The cloud business intelligence market is rapidly growing in adoption and importance. Thirty-five percent of the 1,182 participants in 2013 Wisdom of Crowds® Cloud Business Intelligence Market Study indicated that cloud BI is either “critical” or “very important” in their organizations, and those citing cloud BI as “not important” or “somewhat important” declined.

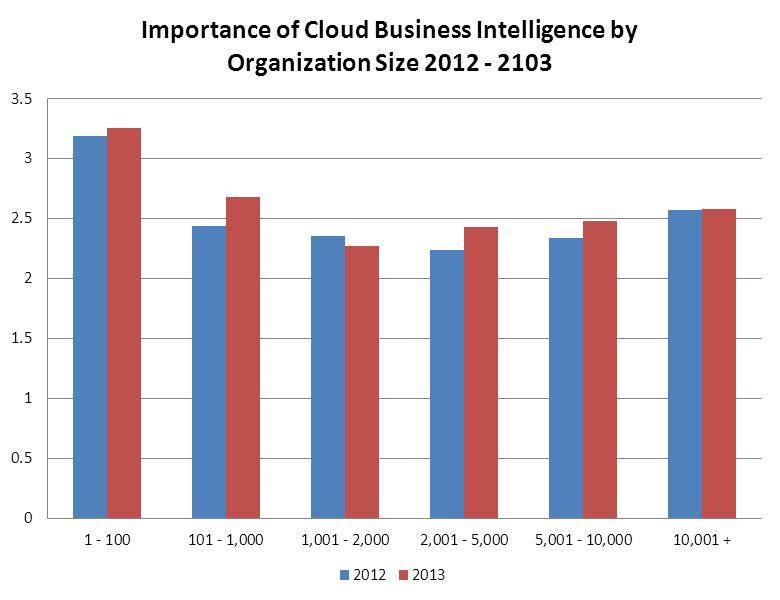

When we first started collecting data on cloud BI two years ago, I assumed that it was going to be flat and pretty much the same for some time because this is a bumpy road and it’s pretty provocative to most organizations. However, not only did its importance increase in the aggregate this year, but it also increased across the board by function (with the exception of IT) and size of organization (with some minor exceptions in the 1,000-2,000 employees bucket).

We’re not at the pinnacle of the tipping point yet, but public cloud BI solutions are much more acceptable to organizations compared to last year’s survey. Although most still favor private cloud BI, plans for both public and hybrid clouds have increased.

- The tip to the other side of the pinnacle will be evolutionary. For now, companies feel more comfortable with big brands offering a range of services as well as reliability and security. But as more and more organizations see their peers move to the cloud and more vendors offer services, there will be constant pressure to go in that direction.

Our survey found that smaller organizations (1-100 employees) are already aggressively moving their BI to the cloud. It levels the playing field, giving them the kinds of services that previously were affordable only to large organizations.

Larger organizations will move to cloud BI departmentally because they won’t or can’t wait for IT to serve their needs.

The midmarket is a different case. This year’s survey reflected an uptick in the importance of cloud BI to all sizes of organizations; but it was most notable in the midmarket ((1,000-5,000 employees). Undoubtedly these organizations are reacting to the growing body of evidence of the benefits and successes of cloud BI. But there is a real risk of their getting eclipsed by smaller organizations gaining near-term competitive advantages because of the cloud.

However, I think we’ll see midsized organizations take longer to move to the cloud. They typically don’t do things on a departmental basis. They don’t have the resources of the large organizations and don’t have the agility of the small organizations. And they have made on-premises investments.

Ranking importance

In ranking the importance of cloud BI by function, R&D groups ranked it highest in importance. Organizations with the greatest penetration of BI usage ranked cloud BI higher, reported the greatest successes and indicated more strategic use of BI.

The survey found that organizations that were looking to deliver business intelligence to external constituents were much more likely to use the cloud to do so or ranked the cloud as much more important. That makes perfect sense because they can isolate it. If they want to deliver BI content and insights to customers and suppliers, they can put it up in the cloud in a sandbox and not have to give them access to on-premises systems or impact those systems.

