Data shared by participants in our 2013 Future of Cloud survey reveals a clear picture of the cloud computing market today and where it’s headed.

One of the most significant findings is that the corporate emphasis on BYOD (Bring Your Own Device) is misplaced as it’s not just about the device anymore. Today, it’s more about what those devices bring into the enterprise: cloud services. The relentless consumerization of IT has moved from BYOD to BYOC (Bring Your Own Cloud).

LinkedIn, for example, has built a service for Salesforce.com, integrating its contact networks and social networks with Salesforce because people are taking cloud services like LinkedIn from home to work and expecting those services to work seamlessly with technologies like their office CRM systems. I believe BYOC is here to stay and will be a very significant force in the enterprise to drive business and on the IT side in terms of how to consume and manage cloud services.

Still an evolving market

Notably, the survey also revealed stronger interest in cloud productivity apps than customer-facing apps. Many of the apps and services created today are being adopted by consumers, end users and visionaries who are looking to create competitive advantage. Enterprises could definitely adopt further cloud services for their business, but many don’t yet know what’s possible or what to ask for. Thus, it’s incumbent on vendors to connect with customers, understand their challenges and then develop services and capabilities that make life easier whether on the business or the IT side.

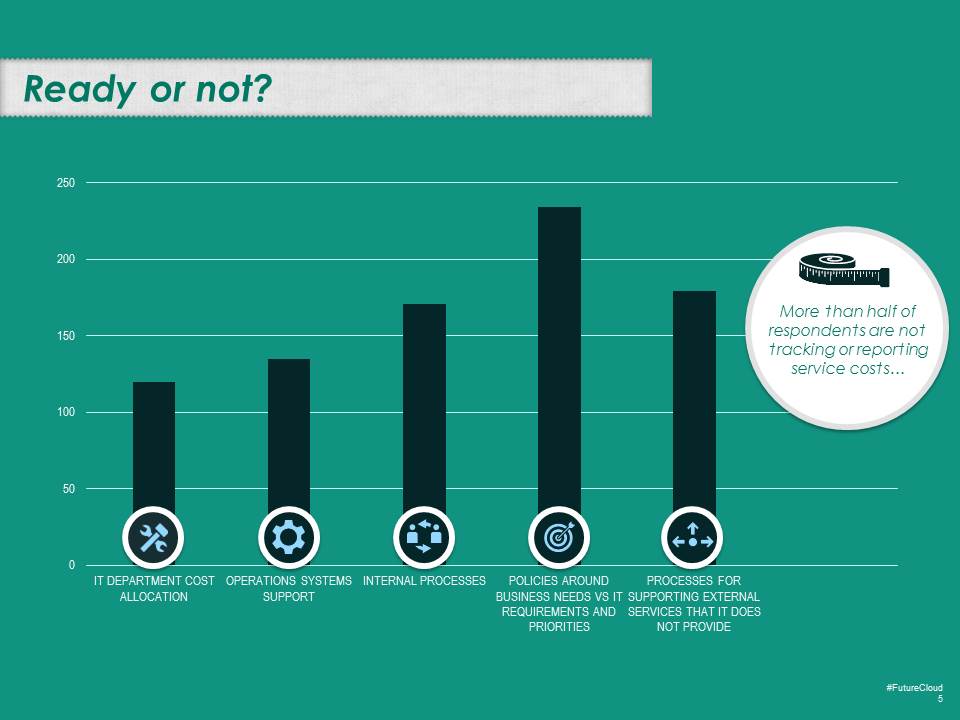

Another indication that cloud is still an evolving market is that more than half of the respondents indicated their companies are not tracking or reporting service costs. People are still busy adopting the best-of-breed products. And, as they adopt them, they are scrambling to understand what their impact is and how to measure and report on it.

Where there are problems, opportunities lie ahead. For years companies have been trying to do IT department cost allocation, and it will never be an easy task. The fact that some cloud costs are distributed services that are inside and outside the firewall adds complexity to tracking and reporting service costs. This is still a challenge because we’re in an evolving market, but it also means that there is an opportunity to create solutions for this problem.

