 years ago?) However, much more in the way of budget and resources are being invested in social media analytics without a guaranteed return on investment. Nonetheless, companies continue to invest for a variety of business reasons.

Organizations invest for multiple reasons

One of the many reasons companies continue to pour money into social analytics software and services is the wide range of business use cases it can be applied to. Companies are more comfortable than ever before in using business intelligence reporting tools to inform their decision making. Now that it is possible for line-of-business functions to see the “why behind the BI” by leveraging contextual information (unstructured content such as social media or user generated content versus data which is structured) along with data, companies are eager to augment their customer intelligence initiatives.

Figure 1: Top reasons enterprises invest in SA&I tools*

* Multi-response answers—will not equal 100%

Source: ©2012 Hypatia Research Group, LLC. All Rights Reserved

According to our results in double-digit findings, companies primarily invest in SA&I software and services for three reasons:

- Customer management (includes service/support; marketing)

- Sales enrichment

- Enterprise risk and liabilities (includes product enhancement or design quality defect; brand management)

Organizations seek candidates with social skills, business process expertise and analytics savvy

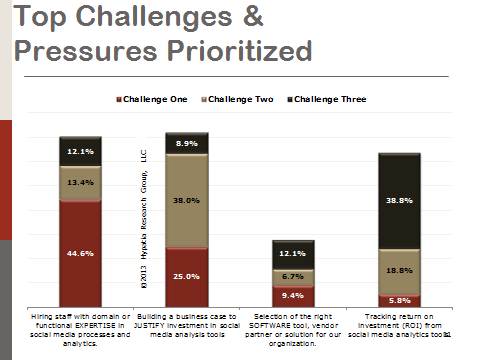

Our research reveals that organizations cite a desire to hire staff with domain and functional expertise in social media processes and analytics as a top priority (44.6 percent) followed by building a business case to justify investment (37.7 percent). Tracking return on investment came in as a third priority (38.6 percent).

This is not surprising as social analytics and intelligence usage for taking action requires numerous skills that are in limited supply and relies on multiple business functions to execute on the decision support provided by contextual analysis. Organizations understand the need to walk before racing competitively. Thus, hiring expertise to help prioritize and to develop business use case justification is more important than tracking return on investment.

Figure 2: Top three challenges: social analytics & intelligence usage*

* Multi-response answers—will not equal 100%

Source: ©2012 Hypatia Research Group, LLC. All Rights Reserved

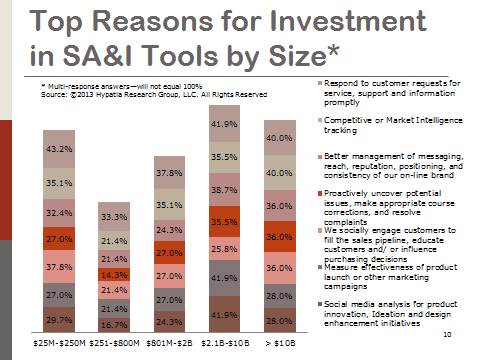

However, when segmenting these reasons by company size, a slightly different story materializes. Of our 526 global responses, 45 percent overall came from organizations with less than $250M in revenues, 17.4 percent had revenues of $251-$800M, 16.1 percent had revenues of $801-$2b, and 21.4 percent had more than $2.1b in revenues. More than half (12.2 percent) of these largest enterprises had greater than $10b in revenues.

Figure 3: Top reasons for investment in SA&I tools by size*

* Multi-response answers—will not equal 100%

* Multi-response answers—will not equal 100%

Source: ©2012 Hypatia Research Group, LLC. All Rights Reserved

Not surprisingly, organizations’ reasons for investing vary considerably by company size, job function and geography. Our business ROI evaluation of cosmetics company L’Oreal is an excellent example of this research finding. (For further social analytics & intelligence research by industry, geography, company size or job function, contact HRG@HypatiaResearch.com.)

Research approach

Hypatia Research defines social analytics and intelligence technologies as enabling the monitoring, filtering, categorization, sentiment and trend analysis, text analysis, correlation discovery and root-cause analysis of all types of unstructured social media and/or user-generated content from multiple sources both private and public. In short, social media analysis helps organizations discover actionable signals within the noise of more than 50 million conversations per day and to use this customer intelligence for guidance, decision support and/or corrective action deemed most advantageous in meeting business objectives and/or corporate goals.

Bottom line

Social analytics and intelligence solutions are much more than a “social media monitoring” tool.

Ideally, social analytics software tools should help organizations measure the effectiveness of social media on business — but, insofar as measuring a tangible ROI — software alone is just a major part of an overall strategy, operational plan and solution.

Stay tuned for more research insights from “Social Analytics & Intelligence: Converting Contextual to Actionable Insight” in future SandHill.com articles.

Leslie Ament, SVP of research and principal analyst at Hypatia Research Group, is a customer intelligence management thought leader and analyst who focuses on how organizations capture, manage, analyze and apply actionable customer insight to improve customer management techniques, reduce operating expenses and accelerate corporate growth. Her coverage areas include CRM, Business Intelligence, Social Media Intelligence/Search/Text Analytics, Web Analytics, Marketing Automation and Customer Data Management/Data Quality. Ament has driven process requirements gathering implementation for both on-premises and SaaS CRM systems. Contact her at LAR@HypatiaResearch.com.

This article is adapted from “Social Analytics & Intelligence: Converting Contextual to Actionable Insight”, ©2012 Hypatia Research Group. All Rights Reserved. Our primary research is designed to provide end-user organizations with an analysis of how companies invest in Social Analytics & Intelligence (SA&I) solutions, what tangible benefits are possible with SA&I, and what metrics can be used to measure the ROI of a SA&I initiative. In short, our research provides actionable insight that companies may use in compiling a vendor short list, request for qualifications and best practice terms of engagement with software vendors.