Shifting priorities

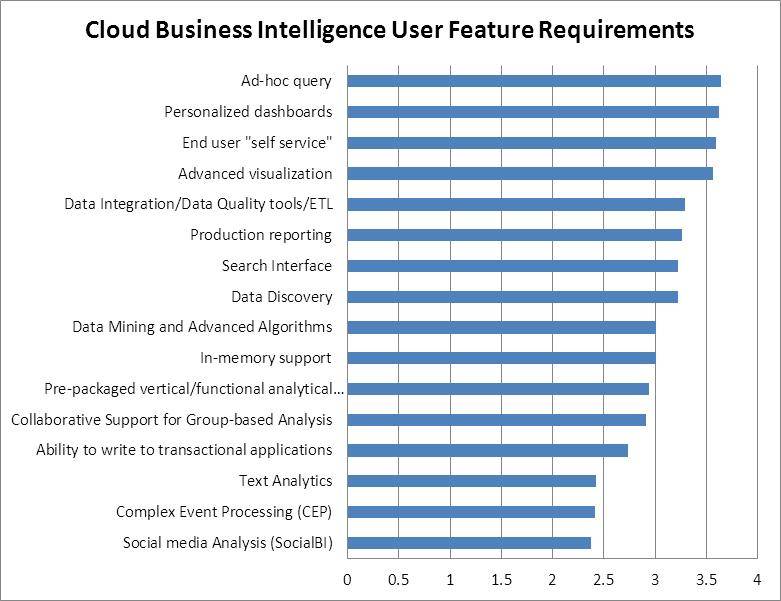

Social media analysis. When asked to rank their basic requirements for features, survey respondents ranked ad-hoc query, personalized dashboards and end-user self-service at the top. Notably, their prioritization of social media analysis dropped substantially from our 2012 survey.

This drop in importance could be due to the cooling off of hype from a couple of years ago surrounding various social media analysis products coming to market at that time.

Another explanation is that organizations are regrouping and deciding to focus on delivering measurable results. Certainly social media analysis is necessary for a consumer business. And it ranked higher in marketing than other areas; even so, it didn’t rank as a top requirement for marketing. Compared to data mining and advanced algorithms that result in money saved or earned, it’s a lower priority.

Security and privacy. The survey revealed an odd contradiction. More than 40 percent of the respondents reported security/privacy was not a requirement for cloud BI, but it was also ranked as the top barrier for adopting cloud BI.

I believe two factors may account for this contradiction. First, some people probably don’t really want a solution to the problem because they can use the security issue as their reason for not moving to the cloud. But it’s an artificial issue.

Second, there is the phenomenon of IT respondents being much more focused on privacy and security than the business users. Unless the users are in a particular industry such as financial services or healthcare where they are more aware of legal responsibilities and regulatory compliance, security and privacy may not be an issue for them.

Data integration issues

Data integration was cited as the number-two barrier (after security & privacy) for adopting cloud BI. The survey found a disconnect between IT groups and sales and marketing when it comes to data integration. Sales and marketing want to be able to connect back to their on-premises data from the cloud, but that is not IT’s priority. In fact, cloud application connectors were not at the top of the IT respondents’ rankings; they were ranked at the bottom. Clearly IT is not focused on what the sales organization is doing with Salesforce.com or NetSuite or any other applications out there. However, sales and marketing ranked connection high among their requirements.

So a democratic cloud services world hasn’t fully congealed yet. It’s still an apps world where integration is still being done on an application-by-application basis. Organizations may do Salesforce or an HR application like SuccessFactors in the cloud, but they’re not thinking about it from a holistic architectural perspective. Otherwise, they would realize: “My data is going to be in database.com and my application is going to be over here, and I’m going to integrate everything over there ….”

Because the architecture integration isn’t a priority yet, organizations will encounter some data problems that will have to be resolved over time the same way we’ve had to resolve them in an on-premises model. This is a pressing problem in the cloud, but it doesn’t appear that it will be solved soon. For now, companies that license apps in the cloud will have to figure out how to integrate them with their on-premises apps.

Vendor and user prioritization gaps

Respondents in all sizes of organizations agreed on the top five required features in a cloud BI solution: personalized dashboards, ad-hoc query, advanced visualization and end user self-service. These functionalities especially rank high among the smaller organizations.

