Software companies pulled down their fair share of 2017’s bullish business climate. The new 2018 Annual Report by M&A advisors Software Equity Group details the health of the software sector, including year-over-year growth across all but 2 of the 21 product categories and verticals studied.

SEG maintains two software indices: the “SEG SaaS Index” which tracks 66 public software companies with subscription- and/or transaction-based models, and the “SEG Software Index” that focuses on 99 software providers with revenue derived from perpetual licenses or annual maintenance.

A comparison of company performance between the two indices underscores the improving performance of SaaS and cloud-based software companies. Consider the following SEG insight on next-generation vs. traditional software providers:

SaaS Company Performance – 2017

- The SEG SaaS Index that monitors publicly-traded SaaS companies shows they continue to grow in size, posting median TTM revenue of $248.1M in 4Q17 and a 27.5% YOY increase from last year’s top line mark of $194.6M.

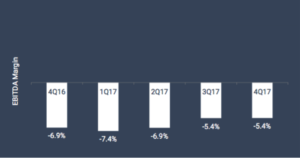

- Public SaaS companies continue to edge closer to GAAP profitability, posting a median EBITDA margin of -5.4% during the fourth quarter of 2017.

- Gross profit and net income margins have improved greatly in recent years for SaaS companies.

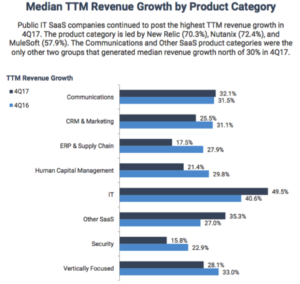

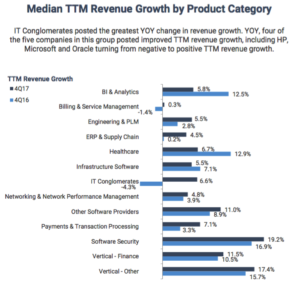

- IT sector SaaS companies posted the highest revenue growth during Q4.

Traditional Software Company Performance – 2017

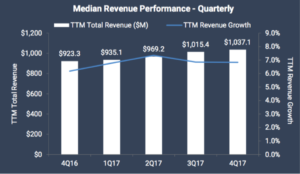

- On a quarterly basis, the SEG Software Index shows public software companies posted median TTM total revenue north of $1.0B, a 12.3% increase over 4Q16’s $923.3M revenue. The median TTM growth rate has hovered around 7% over the past five quarters. Over 60% of public software companies posted TTM revenue growth of 10% or less in 4Q17.

- Public software companies posted a median EBITDA margin of 17.8% in 4Q17, a slight decrease from 4Q16’s 18.8% median, though still a very healthy margin. Nearly 80% of the Index were profitable on a GAAP basis in 4Q17.

- Gross profit remained constant across traditional software companies.

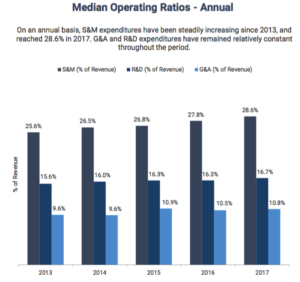

- Sales and marketing expenditures are experiencing year-over-year growth.

- The IT sector of traditional software companies is also demonstrating the highest revenue growth during Q4.

Clare Christopher is editor of SandHill.com.