Summary: 2Q19 SaaS M&A

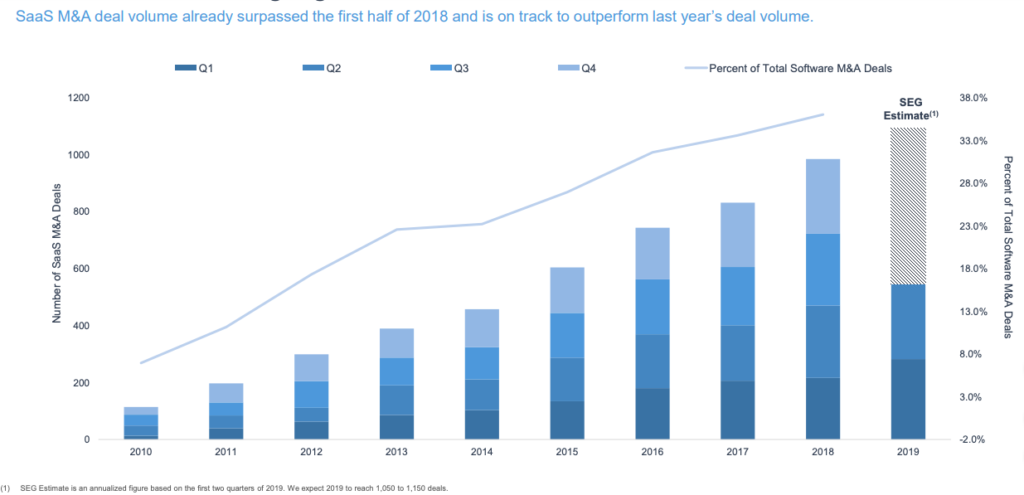

The first half of 2019 ended on a strong note as the overall software M&A industry maintained its bullish trend. The SaaS M&A market followed suit, as each of the past four quarters surpassed 250 transactions.

The overall software M&A industry (including SaaS, software, internet, and mobile deals) remained strong through the first half of 2019 and is on track to outperform 2018.

• The SaaS M&A market continued to roar, as each of the past four quarters posted above 250 transactions. Valuations remained strong, as 2Q19 posted a median of 4.6x EV/Revenue, a high point for the SaaS M&A market.

• The composition of SaaS targets indicated that the majority of companies were not VC funded (60% of targets), based in North America (76% of targets), and SMBs with less than 150 employees (59%).

• In 2Q19, there was an even mix of private equity firms and traditional strategic buyers driving M&A activity.

• CRM & Marketing deal volume increased approximately 27%, posting 47 deals in 2Q19, compared to 1Q19’s 37 deals.

• Healthcare, Real Estate, and Education were the most active verticals over the past three years.

• Select notable Healthcare transactions include The Riverside Company’s acquisition of HemaTerra Technologies(1) and Champion Healthcare Technologies, Allscripts’s acquisition of ZappRX, and JPMorgan Chase’s acquisition of Instamed Communications.

The SaaS report also includes historical deal volume and valuation statistics, most active buyers, notable deals, private equity activity, and more. Click here to download your complimentary copy of SEG’s 2Q19 SaaS M&A Snapshot.