We expand the data we collect annually in our Wisdom of Crowds® Market Study, and late last year we added a segment on key location intelligence issues. Location intelligence is a form of business intelligence where the dominant dimension used for analysis is location or geography. We added this area of study because there is growing demand among BI users for location intelligence functionalities, especially with the increased use of mobile devices. This benchmark study to determine where the use of location intelligence is headed revealed that vendor investment needs to catch up with user priorities.

Early adoption phase

We collected survey data in September-October 2013 from top-management and BI executives for our fifth annual bi-annual benchmark study. Their companies range in size from fewer than 100 employees to more than 5,000, cover more than 14 industries and a wide array of geographies (22 EMEA countries, eight APAC countries, four Canadian provinces and 30 U.S. states).

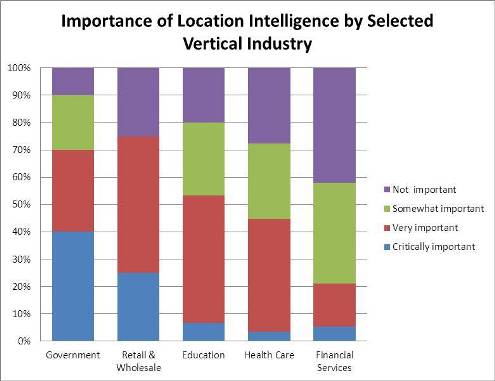

More than half of all respondents in all industries reported that location intelligence is critically important or very important to their business planning. Fewer than 20 percent said it is not important.

But fewer than 10 percent of business intelligence (BI) vendors reported that location intelligence is critically important to their plans, although 70 percent said it’s important.

So what’s going on? Why aren’t the vendors in sync with the market demand?

The study reveals that we’re still in the early days for the location intelligence market. Where things are and what is happening in particular locations is becoming increasingly important in a mobile and Internet of Things world, but it’s slow going right now.

All market dynamics start this way. But I think it will be big in BI. Mobile and cloud BI were the same way. They started off as nascent and turned into something more substantial. There needs to be a number of well-documented use cases in the various industries before companies realize that this applies to them and they can save money or make money by using location intelligence. The early adopters figure it out and start deploying it and get some first-mover advantage. And then it starts getting applied more broadly.

I don’t know how long the early adopter phase will last in the location intelligence segment. Three-quarters of the respondents in our study stated that the penetration of location intelligence in their organizations is currently 10 percent or less. In addition, most of them estimated that the uptake on these functionalities will be slow for at least 36 months.

Adoption by vertical industry

As shown in Fig 1, retail & wholesale, along with education are the two verticals that are most upbeat for faster adoption of location intelligence.

Figure 1

Retail is all about location — not just geographic location but also in-store location intelligence.

Retail businesses are starting to see the potential revenue associated knowing who is at a particular place at a particular time for a particular purpose. For instance:

- As you pass your favorite department store, you might get ads on your phone targeted specifically at you.

- Some high-end stores can change interactive display ads on TV screens inside the store to align with your wish list or make offers based on your purchasing history.

- Using in-store camera technology and location intelligence, a retailer can create a heat-map for the activity and traffic all around the store and can give the merchandising part of the organization a sense of where they ought to put items or why people are drawn to particular things and change the merchandising of some items that people tend to look at together.

Although the healthcare industry is interested in location intelligence advantages, it currently demonstrates lower interest than other verticals. I believe this is due primarily to the industry players being overwhelmed at the data requirements and business transformation thrust on them with healthcare reform.

Although location intelligence isn’t pervasive in healthcare, leading-edge organizations are definitely using it. For instance, applications track the location of expensive diagnostic equipment in hospitals. This has enabled the hospitals to significantly reduce their cost of leasing such equipment from rental companies when leasing is faster for emergency use than trying to locate the hospital’s own equipment somewhere in the facility.