This begs the question — how and when will the cloud market continue to evolve?

Just as companies first outsourced services like F&A, HR and call centers and then eventually outsourced R&D and knowledge management, the cloud market will undergo that same kind of progression.

One thing that will accelerate the way the cloud market progresses compared to the way that outsourcing played out is that this is a world that builds on itself. Think about the law of networks, which states the value of a network is actually the square of the number of participants. The more participants that are added to a network, the more quickly the network becomes valuable to all the participants. In other words, the more people who use cloud services and the more cloud services there are, the greater value it will provide.

Cloud infrastructure perspective

The innovation happening in cloud is not necessarily capital intensive at all levels. For instance, innovation at the infrastructure (IaaS) level is very capital intensive, and there isn’t room for startups at this level because they can’t compete with the economies of scale already in place. But, moving up the stack to the application (SaaS) level, investments are more capital efficient because startups can build their services on software that already exists in the IaaS or PaaS levels.

The survey also found that venture capitalists invested $1.8 billion in cloud companies in 2012. Although that’s less than the $2.4 billion reported in 2011, it’s a very healthy number. I believe the industry is finding an equilibrium point in investment cycles.

The vendor landscape for infrastructure cloud services, as indicated by our survey respondents, is likely to further evolve over the next 12-18 months due to notable cloud partnerships and acquisitions. Take for example, IBM’s recent buy of SoftLayer Technologies — to me this seems like a brilliant move and one that potentially sets IBM up alongside cloud giants like Amazon Web Services and Microsoft Azure.

That said, IBM still has to prove that they should be shortlisted as a player in the cloud infrastructure space. In order to do that, they must not only successfully integrate SoftLayer but also accelerate innovation. The cloud infrastructure layer is a space that is not standing still: Amazon added 156 cloud services last year alone and reduced prices recently by 80 percent.

Biggest growth areas

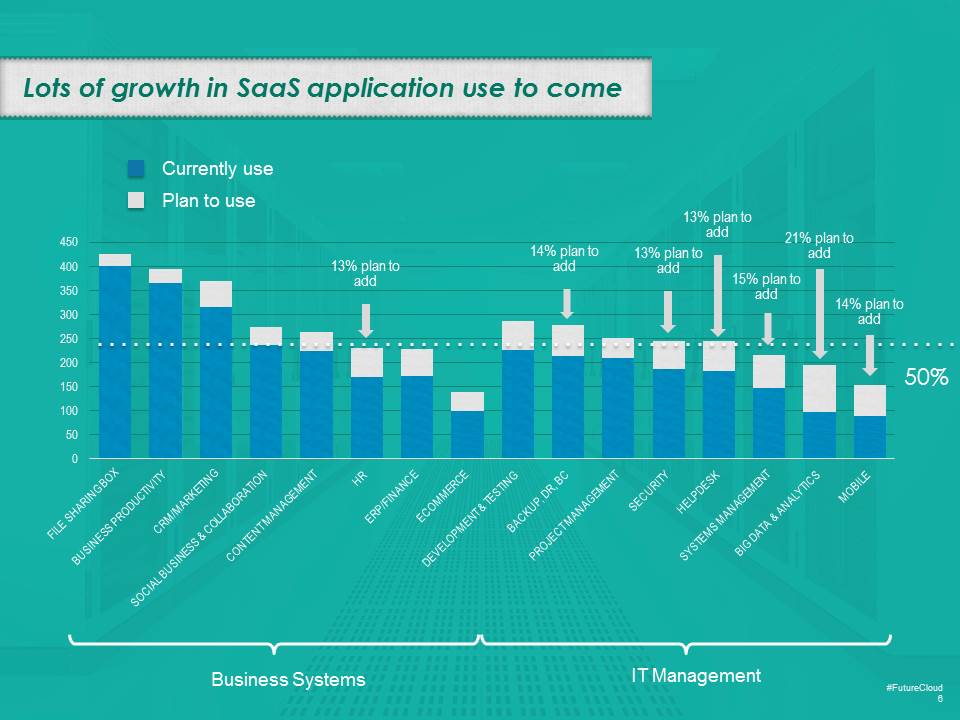

Our survey revealed that SaaS is very much leading the charge to the cloud. Business productivity applications, file sharing, collaboration, CRM and marketing applications are driving growth. Business stakeholders are leading the charge because they are seeing faster return on their investments as they bring those solutions into the enterprise.

