Dropbox, founded in 2007 with annual revenue of more than $1 billion and a market cap of nearly $11 billion, is the premier choice for a free storage plan. Box, meanwhile, was founded a bit further back in 2005 and currently has annual revenue of around $500 million with a market cap hovering around $3.5 billion. While Dropbox has focused more on your average consumer with both “team” and “individual” packages, Box focuses solely on B2B, with their entire service aimed towards businesses. While these companies look like traditional competitors at a glance, they’re chasing two opposite ends of the market.

In this post, we’ll be figuring out the similarities, and differences, of these two cloud storage behemoths, and why we don’t believe the success of one necessarily means the failure of another.

Dropbox doesn’t need to focus on enterprise

“Dropbox figured out early how to basically get as much viral usage and viral growth out of their free plan as possible.” – Patrick Campbell

As we outlined above, Dropbox is aimed at the opposite end of the spectrum compared to Box, and this is visible particularly when observing Dropbox’s history. They’re now infamous for a growth hack they brainstormed soon after their launch in 2008, through which they were able to revive their stagnating numbers and grow from 75,000 to 4 million users in a little over a year. These clever tricks such as double-sided referral programs can absolutely skyrocket a B2C company’s growth, but Box’s style of pursuing enterprise sales is an entirely different ballgame.

Another area in which you can see the valley of space between Dropbox and Box is pricing strategy. While enterprise customers are larger, with a longer sales cycle and often more complex optionality in the pricing you want to present, Dropbox’s pricing page keeps it refreshingly simple. $12.50 per user per month for the Standard plan, or $20 per user per month for the Advanced.

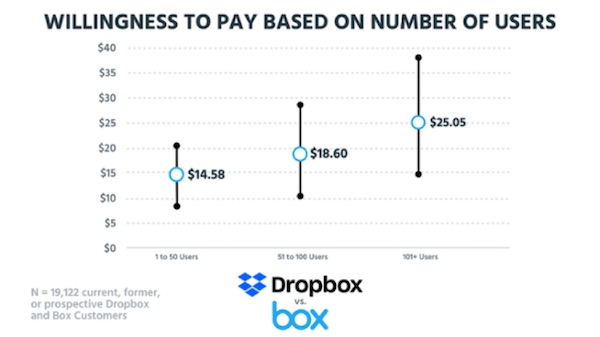

With the difference in their focus in mind, their price points still align closely, and this overlap can also be found in the willingness to pay based on users in data from 19,122 of their former, current and prospective customers.

The most fascinating part of this willingness to pay survey is how well both Dropbox and Box seem to know the cloud storage space. For the tier between 1 and 50 users (the vast majority of customers), the average willingness to pay is $14.58, which is near perfectly in the middle of both of these companies’ publicly listed prices.

If you observe the two data points to the right of 1-50, you’ll see the continuous increase in average willingness to pay based on the increased number of users ($18.60 for 51 to 100 users and $25.05 for 101+ users). These steep increases also display the differences in where Dropbox and Box are trying to enter the market. Dropbox was founded on and continues to focus most heavily on the smallest tier, and Box was founded to serve the tier of 100+ users if not larger. While Dropbox is looking to move up the tiers and Box is looking to move down, most of their users are still rather separated from the other’s focus.

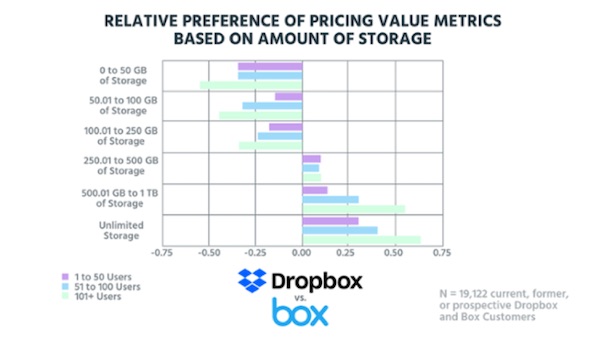

Another interesting insight we found in this data centered around the commoditization of storage, and what companies have come to expect and value in this area.

As expected, we essentially see that customers value as much storage as possible. With the significant bump in willingness to pay for plans that offer unlimited storage, particularly in the 1-50 user tier, we can see that storage itself is being commoditized. As the cost of offering storage is trending to zero, and more cloud storage companies have an unlimited plan, it is becoming increasingly necessary for any competitor in the market to provide it.

As an example of this, both Box and Dropbox along with Google Cloud now offer unlimited storage, creating a need to differentiate from competition in positioning. In this vein, Dropbox has positioned itself to go after the consumer market and work their way up, while Box is targeting the enterprise market and working downward.

Box’s key to winning enterprise

“What’s really fascinating about Box is that they have 700 customers that are paying them $100,000 or more per year because they’re focused on the enterprise.” – Patrick Campbell

To focus on higher-paying leads, Box structures their landing page entirely on enterprise, and clicking on their pricing page serves up an entire page of their business plans and the differentiating features. While they do offer other sections for Individual and Platform, these are an extra click away, as Box aims to draw the reader’s attention into their main offering of Business.

In this Business section, Box offers plans at $5, $15 or $25 per user per month. They make their mark in differentiation, with shiny features such as mobile security controls, full user activity tracking and a ton more as users move up the ladder in price.