The vendors’ development priorities are pretty well aligned with the users’ requirements when it comes to personalized dashboards, advanced visualization and self-service but otherwise are somewhat out of sync with users’ requirements.

For example, the vendors are focused on data discovery, but the users didn’t rank it high. And users rank data integration higher than the vendor capabilities. The vendors have invested heavily in multi-tenancy for architectural support because it’s a big cost factor in running the software, especially in a managed-services offering. But the users don’t care one whit about it because they don’t see it.

So there is some misalignment. Some of the vendors are more forward thinking and see something coming and develop the technology before the market demands it. But most vendors are not willing to do something highly speculative. They tend to follow their peers or what analysts tell them to do. The survey reveals there are certain gaps on a per-vendor basis. But when you look at it year over year, the surveys show that they are catching up. I believe that a year from now, it will look even better than it does now.

Similarly, there are differences between the business users’ interests in features compared to IT’s interests. This finding is a reflection of the maturity of the users. The first generation of functionalities that the users want is what they are already familiar with and get value from today such as ad-hoc query and personalized dashboards (ranked #1 and #2 in required features).

We saw this same phenomenon in mobile BI early on. Users’ required functionalities were very simple the first year. In the second year they wanted to interact with it a little bit and do some filtering and some selection. And then the next year they wanted to do far more and even create something with components. The requirements became more and more sophisticated and looked more and more like a desktop suite of functionality over time.

I think cloud BI will grow the same way. Right now users want to do some basic things. A year or two years from now, their requirements will be much more sophisticated.

Cloud BI licensing preferences

Survey respondents reported that free trial is their top licensing preference. They ranked the pay-per-use model last. This is somewhat surprising, as this model initially attracted people to the cost benefits of cloud computing.

But most organizations don’t like surprises. Although the pay-per-use model may be cheaper, it may cause surprises for those who have to live within a monthly or quarterly budget. If all of a sudden there is a spike in usage because of a particular project or something unexpected, it can blow the budget in a pay-per-use model where the organization is charged for CPU utilization, data volumes or actual time that users are logged on.

The IT respondents reported they prefer free trials, but they also like the perpetual license model as that’s what they’ve been doing for years and they know how to manage that. So there’s a comfort level issue, but I think gradually they will move away from that perpetual license comfort or preference in favor of something a little bit more modern.

It’s the same situation with the on-premises option. A lot of organizations still want that option — especially larger ones where IT drives the adoption. They want BI in a cloud model but want it deployed on premises. Or they may want to pull it out of the cloud. Some may want to start with it on premises with the promise of moving into the cloud later. It’s a matter of control.

Survey respondents ranked “loss of control” as one of the top barriers or hindrances to cloud BI. I think that the issue around loss of control is much bigger than folks are willing to admit. Although security and privacy and data integration are barriers, there are ways to compensate for those or mitigate against those risks. But loss of control is an emotional issue, not a technology issue.

So cloud BI is very disruptive. But the train definitely has left the station. This is where the investment is and where we’re going to see innovation. But it’s going to be a bumpy road with narrow passages to the top of the mountain and tipping point.

The report on the 2013 Wisdom of Crowds® Cloud Business Intelligence Market Study is available at www.cloudbireport.com. The report includes plans for public and hybrid cloud BI by function, user feature requirements, initiatives strategic to BI, importance of cloud BI by function and industry, cloud BI penetration, perceived barriers/limitations, cloud BI licensing preferences, vendor ratings, and a cloud BI Buyer’s Guide. There were 1,182 respondents from North America, EMEA, Asia Pacific and Latin America and representing more than 10 vertical industries.

The Wisdom of Crowds ® Cloud Business Intelligence Market Study was conceived and executed by Dresner Advisory Services, LLC, an independent advisory firm, and Howard Dresner, its president, founder and chief research officer. Howard Dresner is one of the foremost thought leaders in Business Intelligence and Performance Management, having coined the term “Business Intelligence” in 1989. He has published two books on the subject, The Performance Management Revolution — “Business Results through Insight and Action”, and “Profiles in Performance — Business Intelligence Journeys and the Roadmap for Change.” Prior to Dresner Advisory Services, Howard served as chief strategy officer at Hyperion Solutions and was a research fellow at Gartner, where he led its Business Intelligence research practice for 13 years.