Compared to business applications, IT-specific cloud applications such as project management or systems management are much less broadly used. In fact, no IT-specific applications are in use at more than 50 percent of the respondents’ organizations, whereas business-productivity applications are in use at more than half of the respondents’ organizations.

There are two fundamental and very intense pressures on CIOs today, which are gleaned not only from the survey, but also from my conversations with Fortune 1000 CIOS and many of our portfolio companies.

First, CIOs must ensure the business has the applications it needs to be effective and to increase productivity. They can’t put the IT needs for applications such as systems management ahead of the line-of-business priorities for SaaS applications such as CRM, content marketing, etc.

Second, CIOs must enable the organization to function effectively with whatever information processing and back-office systems are necessary for the business. IT, in some instances, is not a core function. A retailer, for example, only needs IT-as-a-service to improve ecommerce, merchandising, marketing and support its brand. A bank, by contrast, considers IT as absolutely a core and strategic asset.

For these reasons, it’s unfair to characterize IT as being laggard in their thinking. Smart CIOs know that their priority is to make the business more productive and continue to ensure line-of-business functions lead the competition. They have to show how IT is enabling the company to gain market advantage. It follows and our survey confirms that IT is starting to invest heavily in the cloud and is likely to grow faster in their cloud investment than line of business so they can close the gap that currently exists between the two.

