We’re very excited about the findings in our recent fourth annual Wisdom of Crowds® Business Intelligence Market Study. The good news is that there is much more awareness around the value companies can realize through BI investments. It’s also encouraging to see the amount of success that respondents reported. Forty percent of the 1,182 respondents worldwide and representing more than 10 industries stated they “completely agree” that their business intelligence initiatives have been successful, and almost 50 percent stated they “agree somewhat” that they have been successful.

Another encouraging finding is the number of companies in Asia Pacific and Latin America stating they have significant plans to invest in business intelligence. And I was pleased to find that BI Competency Centers (BICCs) — which I began encouraging in 2001 — are well represented (17 percent) in the distribution across functions using BI in organizations.

There were also some surprises among the findings, especially the proliferation of BI tools and their impact on success/failure.

Here is my analysis of some of the survey findings.

Success with business intelligence

Although 40 percent of respondents indicated their BI initiatives have been successful, the majority did not “completely agree,” indicating there is room for improvement. As we found in prior years’ surveys, smaller organizations report greater BI success.

Smaller organizations tend to grab the bull by the horns and perceive BI as more strategic because it enables them to drive a wedge in the marketplace and level the playing field. Knowledge is power and at least a short-term advantage.

We also found, as in prior years, that BI penetration is still relatively low in organizations and size is a factor. The smallest organizations have reasonably good penetration levels compared to midsize and large organizations. In the largest organizations, 38-39 percent reported penetration below 20 percent.

I think penetration and success levels go hand in glove. When BI initiatives succeed, BI is much more likely to expand within the organization and touch other functions.

So the question is: How can organizations be more successful with BI so that more can benefit from it? I think it comes down to the fact that the BI inhibitors are the same as the catalysts. It starts at the top with having key involvement from leadership. Leadership must see business intelligence as core to their own success.

In discussing this finding about success with small business leaders, we find two important reasons for their success: 1) executive management “ownership” of BI initiatives and 2) ease and speed of deployment of initiatives compared to the complexities constraining agility in larger organizations.

Our study also found that a stable organization and the requisite skills to deliver solutions influence success. Conversely, the study found that BI fails when there is a lack of management understanding or appreciation of BI, a predominant focus upon technology vs. solving business problems and a lack of skills and resources to deliver solutions.

The impact of BICCs

Could a BI Competency Center help to ensure better implementation, more strategic focus and more success? Maybe; but it depends on how an organization conceives the BICC.

BICCs that report in to IT are, oftentimes, tool and technology competency centers. The way that I conceived BICCs years ago was to be much broader than that. BICCs should serve as sort of an advocate or intermediary for the end users. They need to understand the business, technology and objectives to take more of an expedient approach of getting something into the hands of users right away, with an eye towards longer-term strategy.

When I first started talking about BICCs more than a decade ago, we couldn’t find many of them. Over time, companies began investing in BICCs, and there are quite a few of them now. We find that the ones aligned with the business rather than IT are more successful, and those that report to finance have the greatest chance of succeeding. However, aligning with business rather than IT can cause a great deal of political strife and “people” issues.

BI tools penetration and impact

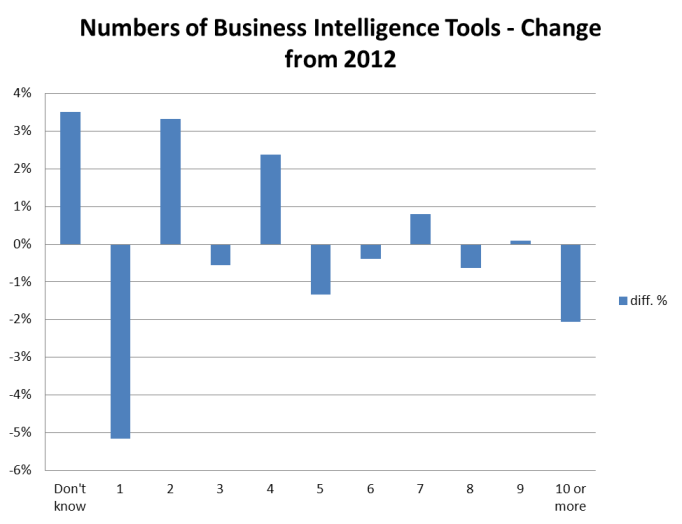

As shown in Figure 1, the survey found an increase in increase in numbers of BI tools in use.

