Reports over the last month claim General Electric is selling off key digital assets, which likely include its Predix IoT platform.

Reports over the last month claim General Electric is selling off key digital assets, which likely include its Predix IoT platform.

It’s still not clear exactly which assets will be sold or spun out. But it is clear GE’s ongoing struggles have come home to roost at the GE Digital unit. Something has to give.

The impending changes at GE highlight a number of important questions for partners, customers, competitors and the industry itself.

- Who are the likely buyers?

- Which parts of GE Digital should be sold and what core value retained?

- What are the implications for customers and developers with investments in the Predix platform and partnerships with GE?

- And ultimately, what are the implications for the IoT?

Who are the likely buyers?

Although we’ll have to wait to see how this story unfolds, you can expect to see interested parties from at least four areas:

- Private equity firms

- Industrial firms in similar industries, some with their own platforms, such as Bosch, Siemens, Schneider Electric, Hitachi and Honeywell

- Large tech companies. Microsoft, Amazon and Google already have enormous cloud investments, a focus on enterprises and large development communities

- Enterprise software companies targeting similar vertical markets and industries, such as SAP and Oracle

How will it shake out?

The sale of GE Digital assets could take a number of forms. In addition to keeping some parts and selling others, there may be a few intriguing variations.

As well as PE firms taking some assets private, we might also see a joint venture where GE retains access to some of the intellectual property and shares in some of a new entity’s upside.

Could Predix be split out into a separate organization that would be more of an open platform? Could it be owned by a number of different parties? Perhaps parts of Predix could be guided by an industry consortium like Industrial Internet Consortium (IIC) or Industrie 4.0? Or might parts of Predix be contributed in open source just as Salesforce and Microsoft recently announced they plan to open source some of their enterprise software offerings?

Might several companies jointly own it in an entity analogous to what we see in the entertainment industry, where the Hulu streaming service is currently owned by Disney, Comcast, Fox and Time Warner?

Could Microsoft, with its strength in the enterprise, enormous developer community, large software distribution network and solution provider relationships, acquire Predix to complement its Azure Cloud? That would certainly help their cloud offerings as they battle Amazon.

A Microsoft acquisition would further enhance their solution offerings, rev up new consulting income and further cement their presence in the enterprise. It would be logical for Microsoft to bid for at least some parts of GE Digital, given the recent strengthening of their strategic partnership last month to include co-selling and co-marketing.

Regardless, you’ll probably see the outright sale of at least one or two of the many companies GE Digital acquired in the last few years, like ServiceMax, Meridium, Wise.io, Shipexpress, Wurldtech and so on.

Parts of GE Digital will by necessity go back to the GE business units. Some of this software was developed in the GE business units before being centralized in GE Digital. Those industry-specific solutions will help differentiate GE’s equipment offerings going forward.

Is Predix too intertwined and critical to GE to sell off completely? Or too big a chunk for other companies to bite off whole? Especially if they have already developed their own platforms? It will be intriguing to see what the final outcome is as this story continues to unfold.

How will this affect stakeholders?

Regardless of how GE Digital is parceled out, industry players need to actively consider how it affects their business. There have been many lessons learned from the demise and break up of old platforms and the migrations of ecosystem players.

Having lived through and worked on platform transitions in the past, I can’t emphasize enough the huge potential consequences. Remember the DOS/CPM battles in the early days of the PC or the DOS to Windows transition? Or the OS/2 and Windows cold war as IBM phased out OS/2? And what about the Symbian, Palm and Blackberry operating systems in the personal digital assistant and phone space?

Many industries in transition have seen multiple players go out of business when they don’t make platform transitions quickly enough. Innovative players step in to take the places of those that are slow to respond.

There is no one right answer for all the players in the ecosystem, but there are some fundamental questions to be asked and issues to be considered.

Independent software developers:

- Can you still work with divisions of GE, especially if they have limited resources?

- Is there an opportunity to work even more closely with them as they no longer have the internal software resources to flesh out a whole solution?

- Can you work with the new owner of the software or platform, however it gets spun out – or are they now going to compete with you?

- If you were not heavily committed to Predix and GE Digital, is there another platform you should migrate to?

Note: GE and its investment bank(s) need to publicly clarify what their plans are soon. Otherwise the default uncertainty will precipitate the departure of engineers and reduction of development resources allocated to focus on Predix or other GE Digital offerings. These are death knells for a struggling platform.

Companies typically wait too long in platform transitions. They worry about internal issues rather than realizing the damaging impact this has on platform momentum. Hopefully GE won’t make that mistake and fritter away the remaining value of these assets.

Ecosystem and platform players with a competitive offering:

- Is there an opportunity to pick up some of the GE Digital pieces?

- Can those pieces get you into new vertical markets or industries?

- Are there competitive migration programs you can build to attract GE Predix customers to your platform – even if you don’t have a deal with GE?

- Can you attract GE’s third-party software developers that may now feel abandoned and are looking to migrate their efforts to another platform?

- Can you hire GE engineering talent that are being laid off or who are uncertain or disillusioned with their futures at GE?

Industrial equipment companies competing with GE:

- Is this an opportunity to go after GE customers when they are going through a period of uncertainty about GE’s strategy and level of investment?

- Should you increase promotion and visibility of your platform in light of GE’s decline?

- If you don’t already have a strong platform offering, consider acquiring some GE assets or partnering with other ecosystem players to offer one.

Companies currently using Predix or GE Digital offerings (for example,Maersk, BP, Exelon, Schindler):

- Stay tuned to see what happens to the core elements of GE Digital.

- Try to determine what level of ongoing support will be provided.

