Software company finance leaders need a solution that helps them track multiple financial and business metrics in real time. However, metrics alone do not tell the entire story of what’s happening in a software business. The finance team needs a system that lets them dig deeper into the meaning of each metric, and understand the dynamic relationships among those metrics, to provide strategic business insight and guidance to the executive team and the board. Here are the facts on software metrics that you need to know to gauge your business success and to avoid financial management mistakes.

Software company finance leaders need a solution that helps them track multiple financial and business metrics in real time. However, metrics alone do not tell the entire story of what’s happening in a software business. The finance team needs a system that lets them dig deeper into the meaning of each metric, and understand the dynamic relationships among those metrics, to provide strategic business insight and guidance to the executive team and the board. Here are the facts on software metrics that you need to know to gauge your business success and to avoid financial management mistakes.

Individual metrics only tell you part of the story

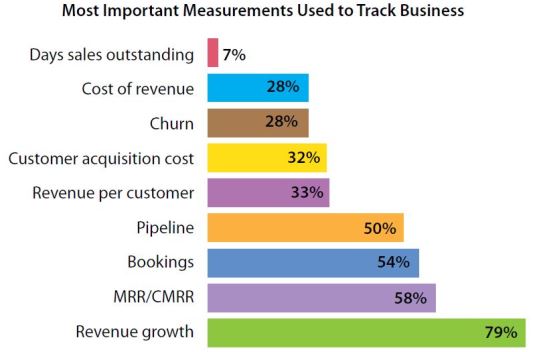

In conducting its annual study forecasting software industry trends, Sand Hill Group asked study participants in 2014 to select the most important measurements they use to track their business. The report, “Software CEO / CFO Outlook 2014: The Complications of Change,” revealed that the majority of participating companies rely on revenue growth as their preferred metric. Let’s talk about the top four metrics in the study and how to use them to gain insight into your software business.

© 2014 Sand Hill Group. All Rights Reserved.

Revenue growth demonstrates your software company’s ability to generate sales over time. This is a fundamental metric because, without revenue growth, your company will not survive in the long term. Corporate activity like fundraising (early and late rounds) and IPO timing tend to be driven by the magnitude and timing of revenue growth. Many in the software industry believe that the majority of a software company’s value at IPO is driven by its growth rate. Management decisions around hiring and product development often hinge on the revenue growth metric.

However, a software company should not be viewed by the revenue growth metric alone because revenue growth tells you nothing about the cost of your growth and your overall profitability. You need other metrics to see a complete picture of your company’s health. Yet revenue growth is an important building block for calculating other important metrics around profitability.

MRR and CMRR: Monthly recurring revenue (MRR) represents your company’s current run rate, showing how much revenue is coming in for the month. Committed (or contracted) monthly recurring revenue (CMRR) lets you look into the future, taking into consideration the term of each customer contract, anticipated renewals and churn, price changes, and new business to determine your future run rate. CMRR is considered among the most important metrics for a subscription-based business (SaaS, PaaS, IaaS, etc.) as it illustrates the predictable, recurring revenue of the business.

MRR and CMRR are also used by subscription businesses to forecast spending needs associated with managing a particular level of recurring revenue, such as planning for investment in customer service and support and product improvements requested by current customers.

But what about cash, which is the lifeblood of software companies? MRR and CMRR only tell you the monthly revenue recognized for accounting purposes but not necessarily the amount of cash collected (or not collected) or the timing of those cash collections. For example, if you have a somewhat healthy MRR but get paid biannually or at the end of a contract (post pay), your company may run out of cash before you ever recognize all of the contracted revenue. Conversely, prepaid revenue or collecting monthly will provide cash in the current period despite recurring revenue being recognized over time for accounting purposes.

Bookings represent the dollar value of the contracts your customers sign. Bookings is an important metric for both perpetual-license and subscription-based software companies because a new booking means that cash is coming in as soon as the software and associated services are delivered (and invoiced). Bookings in subscription-based companies represent the total value of a new contract, but the health of the business is more accurately measured by MRR and CMRR since the cash collection is incremental and ongoing.