Figure 1

Copyright 2013. Dresner Advisory Services, LLC. All rights reserved.

Copyright 2013. Dresner Advisory Services, LLC. All rights reserved.

However, the increased numbers of BI tools doesn’t necessarily lead to success. In fact, the highest degree of success was reported in organizations using fewer than four tools. Our research shows that those that were less successful with BI were more likely to not know how many tools were present in their organization, suggesting a lack of coordination across the enterprise. The proliferation of tools also can cause a lack of coordination around surrounding metadata and semantics, which results in ongoing problems with information consistency.

For a while it looked like the industry was going in the right direction with tools. But this year’s survey indicates the vendors have taken the reins and are driving more tools through organizations than in previous years. And with so many tools now targeted at business users, it is likely that these statistics understate the issue; most users (thus our survey participants) are not aware of all the tools used in their organization.

Tool proliferation often happens in any new software segment. The companies using the tools are to blame as well as the vendors. There is a corporate mindset that adding more technology will somehow compensate for years of mistakes and will solve difficult problems — process problems, people problems, organizational problems, political problems. Just add another tech tool to solve a problem. There are some great tools out there, but technology is an enabler. It doesn’t compensate for bad management, bad processes or organizational inertia.

I think the success that is possible through BI tools comes down to strategic intent. When organizations focus on enterprise-wide strategic use, they will naturally have fewer tools compared to BI being adopted departmentally with finance, marketing, HR, and others all doing their own thing. In contrast, if the CEO sees BI as something that is absolutely strategic at a personal level, as well as an organizational enterprise level, then the CEO will be much more involved in all aspects of BI. One certainly doesn’t want to be the last person standing with a solution not aligned to the CEO’s strategy.

This was evident when I talked with Cleveland Clinic when writing my second book several years ago. Their CEO really “gets it” and was determined to deliver business intelligence solutions for the organization and made it strategic. As a result, he neutralized many bottom-up efforts even though it’s a huge organization. As employees want to curry favor with the CEO, this approach can be especially fruitful.

In the end, it’s not so much about the technology as it is about aligning with a strategic program that really matters. If it matters to the CEO, everyone will get in lockstep.

BI priorities are changing

We tracked priorities among 19 technologies this year. Cloud BI, dashboards and mobile device support are the only three BI technologies that increased in importance since 2012, according to our survey respondents. Complex event processing, Big Data and open source technologies declined the most in priority.

Priorities for the majority of the technologies were consistent across all verticals. However, participants in the healthcare and government sectors gave a higher-than-average priority ranking for data mining and data discovery. Financial services ranked cloud BI as a higher priority.

Slicing the data by organization size, we found that BI technology priorities for larger organizations include data warehousing and data mining. Smaller organizations place priority on mobile device support, cloud BI and social media analysis.

Smaller organizations are less invested in traditional data warehousing. It doesn’t mean that data warehousing doesn’t have currency or add value. But they know that it can be expensive and takes a long time. And historically it’s been a fairly opaque process for them.

There are, and will continue to be, an increasing number of data quality and data integration tools targeting the end users. This is especially helpful in smaller organizations with little or no IT resources.

Over time, how will the increasing use of end-user data integration tools and self-service business intelligence tools impact data warehouses? I think data warehouses as we understand them today will probably subside, but I don’t know what will replace them. I just know that if there is enough pressure and enough investment, it will change. There is a lot of investment right now and a lot of talent being applied to this problem.

Vendors are still trying to provide a single repository for both transactional and business intelligence applications. It has been an aspiration for decades to have a single repository to avoid replicating data and going through a fairly time-consuming and costly process of having to synthesize and move data. If there were a way to do this in a practical, more efficient way, why wouldn’t we? We’ll continue to watch this space.

