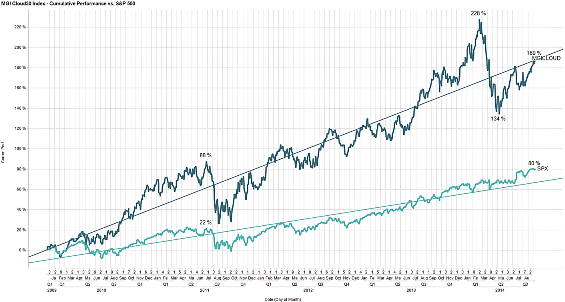

Cloud computing is still in its infancy and many of the pure-play cloud computing stocks potentially have a long runway with lots of headroom. If one were to compare the performance of cloud equities as represented by the MGI Cloud 30 Index to key market benchmarks such as the S&P 500 index (see Fig. 1 below), it is immediately obvious that cloud computing stocks seem to be on a trend line with a slope that is significantly more aggressive than the current continuing upward slope of the S&P 500.

Figure 1: Cumulative performance of MGI Cloud 30 index vs. Standard & Poor 500 index

Since the end of 2009 when we began to track the performance of the MGI Cloud 30, the index value gained over 189 percent while the S&P 500 index gained 80 percent.

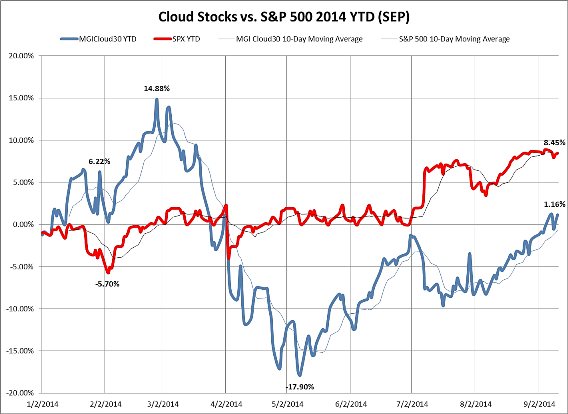

Yet, on a shorter term, Year-to-Date basis (YTD), cloud stocks have had a very rough ride (see Fig. 2).

Figure 2: YTD performance of MGI Cloud 30 vs S&P 500

In the early part of 2014 cloud equities were significantly outpacing market benchmarks with MGI Cloud 30 rising almost 15 percent while the general market was flat to down. But in March, cloud shares began a pullback that continued at least through May 2014. While the broad markets continued to go nowhere fast, the cloud shares recovered somewhat to near the flat line but remained down for the year in early July 2014.

Then in early July 2014, the broad markets jumped while the cloud shares diverged and took a second nosedive of the year. As of September 11, 2014 cloud equities are barely above breakeven line at 1.16 percent YTD while the S&P 500 index is up near 8.5 percent for 2014. A logical question to ask here would be: What is going on?

Cloud adoption continues to grow; it is a steady process with an increasing number of buyers. The growth in cloud far outpaces GDP growth, inflation and growth in IT budgets. Companies with good cloud exposure see average growth that far exceeds that of the broad market. The key drivers for cloud adoption remain the quest of corporate business and IT organizations for improved agility and economics.

The MGI Cloud 30 index includes shares of the 30 leading technology companies that are likely to experience an above-average positive impact from cloud computing adoption. The MGI Cloud 30 index includes shares of companies that are both pure plays in cloud computing and SaaS as well as companies whose products represent the key elements of infrastructure and cloud supply chain. The index includes shares of companies such as Salesforce.com, Rackspace, Amazon, CenturyLink, ServiceNow, DuPont, Fabros, Concur, Workday and Marketo, among others. The details of index composition and maintenance methodology can be found on our website.

We think there are three reasons for this seeming dichotomy in cloud equities performance:

- Outsized gains in 2013: 2013 was a stellar year for the market in general and for cloud shares specifically, which advanced over 32 percent in 2013 with some index components posting triple digit gains. High valuation multiples: By early 2014 cloud equity valuations have become stretched and, as our research highlighted in late 2013, the entire tech sector including cloud and Internet/social media areas was vulnerable to a correction.

- Immaturity and volatility: Many of the cloud companies are still very young and do not have the consistency of earnings typical of large industrial firms. Some are quite illiquid and therefore exhibit higher than typical volatility thus amplifying any up or down moves.

- Portfolio allocation limits: By 2014 many institutional investors were beginning to run into limits of their portfolio allocations for tech stocks in general, and many portfolios were trimmed. In fact, this kind of trimming does not happen in one day but could take months or even years.

What happens next?

The trend line for cloud equities is up and the slope of the trend line is significantly above market benchmarks. Cloud adoption is still in the early games with cloud infrastructure services accounting for only about $6.5 billion in 2014 revenues and SaaS revenues just beginning to approach $20 billion. This is a small fraction of the overall spend on technology platforms and business applications. For now the overall trend remains up despite the bumps and volatility.

Join us on October 23rd 2014 at the New York Academy of Sciences for the 2014 Billing Innovators Summit EAST. See conference details for information and registration.

Igor Stenmark is managing director of MGI Research. His background encompasses nearly 30 years in entrepreneurial, strategic, investment and executive roles in the technology industry. Prior to co-founding MGI Research, Igor was in private practice as a strategist and counsel advising technology industry investors and executives, helping enter new markets, optimize positioning, create value and achieve liquidity. Between 1992 and 2001 he served as the Head of Gartner’s Enterprise Systems Research Group. He can be reached at istenmark@mgiresearch.com and @istenmark.