Users’ prioritization of functionalities and features

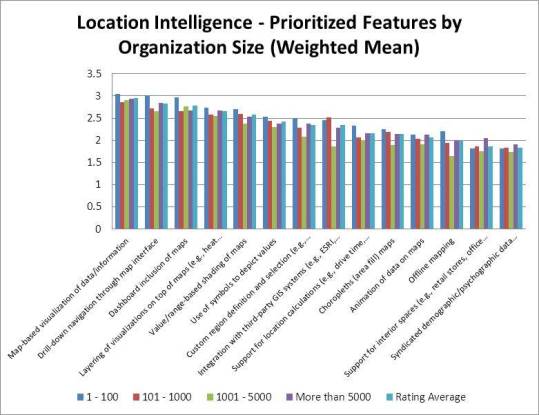

An interesting phenomenon in the study is that the size of respondents’ organizations did not make much difference in their prioritization of the 14 location intelligence features we tracked (see Fig. 2). Most of our BI studies reveal much more contrast in fervor as to importance and feature prioritization than we found regarding location intelligence.

Figure 2

I believe the relative lack of contrast in preferences according to organization size is more evidence that it’s a nascent market and the possibilities are still new to users. The study found that most organizations, whether large, midsized or small, are looking at very basic location intelligence capabilities. Most are not yet ready for more sophisticated capabilities.

In 2010 we saw similar characteristics in our early study of mobile BI. It was new to everybody then; but a couple of years later the users had some real preferences and had moved on from very basic functionalities.

In addition to the 14 functionalities in Fig 2, the study also assessed user priorities among three features for mobile location intelligence:

- Location-based query filtering

- Geo fence alerting (when a mobile device crosses a defined physical boundary)

- Reverse geocoding (the process of creating a physical address or place name from coordinate information via a map or device)

Eighty percent of respondents ranked location-based query filtering as important, with 60 percent stating it’s currently critical or very important to their business.

Vendor investment in location intelligence

The study revealed that more than 80 percent of the participating vendors are considering or making modest investments in location intelligence technologies, but they’re not rushing to market. And 15 percent of the vendors said location intelligence is “not important at all” to their business.

A low level of investment is another indication that it’s a new market. But the study found the users are ahead of the vendors in interest, which is an inversion of what we usually find in BI market segments. Usually the vendors are a couple of years ahead of the users. I don’t know if that’s because BI vendors are focusing on too many other things now, such as Big Data.

Although investing in location intelligence is clearly not important to them now, I believe that if tomorrow customers were to start breaking down the vendors’ doors and ask for location intelligence solutions, the vendors’ priorities would shift overnight. That’s what we observed with mobile BI. Five years ago, there were vendors that said mobile BI absolutely was not important to them. Today there are zero BI vendors that lack a mobile strategy and product offering, and all BI vendors now realize mobile offerings are critically important.

Five years ago, I’m sure there were vendors just waiting out the initial interest in mobile BI. And I’m sure that’s what’s going on now with location intelligence since customers are not clamoring for it. But when they start asking for it, the vendors that have products in this space will get that business, and the vendors that don’t have location intelligence offerings will very quickly lose business.

The report on the 2013 Wisdom of Crowds® Location Intelligence Market Study is available at www.locationintelligencereport.com. In addition to more details on the aspects discussed in this article, the report includes information on importance of location intelligence according to function, organization size, geography, and vertical industry; targeted users; user penetration; where location will be utilized, level of geographic detail required; vendor support for various functionalities in location intelligence, vendor ratings, a buyer’s guide; and more.

The Wisdom of Crowds ® Location Intelligence Market Study was conceived and executed by Dresner Advisory Services, LLC, an independent advisory firm, and Howard Dresner, its president, founder and chief research officer. Howard Dresner is one of the foremost thought leaders in Business Intelligence and Performance Management, having coined the term “Business Intelligence” in 1989. He has published two books on the subject, “The Performance Management Revolution — Business Results through Insight and Action,” and “Profiles in Performance — Business Intelligence Journeys and the Roadmap for Change.” Prior to Dresner Advisory Services, Howard served as chief strategy officer at Hyperion Solutions and was a research fellow at Gartner, where he led its Business Intelligence research practice for 13 years.