- Begin exploring other alternative platforms and approaches to achieve your business objectives if GE Digital and Predix are no longer appropriate.

Consortium or industry groups:

- Can you pick up some assets or pieces to further the role of your consortium or the standards you are promoting?

- Do you need to work with other platform players given the vacuum created by GE’s absence?

- Can you work with GE to build some sort of open software platform that provides continuation for Predix but makes it more industry and company neutral?

What are the implications for the IoT platform markets?

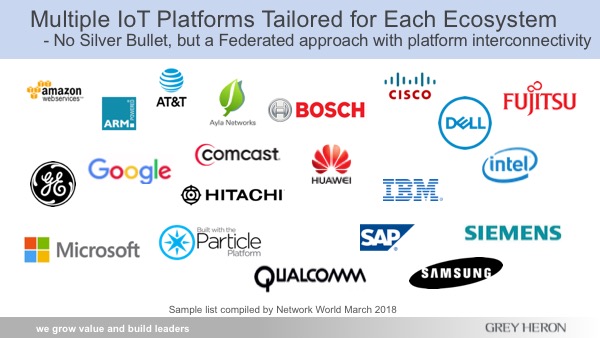

There are numerous IoT platform providers. The question is, will there be one winner, a few leaders or will these platforms remain fragmented for the near future?

In the early days of IoT, there was a belief that one or two platforms might dominate and become the standard. With the profusion of offerings from many vendors and GE’s seeming exit from the space, you should expect to see a fragmented market.

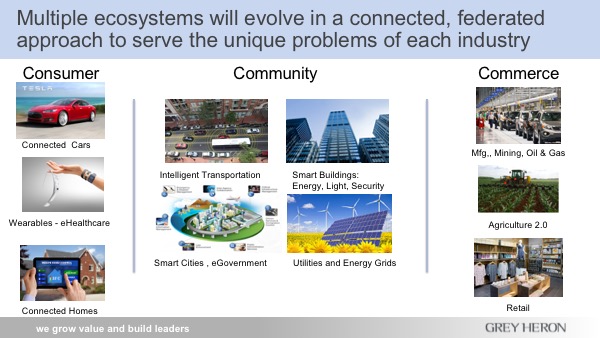

There are many unique industries and ecosystems, as I highlighted in Monetizing IoT: Show me the Money back in 2015 and in various presentations like Industrial IoT Disruption since then.

They each have very different requirements and use cases. What we are continuing to see in the IoT space is the development of platforms and ecosystems, optimized for vertical industries, with some level of interconnection in a federated approach.

In the illustration above, I highlighted 10 different ecosystems. They all have unique characteristics and have evolved over long periods of time, with different leaders in each space. They have been optimized and organized along specific use cases for different users with different problems and different requirements. This has resulted in the use of different technologies, different protocols and processes, and different business models.

This should come as no surprise. Look no further than two simple examples. The connected car space requires high speed, high reliability, powerful computing, wired communications and power hungry devices. Outcomes in this area entail life and death consequences within microseconds.

By contrast, a smart agricultural IoT solution that is distributed over miles may require only periodic wireless communications of occasional small packets of sensor data. It may only need very low bandwidth communication speeds in order to manage day-to-day analysis of moisture content or seasonal fertilization needs. And it may also require extremely low-power devices that can work remotely on batteries for 5 to 10 years.

These are entirely different use cases with different requirements, different standards and different industry players. Why should they both have an identical IoT platform?

More likely, each of these industry areas or vertical markets will continue to coalesce around their own platform(s) optimized for their industry and ecosystem players. In parallel, they may build some level of connectivity to other industry platforms in a federated approach as necessary. A good example of this is the automotive industry, which is developing vehicle-to-vehicle (V2V) communications. To bridge over to smart cities and smart transportation ecosystems, it is also building vehicle-to-infrastructure (V2I) links to reach infrastructure like stoplights, parking spaces, recharging stations and more.

(This view of a federation of IoT platforms was reinforced in recent research and analysis done at Georgia Institute of Technology.)

What about the future?

Are we at a turning point? Although it is not clear now exactly how the GE Digital and Predix sale will transpire, this does seem to be a transition point for IoT platforms. One of the most promoted leaders of IoT platforms is being sold due to lack of profitability and patience to see it through. Was GE trying to do too much too quickly? Will Predix be a casualty of GE’s overly high expectations and expansion in other areas?

In some ways the Predix fate is just another example of industrial mutation that Joseph Schumpeter coined in his concept of “creative destruction.” He described the cycle of economic innovation and business cycles that destroy one structure and then create new ones. Out of the ashes of GE Digital will emerge new and hopefully stronger ecosystems, partnerships, solutions and products to improve productivity and customer experience.

Based on working with clients through multiple business cycles, multiple platform shifts and IoT issues, I believe the GE Predix sale will be just one more point of evolutionary improvement in IoT platforms. I expect we will have multiple IoT platforms tuned to different industry and consumer verticals. Each one will develop around industry ecosystems and then become interconnected in a federated system as needs, priorities and use cases dictate.

What are your thoughts on GE Digital, Predix and the future of IoT platforms?

Chris Kocher is a co-founder of Grey Heron, a management and strategic marketing consulting firm. He has 30 years in both strategic and hands-on operating experience helping executives and investors build revenues and shareholder value. He has consulted with over 130 companies on innovating with new business models, product strategies and monetization. Chris has held management positions at HP and Symantec in addition to advisory roles at startups. He has worked extensively on monetization, SAAS, IoT, ecosystems, partnerships and accelerating growth in new business initiatives. For help on your growth strategies, new business model or monetization initiatives, email him at kocher@greyheron.com or follow him on LinkedIn.