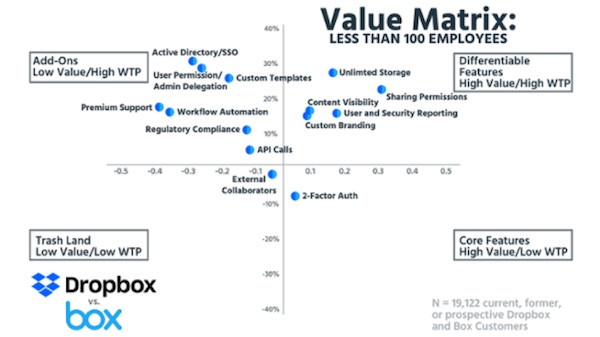

Another piece of data to better demonstrate the differences in where these two companies are targeting is the differences in willingness to pay and feature preference between large companies and small. What some view as an add-on, others will view as a core feature or differentiable feature.

In the survey we conducted of 19,122 current, former and prospective customers of these companies, we found that features such as unlimited storage, sharing permissions, and user and security reporting were consistently valuable across all company sizes. Features that were more enterprise-focused such as regulatory compliance, active directory, and custom templates and branding, however, weren’t high on the priority list for companies with less than 100 employees.

That market of smaller companies is where the contrast of Dropbox from Box is most visible. Dropbox doesn’t mention, or even provide, most of the features we see in the add-ons section of the above value matrix.

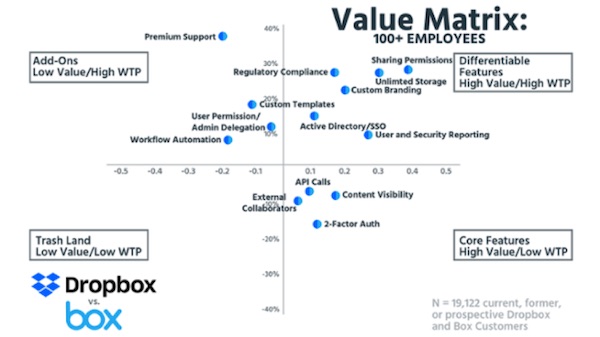

As a company grows out of that 1-100 employee tier, however, their priorities shift substantially.

As visible in the value matrix above, the feature preferences have changed dramatically as we enter the world of companies with more than 100 employees. While some features were previously seen as add-ons that weren’t of a particularly high value, they’ve now moved to the differentiable feature or core feature category, meaning that the cloud storage provider is expected to offer these features, whether or not the company expects to pay more for them.

Some examples of the changes between these matrices include:

- Regulatory Compliance, which has moved from an add-on to a differentiable feature. This shows that enterprise customers both value it more as they scale and additionally are increasingly willing to pay for it.

- API Calls, which has increased in value but not in willingness to pay, resulting in the label of a core feature. This indicates that, while enterprise customers expect this as part of their cloud storage package, they’re not looking to pay more for it. To these companies, it’s a necessary part of the offering.

Other features such as content visibility, external collaborations and two-factor authentication also become core features as a company scales. All of this contributes to the view that Box and Dropbox are chasing drastically different targets, as evidenced by the difference in feature preference between these two buyer personas.

Looking beyond their pricing pages, there’s also pronounced distinctions in their customer acquisition methods based on these different target markets. Box reaches their base by venturing out in sport coats, offering their undivided attention in the effort of attracting large companies that come with massive revenue and a long sales cycle. Dropbox, on the other hand, benefits from automating as much as possible and creating a more touchless sales process, along with a guided onboarding experience that scales well and requires less individualized attention on Dropbox’s end.

Two ‘competitors’ in a growing market

“You’re not going to compete on price; you’re going to compete on focus, and you’re going to compete on volume in some capacity.” – Patrick Campbell

Although Dropbox and Box both provide cloud storage, their packaging and positioning offer a good deal of differentiation, and along with their history, show their focus on opposite ends of the market. Box offers all the features a large enterprise could desire, including a focus on compliance and scale. Dropbox, in pursuit of your average consumer or smaller teams, is short and sweet, without much of a need to build out the same features that have differentiated Box.

Personally, for Patrick and Peter, they would currently opt to stay with Dropbox. They’ve been Dropbox users since the beginning, and don’t yet see a real need for the enterprise features that Box is trying to sell. With that in mind, as the business scales, some of Box’s features such as user permissions and activity tracking are starting to have more appeal.

As for which seems like a wiser investment, Peter would choose Dropbox, given that Dropbox’s lower end of the market appears to offer more potential than Box’s up-market right now. Additionally, as a longtime Dropbox user, Peter has had a largely positive user experience with the service. In Patrick’s opinion, both Box and Dropbox could be good decisions investment-wise. The market is growing rapidly, and it makes sense to back both of the leading providers, which hedges against the failure of either individual company in the future, instead betting on the space as a whole. With that said, Google Cloud and the G Suite have the potential to make waves in the entire industry, which could drastically change the market’s future outlook.

Patrick Campbell is co-founder and CEO of Price Intelligently. Contact him at patrick@priceintelligently.com or @patticus on Twitter.