Bookings are not an accounting measure, like revenue, which is why revenue growth is the more popular metric. Bookings do not indicate the timing of revenue recognition for accounting purposes or your ability to collect cash from customers. Nor do bookings indicate the expense you incurred in securing that contract; so you do not know how cost-effective you are in winning new business.

Pipeline is a precursor of bookings, measuring the dollar value of contracts that are expected to close (convert to a booking) but have yet to do so. There is always a percentage of pipeline business that does not close, and this gap can be a measure of effective sales forecasting and sales capability.

Observations on churn and customer acquisition cost (CAC)

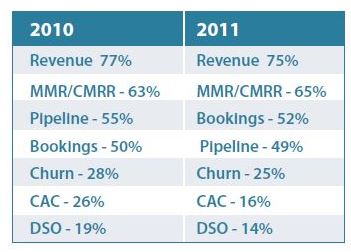

It is worth mentioning that the top four ranked measurements in 2014 are the same as the top four measurements cited by participants in Sand Hill’s 2010 and 2011 studies. But two aspects have changed over time:

- Approximately the same percentage of companies in 2014 use churn as in the 2010 and 2011 surveys, but it ranked lower this year.

- The ranking of CAC in 2014 is approximately the same as in prior years, but the percentage of participants using this method is twice as many as in 2011.

© 2014 Sand Hill Group. All Rights Reserved.

Churn measures the amount of customers or revenue lost in a particular period. A high churn rate means that the company is losing a large number of customers (or amount of revenue), which slows down growth and ultimately lowers the value of the company.

We believe there are several reasons why the churn metric in the table above falls below most metrics in importance for 2014. Sometimes companies want their customers to churn — namely, the unprofitable ones. Churn can be a natural and expected part of the business, such as with a freemium SaaS model where you are trying to get as many customers as possible to try your software and you want to retain customers who will pay for your service and churn those who will not.

Finance leaders want to know who their most profitable customers are, which can determine a tolerable level for churn. They also want to know how much it costs to acquire customers so that they can focus on acquiring profitable customers for the long term rather than acquiring customers who will pay little to nothing for software and services over time. That is why we see these other revenue and cost metrics with a higher level of importance than churn.

Customer acquisition cost, or CAC, is generally measured as the sales and marketing costs you spend to acquire a new customer. This metric is increasing in importance because software companies from 2010 and 2011 are maturing. Companies with three to five years of growth must shift some of their financial focus to profitability, with an eye on the bottom line in addition to continuing to monitor top-line growth.

So while the 2014 CEO / CFO Outlook study clearly shows that revenue metrics continue to dominate, the rise in importance of cost metrics like CAC prove that a significant volume of new software companies are maturing and their leadership is seeking profitable, sustainable growth rather than growth at all costs.

Three best practices in using business and financial metrics

- MRR and CMMR are not GAAP or industry-defined terms. Use them to provide insight into your business, but be cautious when understanding others’ definitions. Be certain that your finance team, executives and board are all in agreement on the definition of your performance metrics and use them consistently on reports and dashboards. Automate calculation of MRR and CMRR within your financial system by delivering sales and contract information from your CRM system directly into your financial system, avoiding double entry of data and error-prone spreadsheet manipulation.

- Once you understand the relationship that software business metrics have to your business, you can combine them to create even more useful metrics. As an example, you can calculate your CAC and divide by customer lifetime value (the total expected revenue and/or contribution over the lifetime of the customer relationship) to create a third metric: payback period. The payback period metric is helpful in understanding how much a company can profitably spend to acquire and retain customers as well as to segment profitable from unprofitable customer groups. The right financial system lets you easily combine operational and financial data to create meaningful metrics without having to export data into Excel for repetitive manual calculations.

- After developing a set of metrics to present a clear picture of your own software company’s performance, the next step is to benchmark. Use your peers’ performance to define your own company targets. Being able to include industry benchmark data alongside your own company data and metrics, in a single system, saves you time and effort (no more messy spreadsheets and manual data input) and will allow you to create budgets and plans more effectively as well.

Robert Reid is CEO of Intacct Corporation, a leading provider of cloud financial management and accounting software. With more than 30 years of experience in the software industry, Rob has a proven track record of driving explosive growth at innovative companies, and has demonstrated a deep expertise in bringing cloud computing to the world of business applications.