2012 year-to-date has demonstrated favorable e-discovery M&A activity compared to the recession years in the late 2008 to 2010 period. This follows the 2011 spate of mega deals and forecasts of dramatic consolidation among e-discovery industry players.

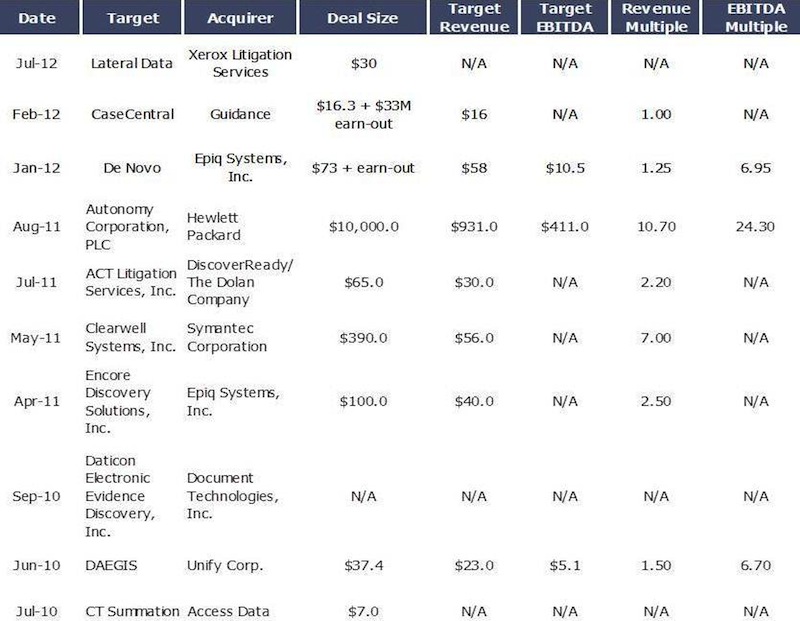

The table below describes certain M&A transactions in the e-discovery and legal software sectors from 2010 through 2012 year-to-date.

By all measures, 2011 was a record year for M&A activity in the e-discovery sector with new players, particularly the large technology majors, entering the field and offering record valuations. Symantec paid seven times revenue for Clearwell. The bellwether deal, however, was Hewlett-Packard’s $10 billion acquisition of U.K.-based Autonomy PLC at 11 times revenue.

In 2012 year-to-date, certain noteworthy M&A transactions have taken place, as follows:

- Guidance Software acquired CaseCentral, a cloud-based document review and production Software-as-a-Service company serving corporations and law firms. (The SaaS public software companies are more highly valued than companies with more traditional revenue models.) CaseCentral was one of the first movers to the cloud. In the current year, electronically stored information, or ESI, in the cloud had been more widely adopted. LexisNexis, one of the industry’s majors, recently announced it is moving e-discovery to the cloud.

- Xerox Litigation Services acquired Houston-based Lateral Data, LP, a software development and litigation services company that provides e-discovery solutions. Its e-discovery platform covers the full EDRM.

In addition to the strategic acquirers, private equity firms invested in the e-discovery sector in 2012:

- LexisNexis divested Applied Discovery to Siris Capital, a New York based private equity firm that focuses on turnaround situations. Under new management, Applied Discovery has now sharpened its focus on e-discovery services.

- Catalyst Repository Systems received a major equity investment from a private equity investor. RenewData Corp., majority owned by private equity firms, and Equivalent DATA, both successfully concluded capital raisings in the private market.

The e-discovery sector continues to spawn new companies. X1 Discovery, Inc., founded in the 2011 – 2012 timeframe and spun out of Idealab venture firm, offers an investigative solution that enables e-discovery and computer forensics professionals to collect, authenticate, search, review and produce ESI from social media sites, such as Facebook, Twitter and LinkedIn, among other offerings. X1 Discovery sells its products online.

The market valuations of the publicly held e-discovery companies in 2012 have risen or held constant at 2011 levels through August. CommVault, Guidance Software and Epiq command premium valuations, compared to many software companies, with FTI Consulting and Daegis lower multiples, for they are not pure e-discovery plays.

Year-end 2012 and beyond

Sector Results

With overall legal firm technology spending still recovering from the economic downturn, 2012 is shaping up as a record year, continuing the strong rebound performance among e-discovery vendors in 2011. This is attributable to widespread use of electronic data in all areas and the innovative product offerings now available to serve law firms and corporate investigative requirements.

Technology assisted review has become more widely adopted and predictive coding, pioneered during the past few years by e-discovery companies, has received heightened recognition. Unfortunately, two recent court cases, Da Silva Moore v. Publicis Groupe and Kleen Products v. Packaging Corporation of America, were settled early without legal support for technology assisted review. In Global Aerospace v. Landow Aviation, the outcome for predictive coding was favorable due to judicial ruling.

A proliferation of new solutions and product enhancements are now being introduced in the e-discovery market. Kroll Ontrack hit its stride with well-received products. AccessData, Nuix and many others have recently introduced major new products for the EDRM spectrum.

M&A

The e-discovery sector, estimated at roughly $1 billion, holds the opportunity for high growth and is likely to continue to be a fertile area for investment and M&A. (Note: Xerox Litigation Services estimates the market will be $1.6 billion in 2013.)

How have the large technology acquirers that undertook major acquisitions in the e-discovery sector fared? Despite the strong demand for software and services required for ESI, these highly-acclaimed acquisitions fell short of expectations by most accounts. Hewlett-Packard has publicly reported the shortfalls at Autonomy post-acquisition. Autonomy’s top-level management, including its founder, has been replaced and a 20-year veteran of Microsoft now heads Autonomy in its integration with Hewlett-Packard. It is unclear as to how well Clearwell fared in its integration with Symantec; the Symantec management crafting the e-discovery strategy and spearheading the acquisition has departed the company. Among the other large e-discovery company acquirers, EMC and IBM, which also consummated e-discovery acquisitions in the recent past, have yet to devise the optimal products and solutions to excel in the sector, according to a 2012 Gartner e-discovery report.

e-discovery companies have proven themselves as visionary innovators in developing software and systems for a landscape of proliferating unstructured data. The sector has the expertise and products that are vital to processing data not only for legal investigative purposes but also in the large regulatory, compliance and government fields. Since the recession that severely impacted the legal firms, the industry has widened its reach to corporations and government organizations, enhancing the e-discovery market’s potential growth and size.

The large technology companies are likely to continue to be active acquirers in the sector. Many of the exceptional e-discovery companies are still young, experiencing rapid growth without the need for outside capital. In the future, they may be more receptive to being acquired when they are more sizeable and before their high growth plateaus.

The year 2012 may still hold surprises in terms of unannounced M&A transactions.

Mary Jo Zandy is a managing director at Berkery Noyes & Co. with over 20 years’ experience in finance and investment banking. She has closed and advised on dozens of transactions, with a principal focus on valuations and divestiture work and sale of privately held companies including divestitures for The McGraw-Hill Companies, IDG Group, IHS Group, Pearson, The Thomson Corporation, Primedia & Standex International. She is a Chartered Financial Analyst. Berkery Noyes provides strategic mergers and acquisitions transaction advisory services, financial consulting and strategic research to middle-market information and technology companies in the United States and internationally.