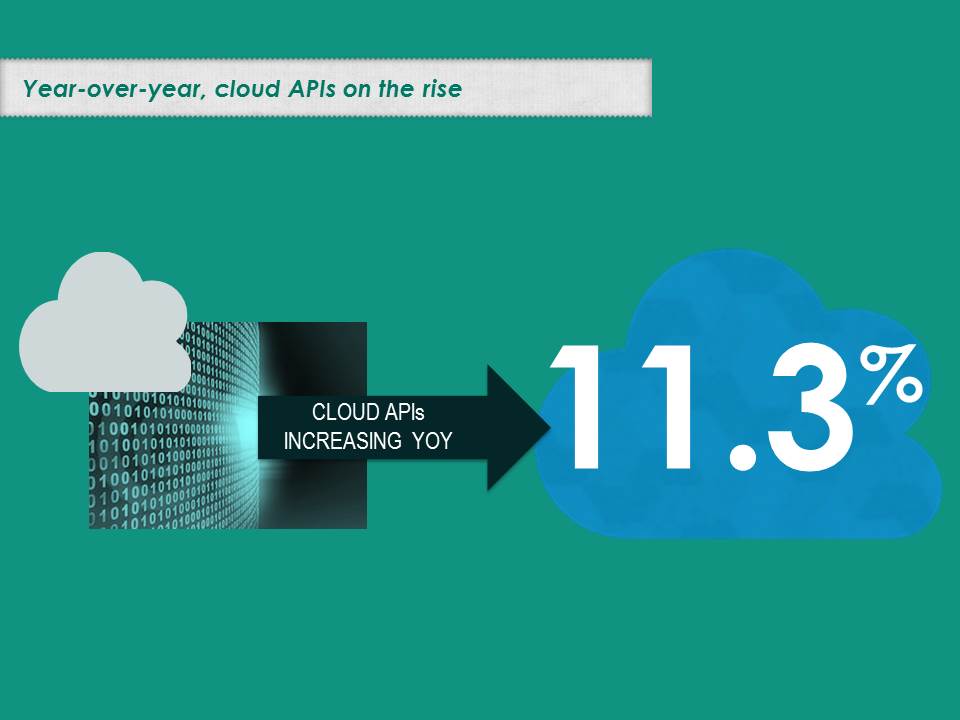

The impact of cloud APIs

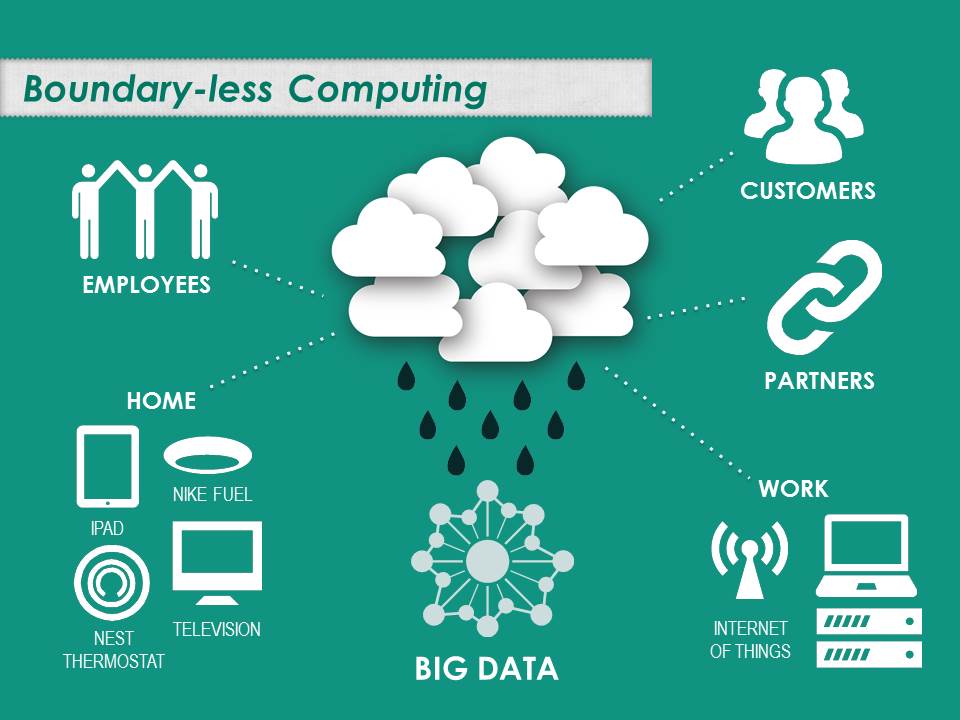

As I began to indicate within my introduction, another important trend we saw in this survey is the shift to making everything available “as a service.” People are using the same devices at home and at work without thinking about it — they expect to access the same cloud services at work as they do at home. IT departments must respond to this “everything-as-a-service,” boundary-less computing, new world order through a series of seamless cloud services; and many businesses are opting to “outservice” to cloud providers that offer best-of-breed solutions and services.

Cloud services are becoming increasingly richer and deeper because they are being built with open API access, allowing discrete services to be “mashed up” into a more complete business process. This trend necessitates a cultural change in many organizations buying cloud services. Instead of siloed purchases that meet the needs of a particular business unit, organizations must consider their ultimate value proposition to customers and then choose cloud services that best helps them fulfill that promise.

I see the business world in a few years as being very differently oriented and led by businesses that have figured out how to innovate on top of core platforms to deliver value to their customers. One factor that will drive this change is the new generation of young entrepreneurs who grew up in a digital world and are redefining the definition of work. I believe companies that adapt to this business model will be the new leaders, and that’s why the future of cloud is so important.

Click here to view a slide presentation of the results of North Bridge Venture Partners 2013 Future of Cloud Computing survey. SandHill was one of 57 survey collaborators.

Michael Skok joined North Bridge Venture Partners in 2002. Michael has been a software entrepreneur and CEO for 21 years. He founded, led and attracted over $100M in private equity to investments in several successful software companies that have generated over $1B in value. He focuses on market-changing technologies such as cloud computing and disruptive business models such as open source. Michael also focuses on applications in ecommerce, enterprise mobility and Big Data. Visit www.futurecloudcomputing.net. Contact him at mjskok@northbridge.com and www.mjskok.com or on Twitter @mjskok.