BI expansion plans through 2016

In this year’s survey we explored functions that drive business intelligence initiatives within an organization. In the lead are executive management and finance.

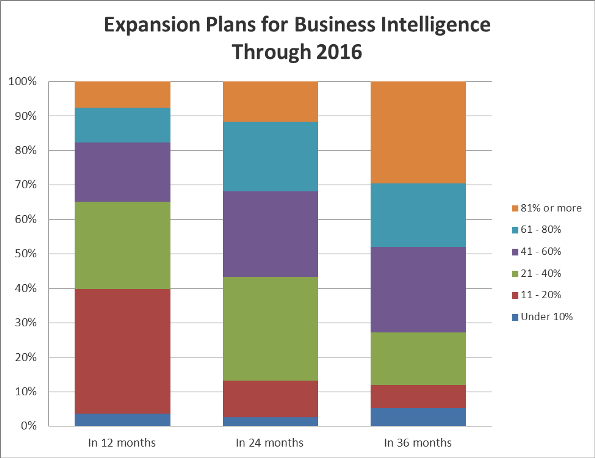

Participants revealed aggressive plans to expand business intelligence to more users in 2014 and over the next 24-36 months. As shown in Figure 2, executive management and marketing reported the biggest intentions to expand BI investment in 2014.

Figure 2

Copyright 2013. Dresner Advisory Services, LLC. All rights reserved.

Copyright 2013. Dresner Advisory Services, LLC. All rights reserved.

Of course these numbers represent aspirations for the next three years; actual accomplishments will be lower. My observation is that there is a better chance to achieve the numbers in 2014 because it’s likely there are real budgets and real plans in place for the next 12 months. They may actually achieve half of what they plan.

It’s hard to make progress and move the needle as much as folks think they will be able to do. It’s not just the technology and data issues that create difficulty; it’s the “people” issues that are really hard.

First, real senior-level support and ownership, such as at the Cleveland Clinic, is hard to get. The C-level folks who really see business intelligence as strategic are like rare birds.

The other component of difficulty, especially in large organizations, is in training people and getting them to embrace BI. There are people that don’t want to know the information a BI initiative reveals because it can be a threat to them. They may have to change their behavior and business processes. Change is really hard. It’s fear of the unknown. And we’re hardwired to avoid “different.” The result is inertia.

Here’s a challenge: How can vendors, consultants and the overall community find ways to make initial BI implementations more successful? Hit and run doesn’t work, but a lot of vendors are incented to do just that — get it in, move on to the next one, oversell.

I challenge the vendors to start focusing on making their customers really successful with an initial implementation; that’s what will get them to the next implementation. It’s about transferring the skills, making them self-sufficient and building internal competencies. It doesn’t matter whether it’s a formal BI Competency Center or not. What matters is that the customer has the competencies. Making customers dependent on the vendor or consultant long term doesn’t serve anyone’s interests. We as a community need to work on making initial implementations really successful.

The report on the 2013 Wisdom of Crowds Business Intelligence Market Study® is available at www.biwisdom.com. The report includes departments and functions driving business intelligence, objectives (per organization size, geography, industry), current penetration plus expansion plans, BI tools in use and their impact on success, BI vendor rankings, perceived success of BI initiatives and key reasons for success or failure, and more. There were 1,182 respondents from North America, EMEA, Asia Pacific and Latin America and representing more than 10 vertical industries.

The Wisdom of Crowds ® Business Intelligence Market Study was conceived and executed by Dresner Advisory Services, LLC, an independent advisory firm, and Howard Dresner, its president, founder and chief research officer. Howard Dresner is one of the foremost thought leaders in Business Intelligence and Performance Management, having coined the term “Business Intelligence” in 1989. He has published two books on the subject, The Performance Management Revolution — “Business Results through Insight and Action”, and “Profiles in Performance — Business Intelligence Journeys and the Roadmap for Change.” Prior to Dresner Advisory Services, Howard served as chief strategy officer at Hyperion Solutions and was a research fellow at Gartner, where he led its Business Intelligence research practice for 13 years.