The American Society of Civil Engineers gave the United States a “D+” in its most recent Infrastructure Report Card, warning, “Deteriorating infrastructure is impeding our ability to compete in the thriving global economy, and improvements are necessary to ensure our country is built for the future.” In a 2016 economic study, the ASCE estimated that the dilapidated state of the nation’s roads, bridges and other critical infrastructure will result in $3.9 trillion in losses to economic output, $7 trillion in lost business sales and 2.5 million lost jobs by 2025, reports PitchBook.

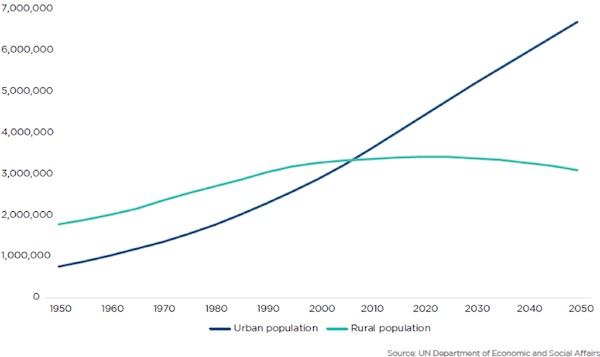

This infrastructure is concentrated in the urban cores, where airports, marine ports, public parks, wireless towers, petroleum pipelines, rail lines and power transmission assets are most densely distributed. And the problem isn’t just relegated to the United States: All over the world cities are growing bigger – putting more pressure on aging infrastructure – as populations move from rural to urban environments.

According to Bank of America Merrill Lynch, the United States alone faces an estimated $3.8 trillion infrastructure gap by 2040. They estimate that the current public infrastructure market is worth between $3 trillion and $4 trillion today and could double to $8 trillion by 2030. Globally, the infrastructure gap is estimated to total $18 trillion on a total investment of $79 trillion.

With those types of sums in play, capital is being increasingly drawn to an area where financing was typically borne by taxpayers via elected officials and not private enterprise. But that could be set to change.

Private investment in infrastructure assets totaled just $337 billion last year, per BofAML, but 90% of institutional investors plan to increase their future allocation to the asset class. It’s easy to see why: Amid a “reach for yield” dynamic, infrastructure assets offer attractive returns, stable cash flows, inflation protection, low default rates and diversification benefits via low correlations to other assets, according to the CAIA Association. Efforts in this layer have been mainly the focus of VC-backed companies and their investors.

The playbook looks something like this: Leverage fundamental technologies developed over the last two economic cycles – smaller, more powerful computers with ubiquitous connectivity and cloud-based storage/processing – to ease acute burdens now via smarter, more efficient usage. Enabled by creative new “application layer” innovations like predictive policing, home automation systems, health wearables, autonomous vehicles, bike/scooter sharing and real-time public transit information.

Sidewalk Labs, an affiliate of Google parent Alphabet, is experimenting with urban innovation in Toronto and is looking to build a new city “from the internet up” in the hope of lowering the cost of living by 14% for an average family.

In a recent analysis, a global team of analysts at McKinsey found that adding digital intelligence to existing urban systems could improve key quality-of-life indicators by 10% to 30%. Examples include shortening emergency response times, cutting commute times, lowering disease burdens and reducing greenhouse gas emissions.

Clare Christopher is editor of SandHill.com.